U.S. Debt Crisis: Rising Treasury Yields and Market Selling

The U.S. debt crisis is at the forefront of financial discussions as unprecedented levels of government spending and escalating deficits push the nation toward a fiscal cliff. With Treasury yields surging, the bond market is reacting sharply, leading to a stock market sell-off that has left investors on edge. Concerns about ongoing fiscal challenges and the implications of the recent government spending bill are driving a wave of uncertainty across Wall Street. In this turbulent environment, expert opinions are warning that the U.S. debt situation could deteriorate further, making it crucial to understand the interconnectedness of these financial phenomena. Without a clear commitment to addressing the mounting debt, the economic stability of the nation hangs in the balance.

The looming crisis in American fiscal policy has sparked conversations around national debt and its potential consequences. As the government grapples with extensive spending measures, worries about financial instability are rising, especially with the significant increases in Treasury yields. Analysts are closely monitoring bond market trends, noting how they influence the broader economy and the stock market’s volatility. The debate surrounding fiscal challenges is intensifying, particularly with regards to the implications of recent legislative moves. A proactive approach towards managing government expenditures is essential to mitigate risks associated with looming budget deficits.

Understanding the U.S. Debt Crisis

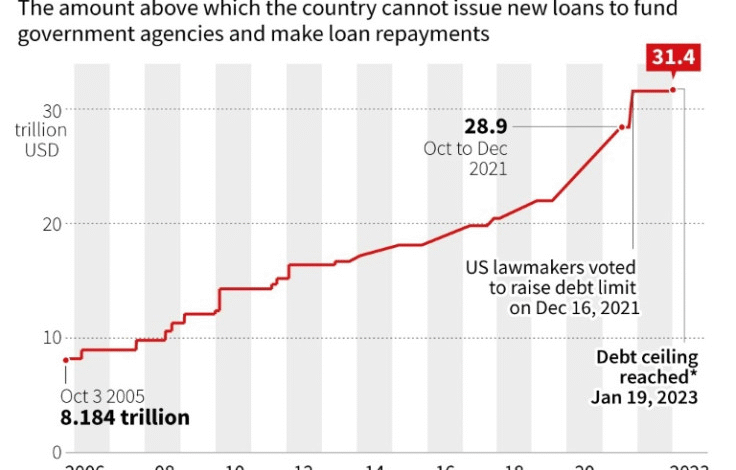

The U.S. debt crisis has reached alarming levels, with the national debt surpassing $36.2 trillion. This situation presents significant challenges for policymakers, investors, and the economy as a whole. As Congress debates the ongoing spending bill pushed by Republican lawmakers, the concerns around government spending, combined with persistent fiscal deficits, paint a troubling picture for the nation’s future. The increasing debt burden not only jeopardizes the financial stability of the U.S. but also raises the specter of additional credit rating downgrades, like the recent review by Moody’s.

Investors are becoming wary as the impact of rising Treasury yields takes center stage. These yields are not just numbers; they represent increasing risks in the bond market, affecting borrowing costs across the economy. With the potential for further fiscal challenges arising from tax cuts that do not align with spending reductions, the U.S. could see its debt-to-GDP ratio spiral out of control. The need for immediate and efficient fiscal reform is paramount to addressing the U.S. debt crisis, yet political inaction continues to stall necessary changes.

The Impact of Treasury Yields on Financial Markets

The surge in Treasury yields is fundamentally altering the landscape of financial markets. Typically viewed as a safe investment, rising yields signal growing anxiety among investors regarding the government’s fiscal health. As yields on long-term government bonds climb, they set the tone for rising borrowing costs across the board, from mortgages to corporate loans. This escalation in yields corresponds directly with the bond market’s reaction to the increasing U.S. debt, driven partly by the ongoing debate over fiscal strategies and government spending bills.

A significant percentage of the investor community is adjusting their strategies based on the prevailing trends in the bond market. When Treasury yields peak, as seen recently with the 30-year bond surpassing 5%, it can trigger a sell-off in equities, leading to a stock market downturn. Market experts are increasingly acknowledging that the trajectory of Treasury yields will be critical to determining the overall economic stability. As Liz Ann Sonders from Charles Schwab points out, the bond market’s dictates create a ripple effect across the equity market, demonstrating how intertwined these financial instruments truly are.

Navigating Market Sell-offs Amid Rising Yields

Market sell-offs are becoming a pressing concern as rising yields create uncertainties for investors. The backdrop of inconsistent fiscal policy and escalating debt levels drives apprehension among market participants. The stock market’s current vulnerability reflects investor fears that higher interest rates will negatively impact corporate profitability and economic growth. Experts warn that this volatile environment could introduce significant fluctuations in stock prices, heightening risks for equity investors and leading to a more cautious investment landscape.

As historical patterns suggest, significant sell-offs in the stock market can often precede broader economic downturns, especially when influenced by external factors like rising bond yields. Consequently, the uncertainty stemming from these fiscal challenges could compel investors to reassess their strategies, potentially leading to increased cash positions and a flight to safety. It’s crucial for investors to stay vigilant and informed about the interplay between Treasury yields and market dynamics, as the ongoing tug-of-war affects both risk appetite and investment decisions.

Fiscal Challenges Facing Policymakers

The persistent fiscal challenges facing U.S. policymakers highlight the urgent need for substantial reform. Despite the promises of stimulating growth through significant spending measures, such as the Republican government’s spending bill, the reality is that these policies are likely exacerbating the existing debt crisis. With mounting pressure from credit rating agencies like Moody’s warning of deteriorating fiscal dynamics, decision-makers must navigate the murky waters of budget deficits with greater care.

As government finances remain stretched, the debate over whether to expand or contract spending is pivotal. Fiscal strategies that prioritize long-term financial stability over short-term gains are essential. However, the immediate reaction of financial markets to any proposed spending adjustments can be unpredictable. Policymakers must find a delicate balance to foster economic growth while simultaneously working towards a sustainable fiscal path that alleviates the risk of a debt crisis and helps restore confidence in the U.S. financial system.

Bond Market Trends and Their Implications

Current trends in the bond market clearly indicate rising yields and shifting investor sentiment. As bonds like the 10-year note and the 30-year bond experience significant yield increases, market experts are predicting a ripple effect that will impact various sectors of the economy. Higher yields typically signal reduced appetite for risk, with investors opting for safer assets amidst fears of inflation and fiscal mismanagement. The result is a complicated landscape for both equities and fixed-income investments.

Moreover, global trends are contributing to rising bond yields, with concerns about fiscal stability in other economies affecting U.S. Treasury yields. As international investors reconsider their perceptions of safety in U.S. debt, the potential for continued sell-offs increases. Understanding these trends is critical for investors navigating the challenges posed by rising government debts and fiscal uncertainties, as market conditions remain susceptible to rapid changes based on sentiment and economic indicators.

The Role of Government Spending Bills

Government spending bills play a crucial role in shaping the economic landscape and determining the direction of fiscal policy. The latest Republican spending bill has stirred considerable debate among economists, as its implications extend far beyond immediate expenditures. By increasing government spending without addressing the underlying debt issues, such measures risk further aggravating the national debt crisis, leading to higher Treasury yields and increasing financial market volatility.

The challenge lies in crafting a spending package that balances growth stimulation with fiscal responsibility. The growing concern among investors centers around whether these spending measures will translate into meaningful economic growth or merely inflate the debt further. Policymakers need to present a coherent strategy that demonstrates a commitment to sustainable economic growth while addressing the fiscal challenges posed by the U.S. debt crisis.

Market Reactions to Fiscal Uncertainty

Market reactions to fiscal uncertainty often result in pronounced volatility, as recent trends indicate. Investors closely monitor government actions and potential policy changes, responding swiftly to signs of instability. The downgrade of U.S. debt by Moody’s exemplifies how market confidence can shift in response to fiscal missteps. Such downgrades not only raise borrowing costs but can also trigger significant sell-offs in both stocks and bonds, reflecting broader investor anxiety.

Additionally, the complex relationship between market reactions and fiscal policy cannot be understated. As concerns about future government spending and deficits persist, investors may pull back, further exacerbating market volatility. A proactive approach by policymakers to stabilize the fiscal outlook is essential to reassuaging both domestic and international investors, which in turn can help reinstate confidence in the U.S. financial markets.

Investor Sentiment in a Volatile Environment

Investor sentiment is a crucial driving force in today’s volatile environment, especially amid rising Treasury yields and uncertain fiscal policies. The psychological elements of investing can lead to significant swings in the stock and bond markets as confidence rises or falls. As financial analysts note, the current market climate, characterized by fluctuations and fears stemming from the U.S. debt crisis, has cultivated a climate of caution among investors who are wary of potential downturns.

This cautious sentiment is reflected in tighter spreads and a preference for perceived safer investments, as investors brace for the implications of rising yields on their portfolios. The uncertain nature of the current fiscal landscape compels investors to reassess their strategies for managing risks, reinforcing the idea that understanding market sentiment is essential for successful investment in today’s unpredictable environment.

The Future of U.S. Fiscal Policy

Looking ahead, the future of U.S. fiscal policy appears fraught with challenges and opportunities. Policymakers must grapple with the reality of soaring debt levels while crafting a coherent strategy that aims to stabilize fiscal dynamics. Key decisions surrounding government spending bills, regulatory policies, and tax implications will have significant consequences for the economy as a whole. Implementing policies that promote long-term sustainability while addressing immediate needs is vital to navigate through the complex fiscal landscape.

As economic indicators signal potential fiscal deterioration, the urgency for effective policymaking grows. If the government continues to prioritize short-term spending over long-term fiscal responsibility, it risks creating an unsustainable financial environment. A commitment to reform is essential not only to avert crisis but to also restore faith in U.S. economic governance, thereby enhancing both investor confidence and market stability.

Frequently Asked Questions

What impact does the U.S. debt crisis have on Treasury yields?

The U.S. debt crisis has led to a significant increase in Treasury yields due to rising concerns about fiscal stability. As the U.S. federal debt continues to expand, investors demand higher yields as compensation for perceived risks associated with U.S. debt, which was traditionally viewed as a safe investment.

How is the stock market responding to the U.S. debt crisis?

The stock market is experiencing a sell-off largely driven by the U.S. debt crisis. Investors are apprehensive about rising interest rates stemming from increasing Treasury yields, which can negatively impact corporate profit margins and consumer spending, resulting in market volatility.

What are the fiscal challenges exacerbating the U.S. debt crisis?

The U.S. debt crisis is exacerbated by large annual fiscal deficits and growing interest costs. As the government continues to spend without reducing fiscal stresses, the budget deficit is projected to remain high, creating further challenges for economic stability and investor confidence.

What trends are emerging in the bond market due to the U.S. debt crisis?

The bond market is reflecting increased risk through rising yields, especially for longer-term securities like the 10-year note and the 30-year bond. Investor concerns about the U.S. fiscal situation, along with inflation fears, are shifting bond market trends, leading to higher yield requirements for U.S. Treasury securities.

What role does the government spending bill play in the U.S. debt crisis?

The government spending bill is crucial in the U.S. debt crisis as it could further inflate the national debt. By making large tax cuts without corresponding spending reductions, the bill increases pressure on the budget deficit, amplifying concerns about long-term fiscal sustainability.

How does the U.S. debt crisis affect global economic dynamics?

The U.S. debt crisis is affecting global economic dynamics by increasing uncertainty. Market reassessments due to rising yields and fiscal challenges are leading to a more cautious investment environment worldwide, potentially signaling permanently higher interest rates and slower economic growth.

What implications does the U.S. debt crisis have for future federal policies?

The U.S. debt crisis necessitates a re-evaluation of federal policies concerning government spending and tax cuts. Without a firm commitment to reducing deficits, there may be ongoing investor concerns about fiscal dynamics, impacting both U.S. economic performance and global markets.

How does the downgrade by Moody’s impact perceptions of the U.S. debt crisis?

Moody’s downgrade of U.S. debt heightens perceptions of the debt crisis by highlighting unresolved fiscal issues such as sustained deficits and rising interest expenses. This development can undermine confidence among investors and lead to further volatility in both bond and stock markets.

| Key Point | Explanation |

|---|---|

| Surge in Treasury Yields | The Republican spending bill has led to a significant rise in Treasury yields, reflecting investor concerns over U.S. fiscal health. |

| U.S. Debt Situation | The U.S. faces severe debt and deficit challenges, with total debt nearing $36.2 trillion. |

| Market Reactions | There has been a sell-off in stocks and bonds as investors react to the Moody’s downgrade and ongoing fiscal uncertainty. |

| Policymaker Influence | The outcome of the fiscal policies introduced by lawmakers will significantly impact market conditions. |

| Future Outlook | Experts predict continuing volatility in financial markets with rising interest rates affecting consumer spending and corporate profits. |

Summary

The U.S. debt crisis is exacerbated by rising Treasury yields and significant market volatility. With the recent spending bill and an alarming debt deficit, experts warn of serious implications for the economy. Policymakers hold the key to managing this crisis, but investor confidence is waning as fiscal challenges persist. As the situation unfolds, continued vigilance and strategic reforms are essential to stabilize the U.S. financial landscape.