U.S. Trade Deadline Concerns Are Pricing in Perfection

As the August 1 U.S. trade deadline approaches, concerns surrounding potential tariff implications have started to grip investors. Verdence Capital Advisors’ CIO, Megan Horneman, warns that market complacency may lead to unforeseen consequences, jeopardizing the impressive gains seen across major stock indices. Despite trading at record highs, Horneman observes a troubling disconnect between optimistic pricing and the looming trade uncertainties. With overbought conditions evident in growth stocks, particularly in the tech sector, investors face a critical juncture for investment strategies amidst the fluctuating landscape. These tariff implications, compounded with the uncertainties surrounding Federal Reserve policy, could ultimately catalyze a valuation correction in the months ahead.

As the deadline for trade negotiations in the U.S. draws near, financial analysts are raising alarms about the potential fallout from unresolved tariffs. The sentiment in the market appears overly optimistic, with many players seemingly ignoring the risks lurking beneath the surface. In light of this environment, investment strategies must be re-evaluated to account for potential shifts in market dynamics caused by trade-related challenges. Megan Horneman of Verdence Capital Advisors emphasizes the need for careful technical analysis as overbought conditions may signal a necessary reassessment of asset valuations. With heightened awareness about international trade developments, investors are urged to remain vigilant and adaptable to the evolving financial landscape.

Understanding Market Complacency: Risks and Opportunities

Market complacency is a condition where investors exhibit excessive confidence in favorable economic conditions, often ignoring warning signs that may hint at underlying risks. As noted by Megan Horneman, the CIO of Verdence Capital Advisors, the current trading environment reflects a belief that everything will go perfectly, especially as the U.S. trade deadline approaches. This mindset can lead to a lack of caution, resulting in distorted valuation metrics that may set the stage for a significant market correction. Keeping an eye on market indicators, such as overbought conditions reflected in technical analysis, is crucial for informed decision-making.

Investors must navigate the balance between optimism and caution. While Horneman identifies long-term bullish trends, especially in international stocks that appear undervalued compared to U.S. equities, it is essential to recognize that a skewed perception of market conditions can disrupt this outlook. The excitement surrounding recent gains in major indexes like the S&P 500 and Nasdaq might overshadow emerging risks, making it imperative that investors reevaluate their strategies and remain vigilant about potential market shifts.

U.S. Trade Deadline Concerns: What Investors Should Know

As the August 1 U.S. trade deadline draws near, investors are increasingly anxious about the implications of potential tariffs and their effects on global markets. Horneman emphasizes that uncertainty surrounding Federal Reserve actions, combined with tariff implications, is creating a precarious situation for stocks, especially growth sectors like Big Tech. With high valuations already leading the market, any adverse news concerning trade negotiations could trigger a swift market reaction and dilute investor confidence.

Given these looming concerns, it’s paramount for investors to incorporate flexible investment strategies that account for unexpected changes in the market landscape. This includes diversifying assets across geographies and sectors, particularly in light of Horneman’s suggestion of focusing on international stocks that could outperform American equities in a pullback situation. Protecting an investment portfolio from potential downturns caused by trade tensions requires vigilance and a proactive approach to asset allocation.

Technicals vs Fundamentals: Navigating Current Market Dynamics

The divergence between technical analysis and fundamental analysis in today’s market presents both challenges and opportunities for investors. On one hand, technical indicators suggest an overbought condition in many equities, hinting that a correction may be overdue. On the other hand, strong earnings and low unemployment data continue to support bullish sentiments. This conflicting information complicates the decision-making process, as investors need to weigh short-term technical signals against long-term fundamental growth prospects.

Horneman’s warnings indicate that a correction could be imminent if the anticipated rate cuts come off the table, or if trade tensions escalate. Investors must thus adopt a holistic investment strategy that takes into account both technical factors, such as price movement and volume trends, and fundamental factors including earning potentials and macroeconomic conditions. This balanced approach will aid in identifying resilient investment opportunities, while mitigating risks associated with possible market corrections.

Investment Strategies Amidst Market Uncertainty

In the face of current market volatility, investors are forced to reevaluate their strategies to ensure they are appropriately allocated. Horneman advocates for a cautious yet opportunistic approach, where pullbacks can be viewed not just as setbacks but as potential entry points for long-term growth investments. As research suggests, integrating a diverse range of assets that consider geographical and sector-specific dynamics can optimize portfolios for both protection and growth.

Moreover, it is vital for investors to stay informed about key economic indicators that could influence market direction. For example, shifts in Federal Reserve policy and tariff developments should be closely monitored, as these factors can have profound implications on market sentiment and valuations. By maintaining flexibility in their investment strategies, investors can better navigate the complexities of market conditions, leveraging both fundamental strengths and technical signals to achieve optimal outcomes.

Impact of Tariff Implications on Investment Decisions

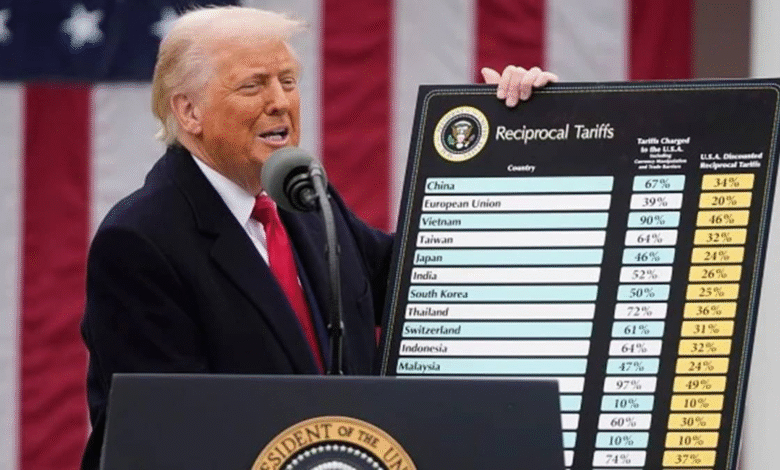

The implications of tariffs on international trade have far-reaching effects on domestic markets and investment strategies. As noted by Horneman, the uncertainty surrounding tariff arrangements is creating a significant headwind for growth stocks, particularly in sectors heavily reliant on trade for profitability. Investors must consider how tariff changes will affect not just current earnings reports but also future growth potential, especially in industries that face competitive pressures from foreign markets.

Effective investment decisions require an understanding of how tariff implications can reshape market dynamics. This understanding necessitates a thorough analysis of the companies and sectors most vulnerable to these changes. Investors should adopt an adaptive strategy, executing more aggressive research and utilizing technical analysis to pinpoint investment opportunities that might arise as the trade deadline approaches. This strategic foresight can potentially lead to substantial rewards, despite the dark clouds of uncertainty.

Long-term Optimism: Capitalizing on Market Pullbacks

Despite the current landscape of uncertainty, professionals like Horneman maintain a long-term bullish perspective on the markets. Recognizing that pullbacks can serve as profitable opportunities, Horneman suggests that investors who can focus on value, particularly in underappreciated international markets, may fare better than those solely concentrated on domestic stocks. This willingness to look beyond immediate setbacks can enhance long-term performance and capitalize on recovery phases.

Moreover, viewing market fluctuations through a long-term lens allows investors to fully appreciate the cyclical nature of economics and market trends. As history has shown, most market declines often precede significant rebounds, particularly for astute investors who have strategically allocated their assets across varied sectors. This long-term outlook requires discipline, patience, and the ability to separate temporary market noise from fundamental growth trends, all essential for successful investment.

The Role of Retail Investors in Market Dynamics

The growing presence of retail investors in the stock market is reshaping traditional market dynamics, according to insights from ‘Fast Money’ trader Guy Adami. With more individuals investing directly, the resulting influx of retail capital has contributed to rising stock prices. However, this trend also raises concerns about market frothiness, where the valuations may disconnect from fundamental realities, particularly in a context where professional investors are being more cautious.

As retail investors continue to exert influence, it is critical for them to be well-informed about market conditions and systemic risks, including those posed by tariff implications and monetary policy shifts. By adopting disciplined investment approaches—focusing on risk management and valuing assets based on solid fundamentals—retail investors can enhance their ability to thrive in today’s market. This proactive mindset distinguishes seasoned investors from those who may be drawn into overzealous speculation during euphoric market periods.

The Importance of Asset Allocation in Market Volatility

In an environment characterized by increasing volatility and uncertainty, asset allocation emerges as a cornerstone of effective investment strategy. Horneman’s advice to ensure appropriate allocation stems from the recognition that varied asset classes can mitigate risks associated with market swings. This diversification not only encompasses geographical considerations but also involves sectors that may be positioned differently in response to external shocks, such as tariff changes and interest rate adjustments.

Strategically rebalancing a portfolio in reaction to market conditions plays a crucial role in safeguarding against adverse outcomes while also positioning for growth. Investors should regularly assess their allocations to ensure alignment with long-term goals, particularly during periods of heightened uncertainty. Emphasizing a well-rounded approach to asset allocation can empower investors to navigate through market disruptions effectively, optimizing potential gains while managing risk.

Evaluating Growth Stocks in a High-Valuation Environment

The current market, marked by high valuations particularly in growth stocks, necessitates careful evaluation by investors. Many analysts, including Horneman, are cautioning against overexposure to sectors like Big Tech, which could face sharp corrections if market dynamics shift unfavorably, especially in light of technical analysis indicators showing overbought conditions. Investors must critically assess the fundamentals of growth stocks and their potential for continued expansion versus the risks of a market correction.

In this high-valuation environment, identifying sustainable growth investments requires a nuanced understanding of sector performance as well as broader economic indicators. As some companies may be priced for perfection, a conservative approach focused on businesses with strong earnings potential, solid cash flows, and competitive advantages may yield more favorable outcomes. By emphasizing thorough analysis and validating growth narratives, investors can better navigate the complexities of the current market landscape.

Frequently Asked Questions

What are the potential tariff implications as the U.S. trade deadline approaches?

As the U.S. trade deadline on August 1 nears, investors are increasingly concerned about tariff implications on both domestic and international markets. Analysts, including those from Verdence Capital Advisors, warn that the market may be overly complacent, underestimating the impact tariffs could have on valuations and overall economic stability.

How does market complacency relate to the upcoming U.S. trade deadline?

Market complacency refers to the tendency of investors to overlook potential risks, such as those related to the U.S. trade deadline. With the markets trading at record highs, experts like Megan Horneman from Verdence Capital Advisors caution that ignoring tariff uncertainties and Federal Reserve policies may lead to significant corrections in growth stock valuations.

What investment strategies should I consider ahead of the U.S. trade deadline?

Ahead of the U.S. trade deadline, investors are advised to consider diversified investment strategies. Megan Horneman from Verdence Capital Advisors suggests focusing on international stocks, which may offer better value compared to U.S. equities that are currently overvalued, especially given concerns regarding tariff implications and market technical analysis.

How does technical analysis play a role in understanding the U.S. trade deadline concerns?

Technical analysis involves assessing market trends and patterns to predict future price movements. With the U.S. trade deadline approaching, analysts are highlighting overbought conditions in stocks, particularly in sectors like Big Tech. This analysis can help investors anticipate potential market corrections as tariff concerns unfold.

What should investors focus on as the tariff deadline looms in relation to U.S. trade policies?

Investors should focus on maintaining appropriate asset allocation, as advised by Verdence Capital Advisors. With the looming tariff deadline and the risks of market complacency, ensuring a balanced portfolio can help mitigate potential losses. It’s important to remain vigilant and consider the implications of ongoing trade negotiations on investment performance.

| Key Points |

|---|

| Market concerns regarding the U.S. trade deadline. |

| Verdence Capital’s CIO, Megan Horneman, warns of market complacency ahead of August 1 deadline. |

| Challenges include tariff uncertainties and Federal Reserve policy. |

| Horneman suggests market is overbought and could see a valuation correction. |

| Despite caution, Horneman remains a long-term bull and sees pullbacks as opportunities. |

| International stocks may present better value compared to U.S. stocks during weaknesses. |

| Advice for investors: ensure appropriate allocation amid uncertain conditions. |

| Trading gains are significantly influenced by retail investors, causing valuation concerns. |

| Major indices reached record highs recently, with S&P 500 and Nasdaq showing strong performance. |

Summary

U.S. trade deadline concerns are shaping market sentiment as investors brace for potential volatility. With the looming August 1 deadline, experts like Megan Horneman, CIO of Verdence Capital, highlight dangers of overconfidence among traders amidst tariff uncertainties and potential shifts in Federal Reserve policy. The prevailing market conditions, characterized by a high level of complacency, call for caution. Investors are advised to evaluate their portfolios carefully, considering international stocks as possibly undervalued compared to their U.S. counterparts. As the market continues to reach record highs, it is crucial to remain vigilant and prepared for any corrections that may arise.