UK Economic Uncertainty: Insights from Bank of England Governor

The UK is currently grappling with significant economic uncertainty that has raised concerns among policymakers and citizens alike. Following a recent trade agreement with the U.S., Bank of England Governor Andrew Bailey highlighted that while such deals are beneficial, they do not erase the complexities of an open economy. The interplay of changing interest rates and global trade impacts adds layers of unpredictability to the UK’s economic landscape. With the Bank of England voting narrowly to cut interest rates, the implications of this decision are still unfolding amid fluctuating tariffs and emerging market dynamics. As uncertainties mount, maintaining a close watch on the evolving situation will be crucial for understanding the future direction of the UK economy and its recovery prospects.

In light of the volatile financial climate, the ongoing fluctuations and challenges in the UK’s economic framework warrant serious attention. The shifting landscape of international trade, coupled with the recent developments from the Bank of England, paints a picture of a nation navigating through rocky waters. With impactful decisions expected from key figures like Andrew Bailey, the complexities surrounding trade relations and monetary policy remain at the forefront. As the UK strives to establish meaningful trade connections globally, understanding the broader economic implications becomes increasingly important. The current state demands not only vigilance but also strategic adaptation to mitigate the risks associated with economic instability.

The Impact of Economic Uncertainty on the UK

The concept of economic uncertainty is pivotal in shaping the forecasts for the U.K. economy. According to Bank of England Governor Andrew Bailey, this uncertainty has been accentuated by the evolving trade landscape post-Brexit. While the recent trade agreement with the U.S. is certainly a positive step, it does not eliminate the myriad of risks associated with a very open economy. The intricacies of global trade impact not only domestic markets but also the regulatory frameworks defining them, creating a complex environment for policymakers.

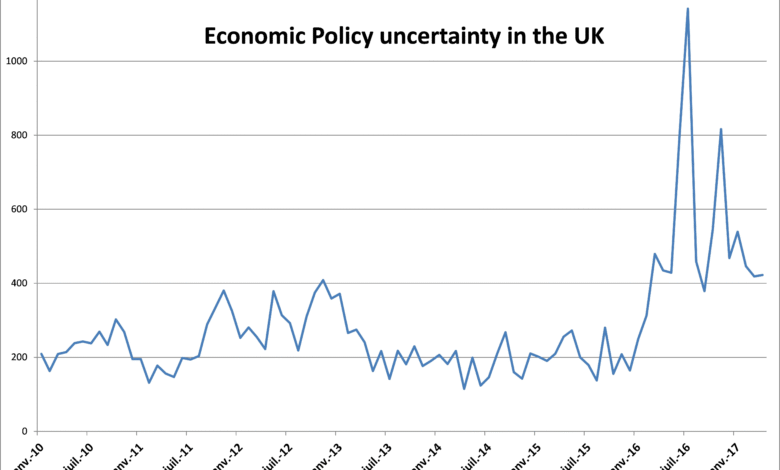

Moreover, the increase in uncertainty can lead to caution among consumers and businesses, subsequently affecting demand. A cautious approach might hamper growth as investments become limited and spending is curtailed, thus creating a cycle of economic stagnation. Andrew Bailey’s remarks on economic unpredictability, emphasized by its mention 41 times in the Bank’s recent report, underline the gravity of the situation. The volatile nature of global markets, coupled with tariffs, heightens these concerns, prompting the Bank of England to adopt a more vigilant stance on interest rates.

Frequently Asked Questions

What does UK economic uncertainty mean in the context of recent Bank of England decisions?

UK economic uncertainty refers to the unpredictable factors affecting the economy’s performance, such as fluctuations in trade agreements and changes in interest rates. Recent comments by Bank of England Governor Andrew Bailey highlight concerns over economic instability, compounded by the recent rate cut and trade negotiations.

How does the UK-US trade agreement affect UK economic uncertainty?

While the UK-US trade agreement is a positive development, it does not eliminate UK economic uncertainty. Governor Andrew Bailey emphasized that despite the agreement, the UK faces challenges related to global trade impacts and tariffs, which contribute to the overall economic unpredictability.

What role do interest rates play in UK economic uncertainty?

Interest rates are a key factor in UK economic uncertainty, as indicated by the Bank of England’s recent decision to cut rates to 4.25%. Changes in interest rates can influence borrowing costs, consumer spending, and investment, all of which are crucial for a stable economy.

Who is Andrew Bailey and how does he relate to UK economic uncertainty?

Andrew Bailey is the Governor of the Bank of England, and he plays a critical role in addressing UK economic uncertainty. His insights on monetary policy, interest rates, and trade issues help shape the economic landscape and inform public understanding of current challenges.

What are the global trade impacts contributing to UK economic uncertainty?

Global trade impacts such as tariffs and international relations add layers of complexity to UK economic uncertainty. As Andrew Bailey noted, these factors can lead to unpredictable changes in demand and inflation, making it difficult to forecast the economic landscape.

How does the Bank of England respond to UK economic uncertainty?

The Bank of England responds to UK economic uncertainty through monetary policy measures, such as altering interest rates. Recent adjustments reflect a reaction to the divided outlook on inflation and demand, showcasing the central bank’s strategy to stabilize the economy amidst uncertainty.

Why is the recent focus on uncertainty important for the UK economy?

The increased focus on uncertainty signals potential risks to economic stability, prompting stakeholders to carefully monitor trade relations and inflation trends. With 41 mentions of ‘uncertainty’ in the Bank of England’s latest Monetary Policy Report, it underscores the importance of proactive management in navigating a complex economic environment.

| Key Point | Details |

|---|---|

| Economic Uncertainty | The UK is experiencing increased economic uncertainty despite a trade deal with the US. |

| Governor’s Statement | Andrew Bailey stated that the UK economy is very open, which adds to the uncertainty. |

| Interest Rates | The Bank of England voted to cut interest rates by a quarter point to 4.25% due to economic risks. |

| Trade Agreement Significance | The trade agreement with the US is seen positively but adds complexity to the trade landscape. |

| Tariff Impact | Current tariff levels are higher than before, affecting both UK and global trade. |

| Future Optimism | The UK aims to build a network of international trade deals following the deal with the US. |

| Monetary Policy Report | The term ‘uncertainty’ was used 41 times in the latest report, indicating rising concerns. |

| Potential Economic Outcomes | A sharp drop in demand may weaken inflation, while higher inflation pressures may arise from wages and energy. |

Summary

UK economic uncertainty remains a significant concern, as highlighted by the recent statements from Bank of England Governor Andrew Bailey. Despite the positive aspects of a trade agreement with the United States, the overall economic landscape is increasingly complex and fraught with risks. The central bank’s recent decision to cut interest rates reflects the cautious approach necessary to navigate the challenges posed by tariffs and the interconnected nature of global trade. As the UK pursues further international trade agreements, managing this economic uncertainty will be crucial for future stability and growth.