Understanding Bitcoin: Key Lessons You Need to Know

Understanding Bitcoin is essential in today’s digital economy, as this revolutionary cryptocurrency reshapes financial transactions globally. Developed by Satoshi Nakamoto, Bitcoin not only offers a decentralized alternative to traditional currencies but also utilizes a peer-to-peer network to ensure security and transparency. At the heart of Bitcoin’s operation is the blockchain—an immutable ledger that records all transactions, thereby enhancing trust and reducing dependency on middlemen. The process of Bitcoin mining is critical, allowing miners to validate transactions and secure the network while being rewarded with newly minted BTC. As more individuals grasp the Bitcoin basics, understanding cryptocurrency becomes vital for anyone looking to participate in this evolving financial landscape.

Grasping the concept of digital currencies is increasingly necessary in our interconnected world, with Bitcoin standing out as the first and most prominent example. Often referred to as virtual gold, this digital asset was introduced to provide users with an uncontestable and decentralized means of value transfer. The unique structure of the Bitcoin blockchain ensures each transaction is securely logged and transparent, making it a trusted alternative to fiat money. Activities such as Bitcoin mining play a significant role in maintaining the network’s integrity, allowing for an ongoing issuance of new bitcoins. Overall, diving into the nuances of cryptocurrency not only demystifies how these systems function but also highlights their potential implications for the future of finance.

Understanding Bitcoin: The Digital Gold Revolution

Bitcoin, often dubbed the ‘digital gold,’ has emerged as a revolutionary asset class in the world of finance. Created in 2009 by the enigmatic Satoshi Nakamoto, Bitcoin operates on a decentralized network known as the Bitcoin blockchain, allowing for peer-to-peer transactions without the need for intermediaries such as banks. This unique feature challenges traditional financial systems, providing a resilient alternative that many see as a safe haven against inflation. As more individuals seek to secure their wealth, understanding Bitcoin becomes crucial, especially in a digital economy prone to volatility.

The allure of Bitcoin stems not just from its potential as a store of value, but also from its intrinsic properties. With a capped supply of 21 million coins, Bitcoin resists inflationary pressures that affect fiat currencies like the Euro and Dollar. This scarcity, coupled with increasing global adoption, underscores its potential as a hedge against economic instability. By grasping the fundamentals of Bitcoin and the underlying blockchain technology, individuals can make informed decisions about investing in this transformative cryptocurrency.

Satoshi Nakamoto: The Mysterious Creator of Bitcoin

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, remains one of the greatest enigmas of the 21st century. In 2008, Nakamoto introduced the world to Bitcoin through a white paper titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System,’ outlining the principles of blockchain technology that would democratize finance. This revolutionary concept combined cryptographic security with a decentralized network, allowing users to transact directly without trusting a central authority. The mystery surrounding Nakamoto’s identity adds to the allure of Bitcoin, as many speculate whether this figure is an individual or a collective effort.

The impact of Nakamoto’s invention extends far beyond the introductory phase of Bitcoin. By laying the groundwork for a new financial paradigm, Nakamoto addressed issues prevalent in traditional banking systems, such as censorship and inflation. The unfinished narrative surrounding Nakamoto’s disappearance in 2010, along with the substantial amount of Bitcoins believed to be owned by this figure, raises ongoing questions about the future of Bitcoin and the ethics of ownership. Understanding Nakamoto’s vision is essential for grasping Bitcoin’s significance in modern finance.

Bitcoin Mining: Powering the Blockchain

Bitcoin mining is a fundamental aspect of the Bitcoin blockchain that ensures the integrity and security of transactions. Miners, who operate powerful computers, compete to solve complex mathematical puzzles that validate transactions and append them to the blockchain. This process not only secures the network but also introduces new Bitcoins into circulation. The decentralized nature of mining means that no single entity controls the network, allowing for greater resilience against attacks and manipulation.

However, the energy consumption associated with Bitcoin mining has raised concerns about its environmental impact. Critics often label Bitcoin a ‘climate killer’ due to the significant electricity it consumes, particularly as the network scales. Yet, advocates argue that this energy use is justified as it underpins a censorship-resistant financial system that upholds human rights. Moreover, with the ongoing development of renewable energy sources and innovations in mining efficiency, it’s becoming increasingly feasible to mitigate environmental concerns while benefiting from Bitcoin’s unique properties.

Bitcoin vs. Fiat: The Store of Value Debate

The debate between Bitcoin and fiat currencies often centers around which acts as a better store of value. While traditional currencies like the Euro can be influenced by inflationary policies and global economic shifts, Bitcoin offers a capped supply that inherently protects against devaluation. This fixation on scarcity is particularly pertinent in today’s financial landscape, where many seek alternatives to hedge against inflation, making Bitcoin increasingly attractive not just as a speculative asset but as a legitimate store of value.

Understanding the dynamics of Bitcoin relative to fiat also reveals its role in global finance. Unlike fiat currencies, Bitcoin operates independently of government manipulations and capital controls, thus acting as a hedge for individuals in politically unstable regions. Through its decentralized nature and transparent blockchain, Bitcoin empowers users, allowing them to safeguard their wealth without reliance on centralized institutions that may not always act in their best interest.

The Bitcoin Blockchain: A Secure Public Ledger

The Bitcoin blockchain operates as a decentralized public ledger that records all transactions made using the cryptocurrency. This innovative structure is built on cryptographic principles that ensure transparency, security, and immutability. Unlike traditional banking systems, where authorities can alter records, the blockchain’s transparency allows anyone to verify transactions, enhancing trust among users. Additionally, the blockchain’s design eliminates the risk of double-spending, a core issue for digital currencies.

Each block in the Bitcoin blockchain contains a list of transactions, a reference to the previous block, and a unique code generated through hashing. This chaining of blocks ensures that any alteration to a single block would render all subsequent blocks invalid, thus maintaining the integrity of the entire network. The decentralized nature of Bitcoin’s public ledger also means that no single party has control, which offers protection against censorship and fraud, further solidifying Bitcoin’s role as a secure digital currency.

Understanding Cryptocurrency: Bitcoin and Beyond

To fully grasp Bitcoin, it’s crucial to understand the broader context of cryptocurrencies. Bitcoin was the first cryptocurrency, introducing key concepts such as blockchain technology and decentralized finance. Since its inception, thousands of alternative cryptocurrencies (altcoins) have emerged, each with unique features and purposes. However, Bitcoin remains at the forefront, often considered the benchmark against which all other cryptocurrencies are measured due to its robust security and widespread adoption.

Moreover, the rise of Bitcoin has sparked a growing interest in the underlying technology of blockchain, leading to innovations in various sectors beyond finance, such as supply chain management and digital identity verification. As more industries adopt blockchain solutions, the potential uses of cryptocurrencies continue to expand. Engaging with this broader understanding of cryptocurrency can provide insights into why Bitcoin retains its dominance within the ever-evolving digital landscape.

Solving the Double-Spending Problem with Bitcoin

One of the critical challenges in digital currency is the double-spending problem, where the same digital coin could potentially be spent more than once. Bitcoin addresses this issue through its decentralized ledger system, where each transaction is confirmed by miners and recorded on the blockchain. By requiring consensus from multiple independent nodes, Bitcoin ensures that each transaction is unique and irreversible, which is paramount for maintaining trust in a digital currency.

This solution to double-spending is central to Bitcoin’s appeal, as it offers a transparent and secure framework for transactions without reliance on intermediaries. The decentralized nature of this verification process not only enhances security but also protects against manipulation by malicious actors. As more businesses begin to accept Bitcoin, understanding how this fundamental problem is solved is essential for realizing the potential of digital currencies in everyday transactions.

Bitcoin’s Fixed Supply: Implications for Investors

One of the defining characteristics of Bitcoin is its fixed supply, capped at 21 million coins. This scarcity is built into Bitcoin’s code and is integral to its value proposition. Unlike fiat money, which governments can print indefinitely, Bitcoin’s limited supply instills a sense of assurance for investors looking to protect their wealth. As demand for Bitcoin increases, particularly in times of economic uncertainty, its finite nature may drive prices higher, making it an appealing investment prospect for those seeking to hedge against inflation.

The implications of Bitcoin’s fixed supply extend beyond investment strategies. Economically, this cap fosters a deflationary environment, contrasting sharply with the inflationary nature of traditional fiat currencies. Investors need to understand how Bitcoin’s issuance through mining decreases over time due to halving events, which reduces the reward miners receive for adding new blocks to the blockchain. This gradual reduction is designed to maintain scarcity and ultimately support the narrative of Bitcoin as ‘digital gold’ in the financial market.

Privacy and Anonymity in Bitcoin Transactions

While Bitcoin transactions are logged on a public ledger, user privacy remains a significant concern. Bitcoin addresses, which represent users in transactions, do not reveal personal information; however, they can be traced, leading to potential threats to privacy. This is where specialized Bitcoin privacy techniques come into play, enabling users to enhance their transactional anonymity. By employing methods such as mixing services or privacy-focused wallets, users can safeguard against unwanted scrutiny and maintain greater control over their digital identities.

Moreover, understanding Bitcoin privacy is crucial as regulatory bodies worldwide increasingly scrutinize cryptocurrency transactions. Users need to be aware of the implications of using Bitcoin in terms of compliance with legal frameworks while also striving to maintain their financial privacy. This balance between transparency and anonymity is not just a technical challenge but also an existential question for the future of cryptocurrencies and their role in a rapidly digitizing world.

Frequently Asked Questions

What are the Bitcoin basics everyone should understand?

Understanding Bitcoin basics involves grasping its key features such as decentralization, trustlessness, and permissionless transactions. Bitcoin is a peer-to-peer electronic cash system created by Satoshi Nakamoto to solve issues stemming from traditional banking. With a capped supply of 21 million coins, it serves as a digital gold and a reliable store of value.

Who is Satoshi Nakamoto and what is the Bitcoin white paper?

Satoshi Nakamoto is the pseudonymous founder of Bitcoin, who published the Bitcoin white paper in 2008. This document outlines the technical foundations of Bitcoin and the concept of the blockchain as a decentralized transaction system that eliminates the need for middlemen like banks.

How does Bitcoin mining work and why is it important?

Bitcoin mining is the process by which transactions are verified and added to the Bitcoin blockchain. Miners compete to solve complex mathematical problems, and the first to solve one gets to add a new block to the blockchain and earn Bitcoin as a reward. This process is crucial for maintaining the security and integrity of the Bitcoin network.

What problem does Bitcoin solve in financial transactions?

Bitcoin solves the Byzantine generals’ problem, which addresses the challenge of achieving consensus among untrustworthy participants. Through its decentralized network and proof-of-work consensus mechanism, Bitcoin allows strangers to agree on a single version of the truth without relying on a central authority, making it resistant to censorship.

How does the Bitcoin blockchain ensure security and trust?

The Bitcoin blockchain is a decentralized public ledger where all transactions are recorded securely across numerous computers. By linking each block with cryptographic hashes, it ensures that any alteration to a single block invalidates the entire chain, preventing manipulation and maintaining trust among users.

What is the difference between Bitcoin and Satoshis?

Bitcoin (BTC) refers to the cryptocurrency as a whole, while ‘Satoshis’ are the smallest units of Bitcoin, much like cents to dollars. One Bitcoin equals 100 million Satoshis, making it possible to conduct transactions of varying sizes, which enhances its usability as a digital currency.

Why is the fixed supply of 21 million Bitcoin significant?

The fixed supply of 21 million Bitcoin is a key feature designed to combat inflation. Unlike fiat currencies that can be printed indefinitely, Bitcoin’s capped supply, controlled by its underlying code, assures scarcity, thereby preserving its value over time and making it a reliable store of wealth.

What does ‘Not your keys, not your coins’ mean in Bitcoin?

This phrase highlights the importance of controlling your private keys when holding Bitcoin. Without access to your private key, you do not truly own your Bitcoin, as your funds are at risk if left on exchanges or wallets controlled by third parties. Self-custody is essential for secure Bitcoin ownership.

How does Bitcoin maintain privacy for users?

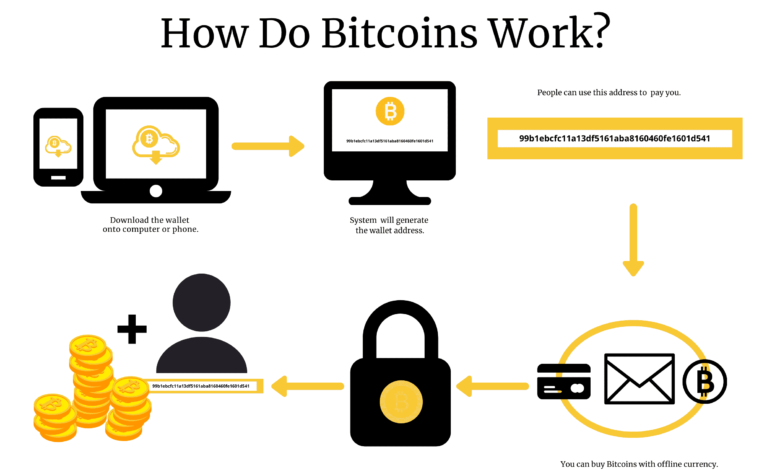

Bitcoin enhances user privacy through public addresses that can be generated for each transaction. While transactions are publicly recorded, the addresses help to mask users’ identities, akin to a PO Box, thereby providing a layer of anonymity while still ensuring transparency in the blockchain.

Why is Bitcoin considered a good store of value?

Bitcoin is regarded as digital gold due to its scarcity, with a capped supply ensuring that inflation does not devalue it like fiat currencies. Its decentralized nature and resistance to censorship also contribute to its utility as a secure and reliable store of value in uncertain economic climates.

How does Bitcoin deal with the double-spending problem?

Bitcoin utilizes a decentralized public ledger to prevent double-spending, ensuring that each transaction is verified by a network of independent nodes. This system maintains a record of Unspent Transaction Outputs (UTXOs) to track ownership and safeguard against the potential of spending the same Bitcoin twice.

What are the benefits of running a Bitcoin node?

Running a Bitcoin node provides users with greater control over their transactions and contributes to network security by verifying and relaying transactions. Nodes enforce Bitcoin’s rules and help maintain decentralization, allowing users to operate independently without relying on third parties.

How does Bitcoin handle transaction fees and miner rewards?

Bitcoin transactions may incur fees, which miners prioritize based on fee levels to include them in blocks. Miners receive rewards in the form of newly minted Bitcoin, combined with the transaction fees from users, incentivizing them to secure the network by processing and confirming transactions.

What is the blockchain trilemma and how does Bitcoin address it?

The blockchain trilemma posits that a blockchain cannot maximize decentralization, security, and scalability simultaneously. Bitcoin prioritizes decentralization and security while exploring layer-two solutions like the Lightning Network to improve scalability without compromising its core principles.

Is Bitcoin mining harmful to the environment?

While Bitcoin mining does consume significant energy, advocates argue that it can play a role in renewable energy utilization, acting as a flexible buyer for excess power generation. Thus, the energy used in Bitcoin mining can potentially contribute positively to energy transition efforts.

Why is Bitcoin preferred over altcoins by many investors?

Bitcoin’s market dominance stems from its established security, reliability, and decentralization, which newer altcoins often sacrifice for speed or features. As the first successful cryptocurrency, Bitcoin’s proven track record and reliability make it the preferred choice for many investors.

Why don’t governments widely ban Bitcoin?

Banning Bitcoin outright is challenging due to its decentralized nature with no central authority to target, making it nearly impossible to enforce. Moreover, as certain countries, including El Salvador, embrace Bitcoin, the financial incentives and benefits to the economy often outweigh potential prohibitions.

| Key Points | Description |

|---|---|

| Understanding Bitcoin | A digital, decentralized currency designed to be a store of value. |

| Satoshi Nakamoto | The pseudonymous creator of Bitcoin, who published its foundational white paper in 2008. |

| Decentralization | Bitcoin operates without a central authority, relying on a global network for security and rule enforcement. |

| Trustlessness | Transactions are validated without a middleman, ensuring fairness without censorship. |

| Limited Supply | Bitcoin’s supply is capped at 21 million coins, providing protection against inflation. |

| Mining and Nodes | Miners process transactions and secure the network, while nodes ensure adherence to rules. |

| Blockchain | A public ledger that records all Bitcoin transactions, ensuring transparency and immutability. |

| The Byzantine Generals Problem | Bitcoin solves this problem by allowing a decentralized consensus without trust. |

| Self-Custody | Users must manage private keys, adhering to the principle ‘Not your keys, not your coins.’ |

| Privacy | Bitcoin offers privacy through the use of public addresses and emphasizes user control. |

| Energy Consumption Debate | Despite criticisms, Bitcoin’s energy use supports a decentralized network and prevents manipulation. |

| Regulatory Perspective | Governments find it difficult to ban Bitcoin due to its decentralized nature. |

Summary

Understanding Bitcoin is key to grasping the future of finance. Bitcoin operates in a decentralized ecosystem that challenges traditional currency systems by providing a limited supply, robust security through mining and nodes, and a transparent ledger for all transactions. Despite criticisms regarding energy consumption, Bitcoin represents a revolutionary shift in how value is stored and transferred globally. As countries begin to acknowledge its potential, the landscape of finance is shifting towards adaptability, transparency, and resilience, emphasizing the importance of educating oneself on Bitcoin.