US Bombs Iran: What Traders Are Wagering Now

US Bombs Iran, escalating tensions in a volatile geopolitical landscape. The announcement of airstrikes on Iranian nuclear sites has set off a flurry of predictions and wagers in the prediction markets, reflecting heightened concerns about the future of the Middle East conflict. As President Trump declared the attacks a success, questions loom over potential Iranian retaliation and the repercussions that might follow. These events have intensified discussions around the US-Iran nuclear deal, with many keenly interested in how this military action could influence diplomatic relations. Betting platforms have become a barometer for public sentiment, indicating a mix of optimism and apprehension about what lies ahead.

The recent military offensive against Iran has triggered widespread speculation about the next course of action in this longstanding conflict. With targeted airstrikes reportedly disrupting Iranian nuclear facilities, analysts are evaluating the implications for regional stability and the broader implications for international relations. Speculation surrounding the impact on potential nuclear agreements—such as the US-Iran nuclear deal—has prompted traders to engage in prediction markets, where they forecast possible outcomes, including regime change and escalated military intervention. The rapidly changing dynamics in the Middle East are a focal point for both policymakers and the public, as they navigate the intricacies of war, peace, and diplomacy in a region marked by historical tumult.

Overview of U.S. Military Actions in Iran

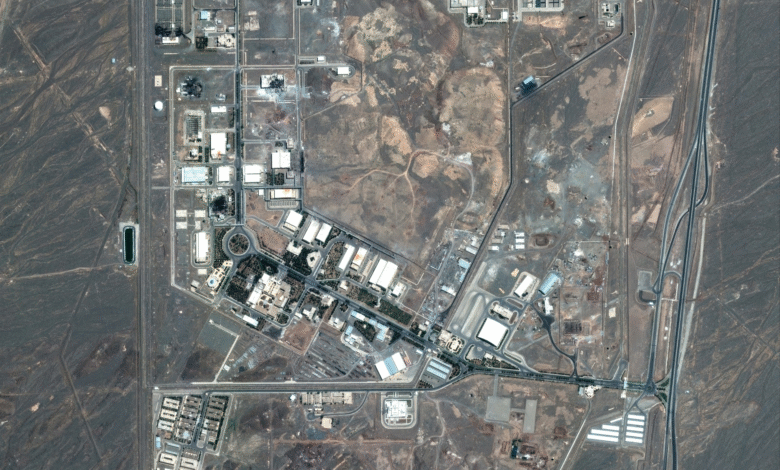

The recent announcement regarding U.S. airstrikes on Iran has significantly heightened tensions in the Middle East conflict, drawing various reactions from both domestic and international observers. President Donald Trump declared these strikes as successful procedures targeting critical nuclear sites such as the Fordow facility. This military action, particularly striking at the heart of Iran’s nuclear aspirations, marks a pivotal escalation in U.S.-Iran relations, which have experienced significant friction under the pressures of geopolitical risks and predictions surrounding future engagements.

As we analyze the ramifications of these airstrikes, it’s vital to consider the impact they have on prediction markets that are responding in real-time to the situation. With traders now debating the likelihood of further military action, regime changes, or even the possibility of striking new deals, the ripple effect of these military moves extends beyond the U.S.-Iran dynamic. Experts are keenly observing how these military engagements could reshape the broader narrative of geopolitical relationships in the Middle East and affect long-standing agreements such as the US-Iran nuclear deal.

Prediction Markets and Their Role in Measuring Public Sentiment

Following the U.S. bombing of Iran, the surge of activity in prediction markets showcases how traders are keenly assessing the unfolding situation. For instance, markets like Kalshi and Polymarket now engage in various predictions regarding potential outcomes following the strikes. With questions circulating about whether key sites would remain operational or whether retaliatory measures would be enacted by Iran, these platforms effectively encapsulate the public’s sentiment regarding the likely developments and strategic decisions moving forward.

Moreover, the data from prediction markets offers crucial insights into the perceived geopolitical risks among investors. Traders are placing their bets on highly consequential questions – the potential for a nuclear deal, the likelihood of military invasions, or even the chances of significant regime changes in Iran. This reaction can be seen as a reflection of the uncertainty that characterizes modern conflict, revealing a society that is not only closely watching these events but actively engaging in an informed conjecture about the future.

Consequences of U.S. Airstrikes on Iranian Nuclear Sites

The targeted U.S. strikes on Iranian nuclear facilities underscore a fundamental shift in military strategy regarding nuclear proliferation in the Middle East. By targeting sites like Fordow, which the U.S. considers vital to Iran’s nuclear ambitions, the strikes serve not only as a military operation but also as a psychological maneuver aimed at deterring further development. However, questions linger regarding the actual effectiveness of these airstrikes, particularly when independent reports suggest that key facilities remain intact, raising doubts about the true impact of this military action.

Additionally, the long-term consequences of these strikes could be profound, with increased geopolitical risk looming over the region. The potential for Iran to retaliate underscores a cycle of hostility that can lead to escalated conflicts. Observers speculate that such retaliation could result in an armed response from the U.S., further complicating the existing relationships among Middle Eastern countries and risking broader regional stability.

This dynamic illustrates the complex interplay between military actions and diplomatic negotiations. The hope for achieving a lasting peace through the U.S.-Iran nuclear deal is now overshadowed by heightened tensions, challenging the prospects for any upcoming diplomatic discussions.

The Ongoing Gamble of War in the Middle East

As the situation between the U.S. and Iran unfolds, the concept of the ‘gamble of war’ resonates strongly. With lives, national security, and international relationships at stake, prediction markets become a fascinating lens through which to view this military conflict. Investors are not just placing bets—they are responding to real feelings of anxiety centered on military escalation, potential nuclear threats, and their broader implications for global stability in the Middle East.

The current activities in these prediction markets, including bets on the likelihood of further military engagements, emphasize that people are not only concerned about immediate outcomes but are also analyzing the longer-term repercussions of U.S. foreign policy. Such speculation may act as a form of public discourse on military involvement, reflecting underlying sentiments on the efficacy of intervention that move us closer to or further away from peace.

The Impact of Geopolitical Risks on Global Markets

The recent U.S. airstrikes on Iranian nuclear facilities have triggered a wave of reactions that extend well beyond the immediate conflict. Investors and analysts are closely monitoring geopolitical risks, which have substantial implications for global markets. The uncertainty surrounding military engagements often leads to fluctuations in oil prices, investment behaviors, and overall market stability, making it crucial to understand how such events influence economic sentiment.

Market reactions to these tensions mirror fears of potential outcomes, whether that involves escalated military actions or negotiations that could reshape alliances. Trading patterns indicate a blend of cautious optimism and trepidation regarding future dealings, such as the prospect of a U.S.-Iran nuclear deal. Ultimately, as the threat of conflict looms large, the intricacies of local tensions magnify sentiments felt in global financial exchanges.

Potential Outcomes of U.S.-Iran Relations

The prognosis for U.S.-Iran relations remains clouded by uncertainty in the wake of recent military actions. Analysts are speculating about a variety of potential outcomes, from heightened military tensions leading towards direct conflict to diplomatic engagements that might provide pathways to peace. The inevitability of geopolitical risk is effectively palpable, as observation and analysis of public sentiment via prediction markets illustrate the broader implications of these tangled relations.

In addition, the engagement in prediction markets allows a window into potential public responses to various scenarios related to U.S. bombing of Iran. From betting on regime change to the likelihood of renewed nuclear discussions, each wager reflects prevailing sentiments about these negotiations. As historical context shows, the path to brokering a sustainable peace has often been non-linear, shaped by both aggressive posturing and the pursuit of mutual interests.

The Response of the Iranian Regime to U.S. Actions

In the wake of airstrikes, the Iranian government’s reaction becomes crucial in assessing the territorial and military responses that may unfold. As President Trump warned of severe repercussions for any retaliation against the U.S., analysts are keen on whether Iran will take bold steps that escalate tensions further. Historically, Iran’s actions have often been proportional, but the current geopolitical atmosphere suggests that stakes could drive them toward more aggressive postures.

Such calculations surrounding Iran’s response not only contribute to the narrative of imminent conflict but also invigorate discussions in prediction markets. Traders are attempting to assess the probability of various responses from Iran, as well as the ramifications these could have on regional stability. Should Iran decide to retaliate, the implications could cascade into a broader Middle Eastern conflict, impacting nations and economies globally.

The Future of the U.S.-Iran Nuclear Deal

Despite the turbulence created by recent airstrikes, the pivot back to diplomatic pathways remains an area of speculation among experts following the U.S.-Iran nuclear deal. The odds in prediction markets hint at continued interest in discussions forming around potential negotiations, but trust has been severely eroded following military actions. This uncertainty creates an environment where analysts are forced to reconcile the potential for dialogue with the delicate balancing of military deterrence.

While some traders see a 32% chance of a nuclear deal being reached by year’s end, the long-term sustainability of such agreements becomes a topic of great debate. Future talks would support the need for transparency and mutual concessions, although the backdrop of military confrontation complicates these efforts. In essence, the volatility present in the U.S.-Iran relationship underscores the larger narrative of diplomatic caution amid military unpredictability.

Implications for U.S. Foreign Policy Going Forward

The bombing of Iranian nuclear sites adds a layer of complexity to U.S. foreign policy that is critical to understanding future interactions with Iran and the broader Middle East. Each military act by the U.S. serves not only as a short-term measure but also creates longer-lasting perceptions that could influence U.S. diplomatic avenues in the region. Following these confrontations, potential military engagements spark discourse among policymakers regarding the best approaches to avoid an escalation that could unintentionally draw in other nations.

Moreover, the informal wagers being placed on prediction markets reflect a societal urge to understand not only military policies but the broader implications such actions have on American credibility in international politics. As foreign policy evolves amid these challenges, the overarching goal remains the prevention of nuclear proliferation while navigating complex relationships effectively.

Frequently Asked Questions

What are the implications of the US bombing Iran’s nuclear sites?

The US bombings of Iran’s nuclear sites, such as Fordow, escalate geopolitical risks in the Middle East. This military action raises concerns about Iran’s response and the potential for increased conflict. It also influences trading activity in prediction markets, where speculators assess outcomes such as regime changes, military escalation, and future nuclear deals.

How do prediction markets react to the US’s recent bombing of Iran?

Following the US’s bombing of Iran, prediction markets have indicated heightened activity, with bets placed on various scenarios including the likelihood of an invasion or regime collapse in Iran. For instance, current odds suggest a 68% chance that the Fordow site will be destroyed before July, reflecting trader sentiments on the escalating conflict.

What factors contribute to the geopolitical risks following US airstrikes on Iran?

After the US airstrikes on Iran, factors such as Iran’s potential retaliation, the stability of the current regime, and ongoing negotiations regarding the US-Iran nuclear deal significantly contribute to geopolitical risks. Additionally, speculation in prediction markets highlights concerns over military actions and the fragility of peace in the region.

What predictions are being made in markets about US-Iran relations after the bombings?

Prediction markets show a variety of forecasts regarding US-Iran relations after the recent bombings. Traders currently estimate a 36% chance of a US-Iran nuclear deal being reached by year-end and a 20% likelihood of further airstrikes on Iran’s nuclear facilities, indicating heightened uncertainty in diplomatic outcomes.

Will US bombing actions lead to greater military involvement in Iran?

The recent US bombings raise concerns about increased military involvement in Iran, with prediction markets suggesting a 14% probability of a US invasion this year. The potential consequences of further Iranian retaliation could drive the US into deeper military engagement, significantly amplifying the existing Middle East conflict.

How does the US bombing of Iran affect nuclear deal negotiations?

The US’s bombing of Iran complicates nuclear deal negotiations, as military actions add layers of mistrust and provoke responses from Iran. Current prediction markets indicate a 36% chance that a nuclear agreement might be forged by year’s end, but ongoing airstrikes could hinder diplomatic progress.

What is the significance of the Fordow nuclear site in the context of US-Iran tensions?

The Fordow nuclear site is strategically significant as it is deeply buried and heavily fortified, making it a tough target for US bombings. Its continued operational status following US airstrikes fuels tensions in US-Iran relations and influences predictions related to future military actions and diplomatic negotiations.

How are traders assessing the chances of US-Iran conflict escalation post-bombing?

Traders are actively assessing the chances of conflict escalation post-bombing through prediction markets. Current odds indicate a 20% chance of additional strikes targeting Iran’s nuclear sites and a 50% likelihood of Iran closing the Strait of Hormuz, highlighting the heightened sensitivity to the evolving geopolitical landscape.

| Key Points | Details |

|---|---|

| US Bombs Iran | On a Saturday evening, President Trump announced successful U.S. airstrikes on Iranian nuclear sites. |

| Geopolitical Implications | Trump warned of severe repercussions if Iran retaliates. Predictions about the consequences are being actively wagered on by traders. |

| Prediction Markets Activity | Prediction markets like Kalshi and Polymarket are experiencing increased betting on potential outcomes, including invasion, regime change, and nuclear deals. |

| Current Betting Statistics | – 68% chance the Fordow facility will be destroyed by July. – 50% chance Iran will close the Strait of Hormuz by July. – 32% chance of a nuclear deal by year’s end. – 20% chance the U.S. recognizes Reza Pahlavi as Iran’s leader. |

| Military Considerations | Fordow’s depth makes it a challenging target for U.S. bombers, despite heavy bombs being used in recent strikes. |

| Future Predictions | The political landscape is volatile, with ongoing speculation around U.S. and Iranian responses to recent escalations. |

Summary

US Bombs Iran marks a significant escalation in U.S.-Iran tensions and has ignited a flurry of speculation among analysts and traders alike. With Trump’s announcement of airstrikes, the geopolitical scenario has become even more unpredictable, prompting intense discussions around potential future conflict, diplomatic engagements, and the stability of the region. As prediction markets show varying confidence in outcomes like the destruction of Iranian nuclear facilities and the possibility of regime change, global observers are closely monitoring the next moves from both the U.S. and Iran, highlighting the critical and multifaceted nature of this evolving situation.