US Dollar Dominance Under Threat from Global Alternatives

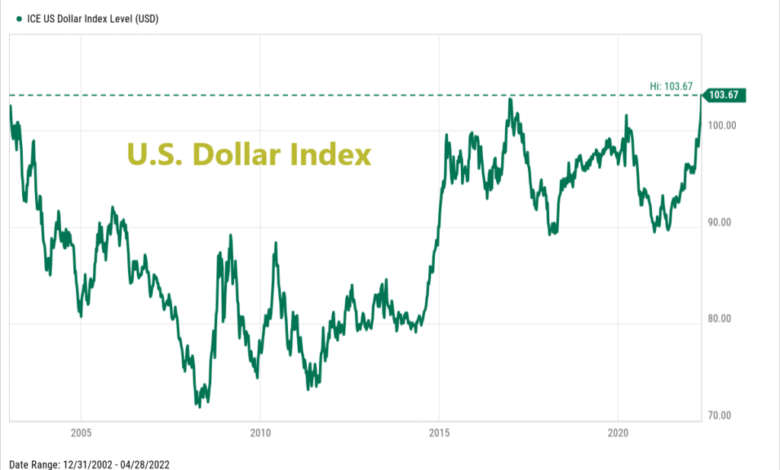

US Dollar Dominance is under increasing scrutiny as the global landscape shifts amidst geopolitical tensions. With nations like Russia reacting against U.S. sanctions, there is a growing movement toward de-dollarization, signaling a challenge to America’s financial supremacy. Politicians argue that the aggressive use of US payment systems as tools for political leverage has inadvertently forced other countries to explore alternative currencies and financial structures. This pivot includes discussions within international coalitions, such as BRICS, suggesting a long-term move towards a multi-currency system that could reshape global financial dominance. As these changes unfold, the implications for international trade and economics could be profound, impacting everything from exchange rates to global market stability.

The supremacy of the U.S. dollar as the dominant global currency is increasingly being questioned. Some analysts suggest that the recent trends in international finance indicate a shift towards alternative currencies, driven by rising tensions and punitive measures like sanctions imposed by the U.S. government. This phenomenon not only raises concerns regarding the dollar’s future but also highlights the possibility of new financial frameworks emerging, including systems aimed at reducing dependence on the dollar. Such discussions around diversifying currency use reflect an evolving landscape where countries seek to safeguard their economic interests outside of American influence. As the world navigates these changes, the concept of a multi-currency system may become pivotal in redefining how global commerce is conducted.

The Shift Toward De-Dollarization

De-dollarization has emerged as a significant trend in the global financial landscape, driven primarily by nations seeking to reduce their reliance on the U.S. dollar. This strategy is gaining momentum as countries like Russia and China advocate for alternative currencies in trade, aiming to establish a more balanced economic ecosystem. As more nations voice their intent to decrease dollar dependence, the traditional dominance of the dollar in international trade faces increasing scrutiny, leading to comprehensive discussions on various currency alternatives.

The push for de-dollarization is also influenced by geopolitical tensions and the economic sanctions imposed by the United States. Many countries view these sanctions as tools of financial coercion that limit their economic sovereignty. As a result, there is a growing desire for a multi-currency system that promotes inclusivity and resilience in global trade. Countries are exploring bilateral trade agreements and regional currencies, showcasing a clear shift toward diversifying away from the dollar.

US Dollar Dominance Challenges Amid Global Turbulence

The dominance of the US dollar is increasingly challenged by various geopolitical dynamics, particularly as sanctions against nations like Russia reveal vulnerabilities in the U.S. financial system. Countries that have been on the receiving end of U.S. sanctions are initiating discussions on alternative payment systems that bypass traditional dollar-based frameworks. This trend not only showcases the limitations of dollar dominance but also reflects a wider push for a more inclusive and equitable global financial architecture.

Furthermore, the reliance on US payment systems has become contentious, prompting nations to seek alternatives that diminish the risk of economic isolation. The sanctions strategy has inadvertently catalyzed a response among countries to forge financial alliances that operate outside of the dollar’s influence. By advocating for a multi-currency approach, these nations aim to create a financial environment where trade can continue unfettered by political pressures, signaling a pivotal moment in reshaping global financial dominance.

The Role of BRICS in Shaping Financial Alternatives

The BRICS coalition, comprising Brazil, Russia, India, China, and South Africa, is directly involved in discussions surrounding the potential shift away from dollar dependence. These countries are exploring financial mechanisms that promote regional currencies and enhance trade relationships while decreasing reliance on the U.S. dollar. While there are concerns about completely eliminating the dollar, the coalition’s initiatives emphasize fostering a multi-currency ecosystem that supports equitable trading practices among member states.

BRICS leaders have recognized the importance of diversifying their economic ties and are determined to create a platform that supports this vision. By diversifying payment systems and negotiating trade agreements that prioritize alternative currencies, BRICS aims to mitigate the risks posed by U.S. sanctions. The discussions around creating a multi-currency system reflect a critical shift in how global trade can be structured, ensuring that countries are not entirely beholden to the fluctuations and policies dictated by Washington.

Sanctions as Catalysts for Change in Global Finance

Sanctions imposed by the United States have acted as catalysts, prompting several nations to reconsider their financial strategies and explore alternative systems of trade. Many nations, feeling the pressure of economic isolation, have sought to establish trade agreements that rely on currencies other than the dollar. This has sparked a reevaluation of traditional financial dependencies and paved the way for innovative approaches to international commerce.

In this shifting landscape, nations are increasingly participating in dialogues around creating multi-currency frameworks to facilitate legitimate trade without the constraints of U.S. payment systems. By adopting diverse currencies in international transactions, countries can safeguard their economic interests while diminishing the impact of sanctions. This paradigm shift reflects a broader trend towards a more decentralized and resilient global economy.

International Responses to U.S. Financial Policies

International responses to U.S. financial policies, particularly those pertaining to sanctions, have led to widespread discussions regarding the future of global financial dominance. Many countries criticize the unilateral approach taken by the U.S. in using its dollar-based systems as leverage against adversaries. Such criticisms have prompted calls for a more democratic approach to international finance, which centers on inclusivity and empowerment through diversified currencies.

The backlash against U.S. financial policies has led countries to seek alliances that prioritize mutual economic interests. In the wake of sanctions, nations such as China and Russia have increased their efforts to establish bilateral trade agreements that utilize their own currencies, emphasizing the need for a transition towards a multi-currency system. This collaboration underscores a collective effort to establish a more balanced global economic framework.

Emerging Trends in Currency Alternatives

Emerging trends in currency alternatives are reshaping how nations conduct trade and interact financially. As discussions around de-dollarization gain traction, countries are exploring innovative frameworks that allow for currency exchange without relying solely on the U.S. dollar. This shift reflects a growing consensus that a diversified financial system can enhance economic stability and resilience in the face of external pressures.

Several countries are now actively piloting initiatives that involve the use of alternative currencies, driven by the realization that a multi-currency system can potentially mitigate the influence of hegemonic powers. Additionally, technological advancements in blockchain and digital currencies are paving the way for new solutions that facilitate smoother transactions while minimizing transaction risks tied to U.S. financial policies. As nations continue to adapt, the future of global finance appears poised for noteworthy transformations.

Future Perspectives on Global Financial Architecture

The future of global financial architecture is increasingly being influenced by the ongoing debates surrounding US dollar dominance and the ramifications of geopolitical tensions. Conversations oriented toward establishing a more balanced system reflect a collective desire to reimagine how international exchanges are conducted. The call for a multi-currency system is gaining momentum as countries express their aspirations for a new financial order that prioritizes inclusivity and fairness.

In envisioning a more equitable financial landscape, nations are assessing the mechanisms that can facilitate robust trade relationships outside the constraints of dollar-based systems. This exploration involves not only traditional currencies but also innovative approaches that incorporate advancements in technology and digital finance. As global stakeholders rally around the idea of redefining financial norms, the transition towards an alternative economic paradigm appears increasingly achievable.

The Implications of US Sanctions on Global Trade

US sanctions have significant implications for global trade, affecting not only the targeted nations but also impacting international business relationships and trade dynamics. Countries feeling the strain of these sanctions are actively looking for ways to circumvent them by adopting alternative trading methods, which often include the use of other currencies. The reliance on the US dollar for transactions has become a double-edged sword, compelling many nations to seek independence from U.S. financial influence.

Furthermore, the implications extend to regional trade agreements and partnerships, as nations explore robust frameworks that can sustain legitimate trade without falling under the pressures of U.S. sanctions. This proactive approach has resulted in the formation of coalitions among countries advocating for multi-currency systems, signifying a strategic pivot towards establishing a new norm in international finance that reduces the unilateral influence of the U.S.

Collaborative Efforts in Establishing Payment Systems

Collaborative efforts among nations are pivotal in establishing new payment systems that challenge existing financial paradigms. Countries are beginning to unite their interests to form partnerships that focus on developing alternative payment mechanisms that operate independently of U.S.-centric systems. Such collaboration arises from the mutual understanding that reliance on the dollar can lead to vulnerabilities in times of adverse geopolitical developments.

These collaborative initiatives include creating frameworks that facilitate transactions in various currencies and utilizing technology to enhance security and efficiency. By embracing a multi-currency approach, nations can forge a financial landscape that supports equitable trade practices while diminishing the impact of sanctions. The collective drive towards establishing robust payment systems speaks to a growing recognition of the need for financial sovereignty and resilience in the global economy.

Frequently Asked Questions

How is US Dollar Dominance affected by de-dollarization efforts?

US Dollar Dominance is increasingly challenged by de-dollarization efforts as countries seek alternatives to the dollar for international trade. This process involves diversifying away from reliance on the dollar, thereby reducing its supremacy in global finance. Such movements are often driven by geopolitical tensions, particularly as nations respond to U.S. sanctions.

What impact do Russia sanctions have on US Dollar Dominance?

Russia sanctions have significantly impacted US Dollar Dominance by prompting countries to explore alternatives to U.S.-based payment systems. As nations face the risk of being cut off from dollar-denominated transactions, many are seeking to establish financial systems that minimize reliance on the dollar, thus contributing to the erosion of its global financial dominance.

In what ways are alternatives to US Dollar Dominance emerging?

Alternatives to US Dollar Dominance are emerging through initiatives such as the promotion of a multi-currency system, where countries collaborate to enable trade in various currencies. Additionally, organizations like BRICS are discussing collaborative frameworks that reduce the dollar’s role in international settlements, providing a decentralized approach to global finance.

Can US payment systems remain effective amidst the push for de-dollarization?

While US payment systems currently play a crucial role in global transactions, the ongoing push for de-dollarization poses challenges to their effectiveness. As more countries pursue alternatives to the US dollar, these payment systems may face diminished use, leading to an overall reduction in US Dollar Dominance and its influence in international markets.

What role does political coercion play in the decline of US Dollar Dominance?

Political coercion plays a significant role in the decline of US Dollar Dominance, as countries like Russia have expressed concerns over U.S. sanctions that leverage the dollar as a tool of pressure. Such actions often backfire by driving nations to seek alternative currencies, thereby undermining the dollar’s uncontested status in global trade.

What is a multi-currency system and how does it challenge US Dollar Dominance?

A multi-currency system allows multiple currencies to co-exist for international transactions, challenging US Dollar Dominance by providing countries with options beyond the dollar. This system advocates for equitable access to trade settlements, reflecting a shift towards a more inclusive financial environment that reduces the dollar’s centrality in global finance.

| Key Points | Details |

|---|---|

| Accusations Against Biden | Russian officials blame Biden for the decline of the USD’s dominance in global finance. |

| Use of Sanctions | Sanctions are viewed as tools of political coercion that have forced nations to seek alternatives to the dollar. |

| Impact on Global Finance | Biden’s strategy is said to be backfiring, with countries exploring options beyond the USD. |

| Response to De-Dollarization | Zakharova states that discussions among BRICS countries do not aim to completely eliminate the dollar but to enhance financial inclusivity. |

| Future of Currency Systems | There is a call for a multi-currency system to ensure fair access to trade settlements. |

Summary

US Dollar dominance is currently under fire as nations affected by sanctions are seeking alternatives to the traditional financial systems. This shift highlights the vulnerabilities inherent in U.S. economic policies, particularly as some countries begin to challenge the dollar’s unparalleled status. The actions of the Biden administration, particularly regarding sanctions, are seen as pivotal in provoking this search for alternative currencies, leading to discussions of a multi-currency approach aimed at ensuring equitable trade access on a global scale.