USDT Laundering: $4 Million Stolen in Kenyan Bank Heist

USDT laundering has emerged as a critical issue in recent financial crime cases, notably involving a notorious Kenyan bank heist where approximately $4 million was siphoned off by insiders exploiting IT security breaches. The seamless flow of USDT, a widely-used stablecoin, facilitated the laundering of these funds through intricate networks of offshore wallets, making the recovery of the stolen assets increasingly challenging. As investigations unfold, the collaboration between the Directorate of Criminal Investigations and the bank’s cybersecurity team shines a light on the pressing need for stringent digital asset regulation to safeguard against such illicit activities. With Kenya’s Financial Intelligence Centre already on high alert regarding cryptocurrency laundering, this incident could catalyze significant reforms in how virtual assets are monitored and controlled. The complexities of this case underline not only the vulnerabilities within financial systems but also the urgent call for enhanced governance to combat the evolving landscape of digital crime in Kenya.

The recent theft of funds from a Kenyan financial institution exemplifies the rising tide of cryptocurrency misuse, with illicit activities being masked through processes like digital asset cleansing. Terms such as cryptocurrency washing or asset laundering reflect the sophisticated methods employed by criminals to conceal their tracks and legitimize stolen funds. This case underscores the broader implications of financial crimes in Kenya, where regulatory bodies must grapple with ensuring that emerging technologies like stablecoins do not become enablers of such wrongdoing. Additionally, incidents of IT breaches within banking infrastructures highlight the vulnerabilities that criminals exploit to access sensitive information. As the landscape of digital finance evolves, so too does the necessity for improved compliance and risk strategies to protect institutions from the repercussions of financial malfeasance.

Understanding the Role of USDT in Financial Crimes

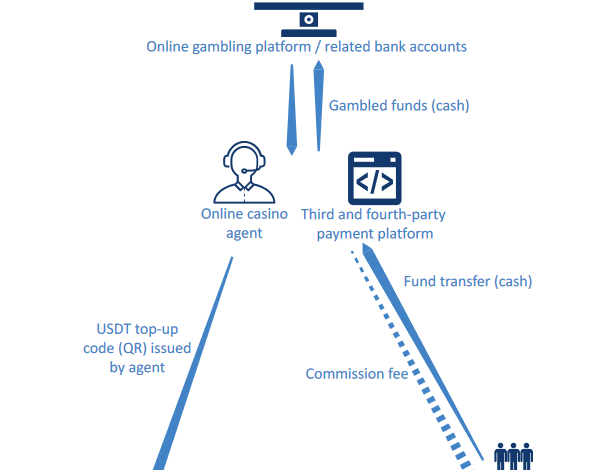

USDT, or Tether, has become a pivotal asset in the world of cryptocurrency, especially in the context of financial crimes such as money laundering. The recent Kenyan bank heist involving the fraudulent transfer of $4 million highlights how criminals exploit digital currencies to obfuscate the trail of illicit activities. By converting stolen funds into USDT, the perpetrators were able to transfer large sums of money swiftly and anonymously, effectively covering their tracks. This type of cryptocurrency laundering poses serious risks not only to banks but also to the broader financial ecosystem as it challenges conventional regulatory frameworks.

The utilization of USDT in laundering operations is particularly alarming in Kenya, where the government’s efforts to crack down on financial crimes are still evolving. With a landscape marked by IT security breaches and inadequate regulation of digital assets, criminals leverage USDT’s stability and anonymity to facilitate transactions that would otherwise raise red flags in traditional banking systems. The Kenyan banking sector needs to enhance its cybersecurity measures and develop more robust monitoring systems to detect and prevent such crimes, ensuring that the integrity of financial transactions is preserved.

The Impact of Cryptocurrency Laundering on Kenyan Banks

Cryptocurrency laundering not only threatens individual banks but also undermines the entire financial sector’s stability in Kenya. The recent breach involving a major Kenyan bank, where contractors exploited their insider knowledge to carry out a heist, demonstrates how internal vulnerabilities can be exploited. The investigation by the Directorate of Criminal Investigations (DCI) underscores the critical need for financial institutions to re-evaluate their internal controls and access permissions. As the banking sector increasingly adopts digital services, the risk associated with IT breaches looms larger.

Moreover, the repercussions of this event extend beyond immediate financial losses; they impact consumer trust and can lead to significant regulatory implications. As the government seeks to enforce stricter regulations under the Capital Markets (Amendment) Bill, banks must transition to better risk management practices. Addressing cryptocurrency laundering necessitates a collaborative effort among banks, fintech companies, and regulatory bodies to create a more secure infrastructure against financial crimes in Kenya.

Strengthening IT Security Against Digital Asset Regulation

The theft of $4 million from a Kenyan bank underscores the urgent need to bolster IT security measures in financial institutions. As digital asset regulation continues to evolve, banks must adopt advanced security protocols to protect against potential breaches. Implementing multi-factor authentication, continuous monitoring of transactions, and regular security audits are critical steps that can mitigate risks associated with cryptocurrency laundering and financial crimes. Without such measures, banks remain susceptible not only to internal collusion but also to external cyber threats.

Regulatory bodies in Kenya, including the Financial Intelligence Centre, play a pivotal role in shaping the regulatory landscape for digital assets. Recent incidents serve as wake-up calls for these institutions to enforce stricter compliance and reporting standards. Financial institutions should prioritize educating employees about the implications of IT security breaches and instilling a culture of vigilance. This proactive approach will not only safeguard assets but will also enhance the overall integrity of the financial system, thereby fostering consumer confidence in digital banking services.

Future of Crypto Regulation in Kenya Post-Breach

The implications of the recent banking heist in Kenya may significantly reshape the landscape of cryptocurrency regulation in the country. With the involvement of USDT in laundering operations, the necessity for comprehensive regulations becomes more apparent. The anticipated reforms under the Capital Markets (Amendment) Bill may introduce stricter guidelines for virtual asset service providers, aiming to eliminate the loopholes that facilitated this theft. As more regulatory frameworks are established, it is crucial for financial institutions to adapt swiftly to remain compliant and secure.

However, regulation alone will not suffice. Banks and other financial entities must actively engage in developing advanced risk management strategies that go beyond mere compliance. This involves investing in cutting-edge technology, enhancing cybersecurity protocols, and fostering partnerships with security experts to defend against cybercriminals. The future of crypto regulation in Kenya hinges on a balanced approach that encompasses rigorous regulations alongside innovative security solutions, ensuring that the financial system is robust enough to thwart emerging threats.

Improving Access Controls in Financial Institutions

The Kenyan bank heist illustrates the critical importance of effective access control measures within financial institutions. As evidenced by the involvement of contractors in the IT infrastructure, internal actors often possess the means necessary to exploit vulnerabilities. It is vital for banks to conduct thorough reviews of their access permissions and ensure that only authorized users have sensitive information. Such practices not only deter potential fraudulent activities but also foster a culture of accountability within organizations.

Furthermore, establishing a multi-layered security framework can significantly enhance a bank’s defenses against IT security breaches. This can include regular training for employees on the importance of cybersecurity, routine audits, and stringent background checks for contractors and third-party service providers. By prioritizing access control as a key component of risk management, banks can better protect themselves from internal and external threats, thereby minimizing the risk of future financial crimes.

The Intersection of Cybersecurity and Financial Crime in Kenya

As cryptocurrency emerges as a convenient tool for financial crimes, the intersection of cybersecurity and financial crime in Kenya becomes more pronounced. The current heist has exposed not only the vulnerabilities in banking practices but also highlights the need for a unified response to tackle such issues. Effective cyber defenses must be developed to keep pace with innovative attacks that leverage sophisticated tools, like digital assets, to execute scams and frauds without detection.

To address these challenges, collaboration among financial institutions, government regulators, and cybersecurity experts is essential. By sharing intelligence on emerging threats and collectively developing security strategies, the financial sector can fortify its defenses against cybercriminals who exploit technological loopholes. This alliance will help create a resilient banking environment capable of rebuffing the increasing trend of financial crime linked to cryptocurrencies.

Enhancing Risk Management Frameworks in Kenyan Banks

The recent $4 million bank heist in Kenya highlights an urgent need for financial institutions to enhance their risk management frameworks. As digital assets and cryptocurrencies gain popularity, banks must integrate comprehensive risk assessments and mitigation strategies into their operations. This includes identifying assets susceptible to laundering through digital currencies and establishing protocols to manage these risks effectively. A robust risk management framework will not only safeguard assets but also ensure compliance with evolving regulations.

Furthermore, adopting a proactive approach to risk management involves continuous monitoring and adapting to the dynamic threat landscape. Financial institutions should invest in advanced analytic tools that detect suspicious activities in real time. By prioritizing a culture of risk awareness and adapting to challenges posed by cryptocurrency laundering, banks can reinforce their defenses. This vigilance will aid in protecting the financial system and help maintain consumer trust amidst growing concerns about financial crimes in Kenya.

The Role of Cybersecurity Teams in Preventing Future Breaches

In light of the Kenyan bank heist, the stark importance of cybersecurity teams has come to the forefront. These professionals play a crucial role in defending financial institutions against the rising tide of IT security breaches. By proactively identifying vulnerabilities and implementing preventive measures, cybersecurity teams are essential in curbing incidents of cryptocurrency laundering and other financial crimes. Their expertise in threat analysis and response is invaluable in detecting anomalies that could signify broader systemic issues.

Moreover, ongoing training and development for cybersecurity personnel are critical to keeping pace with evolving threats. Regular training sessions that include lessons learned from recent breaches, such as the one involving USDT, can empower security teams to develop innovative solutions for risk mitigation. Collaborative efforts with other departments within the bank can also enhance the overall security posture, promoting a unified front against cybercriminals. In this rapidly changing landscape, strong cybersecurity teams are a bank’s frontline defense against the threats posed by criminal exploitation of digital assets.

The Future of Digital Asset Regulation Following Heists

The recent incident involving the laundering of USDT in a Kenyan bank heist is likely to reshape the future of digital asset regulation in the country. Authorities, including the Financial Intelligence Centre, may accelerate their efforts to create a comprehensive regulatory framework that can effectively govern the use of cryptocurrencies. This will involve scrutinizing the operations of virtual asset service providers and imposing mandates that promote transparency in cryptocurrency transactions, aspiring to prevent similar financial crimes in the future.

However, effective regulation requires a balanced approach that fosters innovation while ensuring security. Policymakers must work alongside financial institutions and technology experts to design regulations that accommodate the rapidly changing landscape of digital assets. By prioritizing consumer protection, enhancing compliance measures, and providing clear guidelines for the use of cryptocurrencies, regulators can help fortify the financial system against the pitfalls of digital asset laundering and bolster confidence in both traditional banking and emerging financial technologies.

Frequently Asked Questions

How is USDT involved in cryptocurrency laundering within the Kenyan bank heist?

USDT (Tether) played a critical role in the laundering of approximately $4 million during the recent Kenyan bank heist. Investigations revealed that the stolen funds were transferred into multiple offshore wallets using USDT, making tracking and recovery efforts significantly more challenging due to the nature of cryptocurrency transactions.

What are the implications of USDT laundering on financial crime in Kenya?

The use of USDT in laundering operations highlights serious implications for financial crime in Kenya. It draws attention to the vulnerabilities in the banking sector regarding digital assets and calls for heightened scrutiny of virtual asset service providers, which have previously been flagged by the Financial Intelligence Centre.

What are the risks associated with IT security breaches and USDT laundering in Kenyan banks?

IT security breaches, such as the recent bank heist in Kenya, pose substantial risks by exposing sensitive financial data and infrastructure to exploitation. The laundering of funds through USDT exacerbates these risks, as it complicates efforts to trace illicit transactions and recover stolen assets.

What regulatory actions are being considered to combat USDT laundering in Kenya?

Following the recent heist involving USDT, the Kenyan government may consider regulatory reforms under the Capital Markets (Amendment) Bill to enhance monitoring of cryptocurrency transactions. These reforms aim to strengthen frameworks against financial crimes and improve oversight of digital asset regulations.

How can banks prevent USDT laundering after experiencing IT security breaches?

To prevent future incidents of USDT laundering and enhance security, banks in Kenya must adopt robust risk management frameworks. This includes improving internal access controls, investing in cybersecurity measures, and ensuring compliance with evolving digital asset regulations to better address the vulnerabilities highlighted by recent breaches.

| Key Points |

|---|

| USDT involved in laundering $4 million stolen from a Kenyan bank |

| The theft was executed by IT contractors within the bank |

| Funds were moved to multiple offshore wallets, complicating recovery |

| Kenya’s Directorate of Criminal Investigations is leading the investigation |

| Focus on improving internal access controls and IT governance in banks |

| Possible regulatory reforms under the Capital Markets (Amendment) Bill |

| Call for enhanced risk management frameworks in banks and fintechs |

Summary

USDT laundering has emerged as a critical issue following the reported $4 million heist at a Kenyan bank. The incident not only highlights the vulnerabilities in the bank’s internal controls but also raises significant concerns regarding the effectiveness of existing regulatory frameworks. As investigations proceed, it is clear that both regulatory and operational reforms are essential to mitigate future risks associated with digital currencies like USDT.