Generative AI and Workforce Changes: Insights from Amazon’s CEO

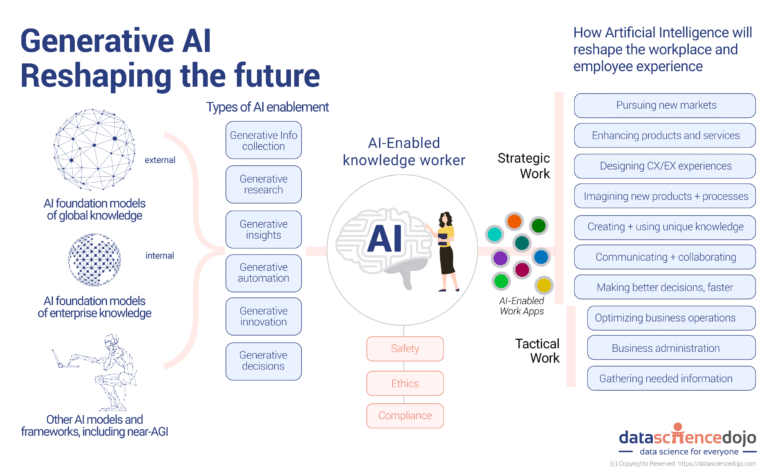

Generative AI and Workforce Changes are transforming the landscape of employment, as highlighted by Amazon CEO Andy Jassy. The rise of AI in the workplace indicates a significant shift where certain roles may be automated, leading to a reduction in the workforce. However, Jassy also emphasizes the dual nature of this technology; while job displacement is expected, generative AI will pave the way for new AI job creation, sparking new opportunities in innovative sectors. The impact of AI on jobs is profound—freeing employees from tedious tasks and allowing them to engage in more meaningful work. As companies like Amazon adapt to these changes, it is crucial to understand both the challenges and the potential benefits of employee automation.

The advent of generative artificial intelligence is reshaping employment dynamics, influencing how businesses operate and interact with their workforce. This technological evolution is prompting companies—including industry giants—to rethink their staffing needs and automate routine tasks. Notably, leaders in the technology sector, such as Amazon’s Jassy, acknowledge the inevitable reduction in workforce size while highlighting the potential for new roles in AI and automation. As industries navigate this transformation, understanding the balance between job displacement and the emergence of more engaging work is critical. It’s a pivotal moment where organizations must embrace this shift to foster innovation and drive growth.

The Influence of Generative AI on Workforce Changes

The potential impact of generative AI on workforce dynamics is a topic of significant discussion in the tech industry. As noted by Amazon CEO Andy Jassy, the increasing use of generative AI indicates a likely reduction in the number of employees required for certain functions. This technology can streamline operations, automate repetitive tasks, and enhance productivity, leading organizations to reconsider their staffing needs. However, Jassy also emphasizes that while some positions may be made redundant, generative AI holds the promise of creating new job opportunities that focus on higher value, strategic roles.

As companies integrate generative AI into their operations, the nature of work will inevitably evolve. Job roles traditionally centered around monotonous tasks are likely to change, enabling employees to engage in more challenging and creative endeavors. This transformation not only enhances work satisfaction but also elevates the overall efficiency of organizations. The push towards automation suggests a fundamental shift in skills required in the workplace, necessitating upskilling efforts to ensure that the workforce remains adept and competitive in an AI-driven landscape.

AI in the Workplace: Opportunity vs. Automation

The dual nature of AI in the workplace presents both challenges and opportunities. On one hand, advancements in AI technologies lead to employee automation, which can replace certain roles within companies, creating uncertainty among the workforce. Notably, organizations are witnessing significant workforce reductions as seen in companies like Klarna, which recently reported a 40% cut in their staffing levels due to AI implementations. This trend raises important questions about job security and the future of certain job sectors.

Conversely, the ongoing discourse underscores that AI introduces avenues for job creation rather than just elimination. Companies like Salesforce and Microsoft are leveraging AI to enhance productivity, advocating for employee adaptation to these technologies. The emphasis is on reskilling current employees to manage AI tools, thus transforming their roles rather than replacing them entirely. By fostering a culture of innovation and continual learning, businesses can reposition their teams to thrive in an evolving job market where technology complements human effort.

Amazon’s Strategy in AI and Workforce Management

As part of its strategic vision, Amazon is navigating the challenges presented by AI in workforce management. CEO Andy Jassy has made it clear that while the introduction of generative AI could lead to a reduction in Amazon’s overall workforce, the company is still focused on hiring in high-demand areas such as AI development and robotics. This proactive approach not only prepares the organization for future advancements but also aligns with the overarching trend seen across the tech industry, where skilled professionals are increasingly necessary to manage and implement AI technologies.

Moreover, Jassy’s insights reveal a key focus on enhancing employee roles within Amazon. By automating menial tasks, employees can concentrate on more complex, rewarding projects that require human intuition and creativity. The integration of AI has the potential to redefine job descriptions and open up new roles that focus on innovation and customer experience. As businesses like Amazon invest in cutting-edge technologies, they are also committing to their workforce’s resilience against the changing job landscape, ensuring that employees are equipped to thrive in a more technologically advanced environment.

The Broader Impact of AI on Jobs and Employment Trends

The discussion around the impact of AI on jobs extends beyond individual experiences within companies like Amazon; it resonates across various sectors. The push for AI adoption often highlights the need for a skilled workforce capable of adapting to rapid technological changes. While the fear of job displacement is prevalent, experts argue that the introduction of AI will fundamentally alter job landscapes, leading to the emergence of new roles that align more closely with the advancing technological ecosystem.

Research and industry observations suggest that as firms embrace AI, they often experience an increase in productivity and innovation, further driving the demand for jobs in AI-related fields. For example, roles in data science, AI ethics, and machine learning are becoming increasingly crucial to ensure that the technology is implemented responsibly and effectively. This shift indicates that while some roles may be lost to automation, others will be created in support of the broader AI framework, underscoring the importance of adaptability in the modern workforce.

Employee Adaptation to New AI Technologies

The successful integration of AI in the workplace relies heavily on employee adaptation to new technologies. As seen at major corporations, including Amazon, top executives emphasize the importance of reskilling and training programs to prepare employees for upcoming changes. Companies are encouraged to foster an inclusive environment where employees are motivated to learn and grow in their roles, particularly as the demand for AI proficiency rises. Facilitating workshops, training sessions, and ongoing education can empower employees to integrate AI solutions into their daily responsibilities.

Furthermore, businesses that prioritize employee development surrounding AI technologies benefit from higher engagement and satisfaction levels among their workforce. Engaged employees are not only more productive but also contribute to a culture of innovation that supports a company’s long-term success. As organizations continue to evolve, prioritizing employee training and adaptability will be crucial in helping individuals navigate their careers amidst the transformative impact of AI in the workplace.

Navigating Job Security in an AI-Revolutionized World

Job security is an important concern in the wake of an AI revolution. With technologies automating roles across industries, employees often find themselves questioning their long-term employment prospects. Companies, including Amazon, are acknowledging these concerns by communicating transparently about their workforce strategies and the anticipated shifts due to automation. This openness is crucial in alleviating anxiety among workers while outlining the organization’s commitment to supporting them through changes.

Additionally, organizations can take proactive measures to ensure job security by investing in upskilling initiatives, thus reinforcing the idea that adaptability is key. By preparing employees for evolving roles and potential job changes, companies can foster a resilient workforce capable of thriving amid industrial shifts. Ultimately, navigating job security within an AI-driven landscape will hinge on organizations’ willingness to invest in their human capital, ensuring that employees are equipped with the necessary tools and skills for future challenges.

Reskilling Initiatives for a Future-Ready Workforce

In light of the rapid rise of AI technologies, reskilling initiatives have become essential for building a future-ready workforce. Companies are increasingly recognizing that equipping employees with the latest skills will not only stave off obsolescence but also enhance organizational performance. Amazon’s ongoing commitment to employee education around AI tools exemplifies a growing trend where firms invest in their staff to facilitate a smooth transition into technology-enhanced roles. These initiatives often focus on practical training, providing employees with hands-on experience to boost their confidence and competence in using AI aids.

Moreover, by prioritizing reskilling programs, organizations not only improve their operational efficiency but also foster employee loyalty and retention. Reskilled employees contribute significantly to a company’s innovation efforts, driving forward the adoption of new technologies and improving productivity. As businesses adapt to the AI era, the emphasis on reskilling will continue to shape the labor market, with a clear expectation that employees will need to evolve alongside technological advancements.

Long-Term Implications of AI on Employment Landscape

The long-term implications of AI on the employment landscape are poised to reshape economies and workforce structures. While some jobs may become obsolete, the infusion of AI technologies is expected to spur new job creation in various sectors, particularly in tech-driven fields that require advanced skill sets. CEOs, like Amazon’s Andy Jassy, have indicated a recognition of this dual impact, where business strategies must align with the necessity of both automation for efficiency and human talent to drive innovation.

Additionally, as more companies invest in AI, the resulting demand for skilled professionals is likely to increase, creating a competitive labor market for those equipped with the right qualifications. Educational institutions and training programs will need to adapt to these evolving needs, ensuring that upcoming graduates possess the necessary skills for success in an increasingly AI-centric workforce. The future of work will undoubtedly hinge on finding a balance between leveraging AI advancements and nurturing human talent to complement these technologies.

Building a Collaborative Future with AI

The integration of AI into workplaces presents an opportunity for fostering a more collaborative environment between technology and human workers. By leveraging AI functionalities to automate routine tasks, companies can enable their employees to focus on collaborative projects and strategic initiatives. This collaborative future not only maximizes the strengths of both humans and AI but also enhances job satisfaction, as employees are empowered to engage in more meaningful work.

Moreover, fostering a collaborative relationship with AI tools encourages continuous learning and adaptation among the workforce. As employees become accustomed to working alongside AI, they will likely gain new insights and capabilities that enhance their performance and overall contribution to the organization. By promoting this culture of collaboration, companies can effectively integrate AI into their operations while also prioritizing employee growth and development in an increasingly automated world.

Frequently Asked Questions

How will generative AI impact workforce changes at Amazon?

Generative AI is expected to change workforce dynamics at Amazon by automating certain tasks, potentially reducing the need for employees in specific roles. Amazon CEO Andy Jassy has indicated that while some positions will be eliminated, the introduction of AI will also lead to new job opportunities in areas such as AI development and robotics.

What did Amazon CEO Andy Jassy say about AI in the workplace?

Amazon CEO Andy Jassy highlighted that generative AI could lead to a decrease in the workforce due to automation. However, he emphasized that AI will also create new jobs, freeing employees from monotonous tasks and allowing them to engage in more innovative and fulfilling work.

Can AI job creation offset employee automation in the tech industry?

Yes, AI job creation can offset some levels of employee automation in the tech industry. As companies like Amazon and Salesforce incorporate generative AI, they may eliminate some jobs but also generate new roles that focus on higher-level tasks, ultimately leading to a transformation in the workforce.

What are the predicted effects of employee automation on job numbers?

Employee automation is predicted to decrease job numbers in specific sectors as generative AI takes over routine tasks. However, industry leaders like Amazon’s Jassy believe that this shift can result in a net job creation effect by fostering innovation and increasing demand for jobs related to AI and tech.

How are companies like Microsoft and Shopify adapting to generative AI?

Companies like Microsoft and Shopify are adapting to generative AI by encouraging their employees to leverage AI technologies in their workflow. This integration aims to enhance productivity and efficiency, highlighting a trend where AI reshapes the labor landscape while still creating new opportunities.

What are the long-term workforce changes expected due to generative AI?

Long-term workforce changes due to generative AI are likely to include a shift in job roles, the elimination of repetitive tasks, and the creation of new positions in tech sectors. Firms will focus on upskilling their workforce to manage AI technologies, as seen in companies like Amazon and Salesforce.

What does Jassy’s memo to Amazon employees reveal about the future of the workforce?

Jassy’s memo indicates a future workforce with fewer employees in certain roles due to automation driven by generative AI. Nonetheless, he remains optimistic about job creation in emerging areas such as AI and robotics, emphasizing the need for a skilled workforce to thrive alongside evolving technologies.

How are workforce dynamics shifting as generative AI becomes more prevalent?

As generative AI becomes more prevalent, workforce dynamics are shifting towards automation of routine tasks, leading to potential job reductions in some areas. However, this transition is also spurring growth in new job sectors that focus on AI management and innovation.

What insights can we learn from Klarna’s workforce changes due to AI?

Klarna’s report of a 40% workforce reduction due to AI illustrates the immediate impact of generative AI on job numbers. It highlights a trend where companies are optimizing operations through technology, which can lead to significant workforce adjustments while also paving the way for new roles associated with AI.

What should employees consider in light of generative AI’s impact on jobs?

Employees should consider upskilling and adapting to the changes brought by generative AI, focusing on enhancing skills in tech and AI-related fields. As automation expands, being proficient in managing AI tools and understanding their applications will be crucial for job security and new employment opportunities.

| Key Point | Details |

|---|---|

| Impact of Generative AI | Generative AI is expected to automate certain jobs at Amazon, leading to a potential decrease in workforce. |

| Creation of New Opportunities | Though some positions may be eliminated, AI is anticipated to create new job opportunities by freeing employees from repetitive tasks. |

| Workforce Reduction vs. Hiring | Amazon is projecting a decline in overall employees, yet continues to hire in the AI and robotics sectors. |

| Tech Industry Trends | Other companies, like Salesforce, report AI managing a significant portion of their workloads, indicating a wider trend across the sector. |

| Consequences of AI Investments | Companies, including Klarna, have laid off substantial numbers of staff due to their AI initiatives. |

| Optimistic Outlook | Andy Jassy believes that AI will enhance employee productivity by fostering faster innovation and improving services. |

| Ongoing Workforce Challenges | Despite recent layoffs, Amazon’s stock performance has not improved significantly, suggesting challenges ahead. |

Summary

Generative AI and Workforce Changes are reshaping the employment landscape as demonstrated by Amazon CEO Andy Jassy’s remarks on the potential for workforce reductions due to automation. While generative AI will eliminate certain roles, it will also pave the way for new job opportunities that focus on more engaging and innovative tasks. This duality of job loss and creation embodies the complex nature of technological advancement in the workplace.