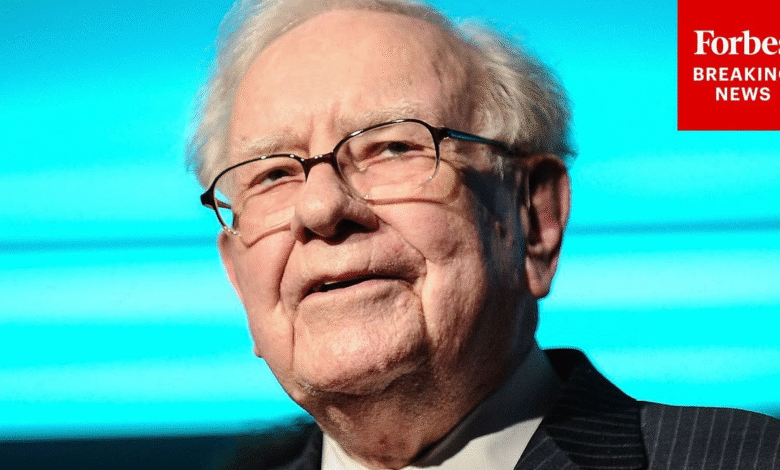

Warren Buffett Retirement: A New Era for Berkshire Hathaway

Warren Buffett retirement has become the talk of the financial world, as the 94-year-old CEO of Berkshire Hathaway prepares to step down after an astonishing 60 years at the helm. Marking a significant transition for one of the world’s most prominent investment firms, Buffett has chosen to pass the leadership baton to Greg Abel, signaling a new era for Berkshire Hathaway. In a candid revelation, Buffett shared that the physical realities of aging prompted his decision, emphasizing that while his mind remains sharp, the challenges of age are inescapable. Despite this change, the value investor, often synonymous with strategic, shrewd investment decisions, reassured stakeholders of his ongoing engagement in investment strategies. As investors and followers closely monitor the unfolding Warren Buffett news, the legacy and influence of this iconic figure will undoubtedly echo through the annals of financial history.

As Warren Buffett prepares for retirement, the investment community is buzzing with anticipation over this major CEO transition at Berkshire Hathaway. The decision, driven by Buffett’s candid acknowledgment of aging, marks the end of an illustrious era characterized by remarkable investment acumen and growth. With Greg Abel stepping into the role of president and CEO, many are eager to see how his leadership will shape the future of this iconic company. The news surrounding Buffett’s retirement highlights not just a change in personnel, but also a reflection on his unparalleled journey and well-informed investment choices that have made Berkshire Hathaway a powerhouse in the market. This pivotal moment encapsulates both a farewell and a new chapter, promising continued intrigue for those tracking the evolution of the firm and the legacy of its legendary founder.

Warren Buffett’s Retirement Announcement: A Turning Point for Berkshire Hathaway

Warren Buffett’s recent announcement about his retirement as CEO of Berkshire Hathaway marks a significant milestone in the investment world. After 60 remarkable years at the helm, Buffett, often referred to as the Oracle of Omaha, revealed that he would resign from his position effective January 1, 2026. While he expressed the unavoidable consequences of aging as a reason for his decision, the move also signifies a pivotal moment for the conglomerate that has seen astounding growth under his leadership. With Berkshire Hathaway’s market capitalization nearing $1.2 trillion, this transition occurs at a high point, promising potential growth in the years to come as new leadership emerges.

Following Buffett’s retirement, many are eager to see how Greg Abel, appointed as the new CEO, will navigate the future of Berkshire Hathaway. Abel, who has served as the vice chairman of non-insurance operations, is well-versed in the company’s operations and culture. Investors are optimistic that Abel will uphold Buffett’s legacy while bringing fresh strategies to the table. The investment landscape will be keenly watching this transition, as it could lead to new investment directions and maintain the company’s consistent growth trajectory.

The Legacy of Warren Buffett and the Future of Berkshire Hathaway

Warren Buffett’s influence on Berkshire Hathaway is undeniably profound, with his investment philosophy and unwavering principles serving as the backbone of the company’s impressive performance. Over the decades, Buffett’s ability to identify value investments has not only enriched Berkshire shareholders but also made significant contributions to the broader economy. As he steps down, his legacy will live on through the foundational strategies he established and the enduring principles of value investing that he has tirelessly advocated.

Looking ahead, the move to transition leadership to Greg Abel presents both challenges and opportunities for Berkshire Hathaway. With a strong record in business operations, Abel’s appointment is seen as an integral step in maintaining the conglomerate’s success. It is anticipated that while he will preserve Buffett’s longstanding investment strategies, Abel may also introduce innovative approaches to diversifying the company’s portfolio, thus ensuring that Berkshire Hathaway remains at the forefront of investment excellence.

Understanding the CEO Transition at Berkshire Hathaway

The transition of power from Warren Buffett to Greg Abel at Berkshire Hathaway is a notable event for shareholders and corporate leaders alike. This shift brings with it questions about continuity and market stability. Berkshire Hathaway has built a reputation on strong leadership, and Buffett’s wisdom has significantly contributed to its success. Therefore, the appointment of Abel, who is already familiar with the intricacies of Berkshire’s operations, provides a sense of reassurance to investors who are concerned about potential shifts in company strategy and performance.

Moreover, this transition is not just about succession; it is also about the continuity of Buffett’s investment strategies, which have proven effective for decades. Abel’s capabilities in driving growth in non-insurance sectors of the company, combined with Buffett’s continued involvement as chairman, gives hope to stakeholders that Berkshire Hathaway will continue to thrive in a complex market environment. As shareholders brace for this change, maintaining trust in the company’s established processes and leadership could be essential for future prosperity.

Investment Decisions Post-Buffett: What to Expect from Berkshire Hathaway

As Warren Buffett prepares for his retirement, the focus shifts to how investment decisions will be made under the new leadership of Greg Abel. Buffett’s acumen for identifying undervalued assets during market lows has garnered him iconic status as a value investor. With decades of market experience, many anticipate that Abel will adopt a similar approach to investing, emphasizing long-term growth and stability rather than short-term profits. The seamless integration of his strategies will be critical in maintaining shareholder confidence during this transitioning phase.

Additionally, the landscape of investment decisions is likely to evolve under Abel’s guidance, as he brings a fresh perspective to an ever-changing market. Abel’s experience in managing various sectors within Berkshire Hathaway will be instrumental in making informed investment choices. Investors are curious to see whether Abel will continue Buffett’s legacy of strategic acquisitions or pivot towards new industries that align with emerging market trends.

Berkshire Hathaway Shares: The Impact of Leadership Change

The impending leadership change at Berkshire Hathaway prompts speculation about its potential impact on the company’s stock performance. With shares reaching near record highs, investors are vigilant about how Greg Abel’s stewardship will influence the value of their investments. Historically, market reactions to CEO transitions can be unpredictable, but Buffett’s unwavering support in the lead-up to his retirement might cushion any immediate impacts. Abel’s ability to execute Berkshire’s investment philosophy will be crucial in maintaining shareholder trust and ensuring sustained growth.

Furthermore, analysts suggest that as long as Berkshire Hathaway continues to operate under the principles laid down by Buffett, the company should weather the transition effectively. The investment community’s initial confidence in Abel bolsters the sentiment that it’s business as usual at Berkshire, focusing on strategic opportunities and value-driven investments. The market will closely monitor how Abel’s decisions shape Berkshire’s future, particularly amidst evolving economic conditions.

Berkshire’s Diversified Portfolio: Insights on Future Directions

Berkshire Hathaway is renowned for its diverse range of investments spanning various industries, a strategy that has been integral to its long-term success. As Greg Abel steps into the CEO role, there will likely be discussions on how to capitalize on emerging opportunities while managing the risks associated with a vast array of businesses. This diversified approach has historically buffered Berkshire against market disruptions, and it may be central to aligning the company with future trends and maintaining its competitive edge.

Abel’s leadership could potentially drive an exploration of innovative sectors such as technology, renewable energy, and beyond, reflecting a shift towards industries that are poised for growth. Investors will closely observe how these decisions align with Berkshire Hathaway’s established framework of prudence and value. Transitioning the focus onto new markets while respecting the legacy of Buffett’s investment strategies will be the test of Abel’s leadership, ensuring Berkshire Hathaway continues to thrive.

Warren Buffett’s Philosophy: Lessons for Future Investors

One of the most enduring aspects of Warren Buffett’s career has been his investment philosophy, characterized by patience, discipline, and thorough research. As he moves towards retirement, these principles will remain central to the culture at Berkshire Hathaway and will undoubtedly influence the new CEO, Greg Abel. Buffett’s steadfast belief in investing in fundamentally strong companies, regardless of market fluctuations, serves as a vital lesson for aspiring investors looking to build wealth over time.

Furthermore, Buffett’s approach to investing in quality over quantity reinforces the idea that successful investing requires a focus on long-term value rather than speculative short-term gains. Under Abel’s leadership, the challenge will be to continue promoting this thoughtful investment philosophy while adapting to the contemporary economic environment. Future investors can glean important insights from Buffett’s strategy, integrating his wisdom into their investment decisions for years to come.

Market Reactions to Warren Buffett’s Retirement Plans

Market reactions to significant corporate leadership changes can often set a tense atmosphere, and Warren Buffett’s plans for retirement are no exception. Investors and analysts alike are keenly observing how the announcement of Greg Abel as the successor will influence market performance. Upon the news of Buffett’s resignation, stock analysts have issued varying forecasts, with many expressing optimism about the retention of Berkshire Hathaway’s core values. The confidence in Abel’s existing rapport with shareholders may alleviate some fears typically associated with leadership transitions.

Additionally, as markets react to the news, it will be essential for Abel to communicate effectively with investors, providing reassurance about future strategies. As the company embraces this new chapter, developing a clear and actionable plan will be crucial in instilling confidence and stability in the Berkshire Hathaway brand. Investors will be gauging Abel’s inaugural decisions closely, especially how he addresses the high expectations set by his predecessor.

Transitioning Wisdom: Warren Buffett’s Continued Influence After Retirement

Although Warren Buffett is stepping down as CEO, his influence will undoubtedly linger within Berkshire Hathaway. The company’s board has confirmed that Buffett will continue to serve as chairman, allowing him to provide guidance to Greg Abel and the management team. This arrangement offers a unique opportunity for continuity in leadership while encouraging a fresh perspective under Abel’s management. Buffett’s experience and insights will likely be an invaluable resource for navigating the complexities of the market.

Furthermore, Buffett’s commitment to philanthropy and responsible investing sets an admirable standard that Abel can carry forward. As he transitions out of an executive role, the principles that have underpinned Buffett’s success—integrity, hard work, and a focus on long-term wealth creation—will remain critical to the identity of Berkshire Hathaway. This ongoing influence of Buffett ensures that the legacy of sound investing and ethical business practices will continue to resonate within the company for years to come.

Frequently Asked Questions

What prompted Warren Buffett’s retirement as CEO of Berkshire Hathaway?

Warren Buffett announced his intention to retire as CEO of Berkshire Hathaway primarily due to concerns about the physical impacts of aging. At 94 years old, he noticed issues such as impaired balance and vision, which influenced his decision to step down after 60 years of leadership.

Who will succeed Warren Buffett as CEO of Berkshire Hathaway?

Greg Abel, the current vice chairman of non-insurance operations, has been appointed as the next CEO of Berkshire Hathaway, effective January 1, 2026. This transition comes as Buffett prepares for retirement while continuing as chairman.

How does Warren Buffett’s retirement impact Berkshire Hathaway’s investment strategy?

Despite his retirement, Warren Buffett remains mentally sharp and involved in making investment decisions, especially during market volatility. He expressed confidence in continuing to offer valuable insights and guidance even after stepping down as CEO.

When is Warren Buffett’s retirement expected to take effect?

Warren Buffett’s retirement as CEO of Berkshire Hathaway is set to officially take effect on January 1, 2026, when Greg Abel will assume the position, allowing a seamless transition in leadership.

What can shareholders expect from Berkshire Hathaway after Warren Buffett’s retirement?

After Warren Buffett’s retirement, shareholders can expect Berkshire Hathaway to continue its strong performance under Greg Abel. Buffett’s extensive legacy and mentorship will likely guide the company’s future, maintaining its robust investment strategies and operational efficiencies.

How long did Warren Buffett serve as CEO of Berkshire Hathaway?

Warren Buffett served as CEO of Berkshire Hathaway for an impressive 60 years, transforming the company from a struggling textile mill into a leading conglomerate with a diverse portfolio of businesses.

What legacy will Buffett leave behind at Berkshire Hathaway post-retirement?

Warren Buffett will leave behind a legacy of exceptional investment acumen and corporate leadership at Berkshire Hathaway. His focus on value investing and tolerance for market fluctuations has shaped the company’s strategic direction and financial success.

What are some key businesses under Berkshire Hathaway guided by Warren Buffett?

Under Warren Buffett’s leadership, Berkshire Hathaway has grown to include major companies such as Geico Insurance, BNSF Railway, and various other diverse investments spanning different industries, showcasing Buffett’s adept investment decisions.

Will Warren Buffett continue to influence Berkshire Hathaway after his retirement?

Yes, Warren Buffett will continue to influence Berkshire Hathaway as chairman after his retirement as CEO. His insights and market experience are expected to remain a guiding force for the company.

How has the market reacted to news of Warren Buffett’s retirement?

The market has responded positively to Warren Buffett’s retirement announcement, reflecting confidence in the strong position of Berkshire Hathaway, which boasts a near-record market capitalization of approximately $1.2 trillion.

| Key Points |

|---|

| Warren Buffett resigns as CEO of Berkshire Hathaway after 60 years. |

| Buffett is 94 years old and has felt the physical impacts of aging. |

| He has experienced balance issues and memory struggles. |

| Berkshire Hathaway is valued at nearly $1.2 trillion, nearing record share prices. |

| Greg Abel appointed as new CEO effective January 1, 2026. |

| Buffett remains mentally sharp and involved in investment decisions despite his retirement. |

Summary

Warren Buffett’s retirement signals a significant transition for Berkshire Hathaway and marks the conclusion of his remarkable 60-year leadership. At 94, Buffett has acknowledged the physical challenges of aging, including balance issues and memory lapses. Nevertheless, he leaves the company in a strong position, as Berkshire approaches a market capitalization of nearly $1.2 trillion. Greg Abel is set to take over as CEO in January 2026, but Buffett will continue to play a key role as chairman, ensuring that his legacy endures even after his retirement.