Withholding Federal Payments: A Bold Strategy Against Trump

Withholding federal payments has emerged as a bold strategy employed by Democratic lawmakers in blue states as a response to Trump’s funding freezes. This innovative approach aims to retaliate against the Trump administration’s attempts to curtail federal funding that many states rely on for crucial programs such as healthcare and education. With legislation now introduced in states like Connecticut and New York, the move reflects growing frustration over what many see as a significant overreach in federal authority. As states grapple with the implications of potentially withholding these payments, the conversation around federal funding is poised to shift dramatically. In this heated political climate, the stakes have never been higher, as Democratic lawmakers fight to protect their constituents from the adverse effects of federal fund cuts.

States are increasingly adopting measures that may involve retaining federal contributions as a counteraction to Trump-era funding cutbacks. With terms like federal remittances and funding supplies at play, this tactic signifies a notable shift in statecraft. Lawmakers, especially in Democratic-leaning areas, are crafting legislation that would enable them to withhold state contributions to the federal pool, effectively flipping the script on federal noncompliance. This newly coined strategy represents a significant pushback against federal policies perceived to be harmful, particularly regarding essential safety nets for vulnerable populations. Amidst these discussions, the focus on state autonomy and fiscal responsibility is sharpening, highlighting the evolving dynamics between state and federal partnerships.

Understanding Trump’s Funding Freezes: Implications for States

The funding freezes instituted during Trump’s administration marked a significant shift in federal-state relations, leading to an unprecedented tension as states sought to navigate reduced financial support. These actions, particularly affecting essential services such as healthcare and education, drew sharp criticism from Democratic lawmakers in blue states. States like Maryland, Connecticut, and New York have felt the impact profoundly, pushing legislators to seek remedies through innovative new laws aimed at counteracting funding cuts. This potential strategy underscores a deepening divide in a polarized political landscape, which complicates the dynamics of governance.

Despite the challenges posed by these freezes, state politicians remain determined to explore options that reinforce their financial sovereignty. By contemplating measures such as withholding federal payments, state lawmakers signal their disapproval of the cuts and highlight the struggle for financial independence against federal overreach. The political repercussions of these funding disputes are profound, as lawmakers contend with public expectation while grappling with the practical limitations of enacting such legislation.

Frequently Asked Questions

What is the strategy of withholding federal payments proposed by Democratic lawmakers?

Democratic lawmakers in blue states like Connecticut, Maryland, New York, and Wisconsin are proposing legislation to withhold federal payments if they believe the federal government is failing to meet its funding obligations. This strategy aims to counteract President Trump’s funding freezes which have affected critical state programs.

How does withholding federal payments relate to Trump’s funding freezes?

Withholding federal payments is a response to Trump’s funding freezes, where his administration has unilaterally halted billions in funding for essential programs. This strategic move by Democratic states seeks to challenge and push back against such funding cuts that negatively impact state services.

What legal challenges do states face when considering withholding federal payments?

States may face significant legal challenges due to the U.S. Constitution’s supremacy clause, which grants precedence to federal law over state law. Legal experts warn that attempting to withhold federal payments could lead to complicated court battles and may not resolve the issues stemming from federal funding cuts.

What implications do the proposed bills on withholding federal payments have for state residents?

The proposed bills on withholding federal payments aim to protect state residents from suffering due to enacted funding freezes. Democratic lawmakers argue that these bills would provide legal remedies to ensure that states receive federal funds essential for health care, food aid, and environmental programs.

Are there potential risks involved with states withholding federal payments?

Yes, there are potential risks, including retaliation from the federal government, which holds more leverage in budgetary matters than states. The approach could worsen the situation for state residents reliant on federal programs, as emphasized by some lawmakers and legal experts.

Can states legally withhold payments to the federal government in retaliation for funding freezes?

While some states are moving forward with proposals to withhold payments in retaliation for federal funding freezes, the legal landscape is complex. Challenges related to the supremacy of federal law and potential repercussions hinder the feasibility of such actions.

What are the potential benefits of withholding federal payments despite the legal risks?

Even with legal risks, withholding federal payments might send a strong political message to the federal government, showing disapproval of funding cuts and asserting state authority. It may also help audit unpaid federal funds owed to the states.

Which states are currently considering legislation to withhold federal payments?

Currently, Connecticut, Maryland, New York, and Wisconsin are actively pursuing legislation to allow withholding federal payments as a counter strategy against Trump’s funding freezes, with Washington state lawmakers also indicating plans for similar measures.

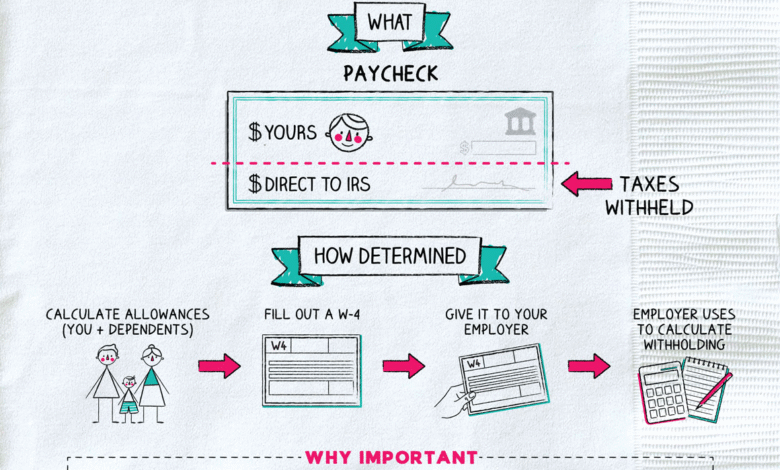

What types of federal payments could states potentially withhold?

States could potentially withhold federal tax payments collected from state employee paychecks and other federal funds owed back to the government. This includes funds earmarked for various state programs such as agriculture and childcare.

How has the situation with federal funding and state responses evolved amid Trump’s presidency?

Throughout Trump’s presidency, there has been growing tension between state administrations, particularly in blue states, and the federal government regarding funding. States are increasingly seeking innovative legal strategies, such as withholding federal payments, to address perceived federal overreach and funding issues.

| Key Points | Description | |

|---|---|---|

| Democratic Response | Democratic lawmakers in blue states are introducing legislation to withhold federal payments. | |

| Affected States | States involved include Connecticut, Maryland, New York, Wisconsin, and potentially Washington. | |

| Legislation Purpose | The bills aim to compel the federal government to fulfill funding obligations. | |

| Legal Challenges | Legal experts express skepticism about the feasibility due to federal supremacy. | |

| Economic Impact | States risk retaliation from the federal government, exacerbating negative impacts on resident programs. | |

Summary

Withholding federal payments has emerged as a strategic legislative response from Democratic lawmakers aimed at addressing funding cuts by the Trump administration. This initiative underscores a significant state-level pushback against perceived federal overreach, highlighting states’ growing assertiveness in safeguarding their financial interests. While the legal validity and efficacy of such actions remain uncertain, the narrative around withholding federal payments illustrates the contentious dynamics between state and federal governance amidst ongoing political strife.