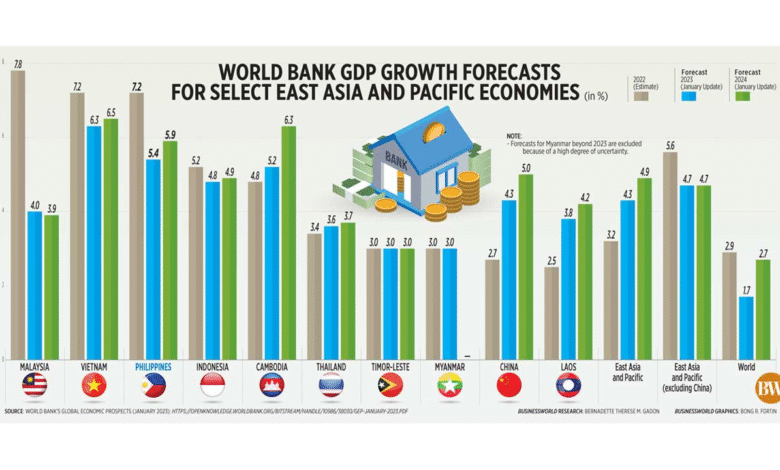

World Bank Economic Projections Show Dismal Growth for 2025

The World Bank economic projections have generated significant attention as they reveal a stark revision in global growth expectations. In its latest report, the Bank has lowered its global economic growth forecast to a mere 2.3% for 2025, a figure reminiscent of the sluggish pace of growth seen during the post-2008 financial crisis. This downward adjustment highlights the impact of trade uncertainty effects that have permeated international markets, creating a ripple effect on nations’ GDP forecasts. The World Bank also downgraded its projections for key economies, including the U.S. and the euro area, signaling potential challenges ahead in sustaining economic momentum. As we delve into the details of the World Bank report 2025, understanding the resulting economic outlook is crucial for businesses and policymakers alike.

Recent findings from the World Bank have provided new insights into future global economic health. The latest forecasts indicate a concerning trend that suggests an upcoming slowdown in international economic activity. Analysts are now grappling with the implications of increased trade tensions and their potential repercussions, particularly in major economies. In light of these developments, evaluating the economic scenario for 2025 has become essential for various stakeholders. Given these uncertainties, the economic projections paint a complex picture that necessitates strategic planning and adaptive policymaking.

World Bank Economic Projections for 2025

The World Bank recently updated its economic forecasts, predicting a slowdown in global economic growth to just 2.3% for the year 2025. This marks a significant reduction from previous expectations, which suggested a 2.7% growth. The revision reflects deepening concerns over trade uncertainties and their impacts on the global economy. This forecast indicates that 2025 could witness the slowest rate of global growth since the financial crisis of 2008, highlighting dire consequences for global economic stability.

Moreover, the World Bank’s report not only addressed global growth but also specifically highlighted revisions for the U.S. and euro area economies. The growth projection for the U.S. was adjusted down to 1.4%, whereas the euro area GDP expectation was lowered to 0.7%. Such downward adjustments signal a possible lingering effects of trade disputes and the dire necessity for effective international trade agreements to bolster economic performance moving forward.

Impact of Trade Uncertainty on Global Economic Growth

Trade uncertainty has emerged as a critical factor impacting the global economic landscape, as per the World Bank’s findings. Disruptions in international trade relationships threaten to inhibit economic performance, thereby limiting growth prospects across various economies. The Bank’s senior economist, Indermit Gill, emphasized that the ongoing trade discord has dismantled many of the policy frameworks that contributed to reducing global poverty and fostering post-war prosperity.

As negotiations continue between prominent economies, the future remains uncertain. If tariffs remain high and trade disputes escalate, the projected growth rates may continue to dwindle, hindering recovery from the economic fallout experienced during previous years. Yet, the World Bank suggests that resolving current trade disagreements could potentially boost global growth by 0.2 percentage points, offering a glimmer of hope amid the prevailing uncertainties.

Implications for the U.S. and Euro Area Economies

The U.S. economy stands at the brink of sluggish growth, with the World Bank projecting a decline in its economic expansion rate to 1.4% for 2025. This significant revision downwards raises concerns regarding the wider implications for global economic recovery. The anticipated slowdown reflects increasing headwinds stemming from trade policies and tariff disputes that have characterized recent U.S. trade relations with countries like China and members of the European Union.

Similarly, the euro area’s growth forecast of 0.7%, adjusted downwards by the World Bank, illustrates how interconnected economies can be adversely affected by political and trade dynamics. As the eurozone grapples with its own internal challenges coupled with external trade uncertainties, achieving stable growth may prove to be increasingly difficult. Policymakers may need to consider innovative solutions and cooperative agreements to restore confidence and stimulate growth in this intricate economic landscape.

World Bank Report 2025: A Broader Economic Outlook

The World Bank’s Global Economic Prospects report for 2025 indicates a cautiously pessimistic outlook for global economic advancement. The decline in the growth forecast underscores the mounting pressures from ongoing global trade tensions, underscoring the intricate nexus between international policy decisions and local economic health. As the report forecasts the slowest pace of growth since the global financial crisis, it raises important questions regarding the sustainability of current policies and the potential for future economic recovery.

In these challenging times, the report emphasizes the need for nations to collaborate more effectively in addressing trade barriers and creating a more favorable economic environment. The potential for economic growth depends significantly on the willingness of countries to engage in constructive dialogue aimed at resolving disputes and fostering a cooperative trade atmosphere. As we look towards 2025 and beyond, strategic international partnerships will be vital in shaping the global economic narrative.

Economic Indicators to Watch in 2025

As we approach 2025, several key economic indicators will play a pivotal role in shaping the economic landscape globally. Analysts will be monitoring GDP growth rates, trade volumes, and consumer confidence indices, all of which will provide critical insights into the health of the global economy. A decline in these indicators may signal broader economic implications, potentially leading to recessionary trends if not mitigated through effective policy measures.

Additionally, inflation rates, employment figures, and international trade agreements will be essential in understanding the economic outlook. Should tariffs remain elevated and trade disputes unresolved, it is likely that the global economic recovery may stutter, emphasizing the need for proactive responses from governments and economic institutions alike to stimulate growth and ensure stability.

Strategies for Stimulating Economic Growth Amidst Uncertainty

To counteract the predicted slowdown in global economic growth, policy measures aimed at stimulating economic activity will be crucial. Governments need to adopt proactive public investment strategies focusing on infrastructure development and technology innovation to create jobs and enhance productivity. Such investments not only stimulate immediate economic activity but also lay the groundwork for future growth, emphasizing the importance of long-term planning in addressing immediate uncertainties.

Moreover, enhancing trade partnerships and pursuing collaborative agreements can significantly rejuvenate economies. Reducing tariffs and creating favorable trade relations will not only buffer local economies from the effects of global downturns but also contribute positively to global economic health, as evidenced by the World Bank’s analysis regarding trade agreements. Ultimately, a commitment to cooperation among nations may aid in overcoming present challenges and fostering a more resilient economic environment.

The Role of International Organizations in Economic Recovery

International organizations such as the World Bank and the OECD play an essential role in shaping global economic policies and strategies. Their reports serve as crucial resources for understanding economic trends and challenges facing different nations. As they highlight significant issues such as trade uncertainties, their findings can inform national policies and foster collective action among member states aimed at reviving economic growth.

Moreover, these organizations provide financial support and development aid to countries facing economic difficulties, ensuring that essential services and infrastructure continue to function despite external pressures. Such support is invaluable in fostering resilience against shocks and enhancing economic stability, demonstrating the integrative role that international organizations play in facilitating economic recovery on a global scale.

Future Challenges Facing Global Economies

As the global economy navigates the uncertain waters of 2025, it is crucial to recognize the upcoming challenges that may hinder recovery efforts. Rising geopolitical tensions, persistent trade disputes, and evolving economic policies could pose significant threats to both developed and emerging economies. Adapting to these changes and developing strategies to mitigate their impact will be essential for sustaining economic growth and stability.

Additionally, international economies must be prepared to address potential environmental challenges that can disrupt trade flows and economic activities. Climate change and resource depletion are pressing issues that necessitate a unified global response. The interconnectedness of today’s economic systems means that addressing these challenges through sustainable practices will be crucial for future economic resilience and growth.

The Impact of Fiscal Policy on Economic Growth

Fiscal policy remains a pivotal tool for governments aiming to stimulate economic growth, particularly in uncertain times. Adjustments to taxation and government spending can create immediate effects on local economies, influencing consumer behavior and investment levels. The World Bank’s downward revision of growth forecasts highlights the importance of thoughtful fiscal measures in boosting economic activity and fostering resilience against external shocks.

Furthermore, investing in education, infrastructure, and social programs can create a more robust economic environment. Such investments not only enhance productivity and long-term growth potential but also contribute to reducing inequality, ultimately fostering a healthier and more dynamic economy. Thus, effective fiscal policies are essential in addressing immediate challenges while positioning economies for future growth.

Frequently Asked Questions

What does the World Bank’s economic outlook predict for global economic growth in 2025?

The World Bank’s economic outlook projects a global economic growth of 2.3% in 2025. This figure represents a significant downgrade from previous estimates and marks the slowest rate of growth since 2008, with the exception of outright global recessions.

How has trade uncertainty affected the World Bank’s GDP forecast?

The World Bank has attributed its downgraded GDP forecast partly to trade uncertainty. Disruptions caused by international trade tensions are seen as critical factors adversely impacting the economic outlook, leading to a reduction in projected growth rates.

What are the specific GDP forecasts for the U.S. and the euro area according to the World Bank report 2025?

In its report, the World Bank cut the GDP forecast for the U.S. to 1.4%, a decrease of 0.9 percentage points, while it lowered the projection for the euro area to 0.7%, down by 0.3 percentage points.

What implications does the World Bank’s economic outlook have for international trade negotiations?

According to the World Bank, if trade tensions among major economies escalate, it could further suppress growth. Conversely, successful trade agreements that reduce tariffs could lead to improved global economic conditions.

Why is the World Bank’s global economic growth projection significant for policy makers?

The World Bank’s projection is significant as it highlights the potential slowdowns in global economic growth due to factors like trade uncertainty. This analysis serves as an essential reference for policymakers to address economic challenges and pursue effective trade agreements.

What could happen if current trade disputes are resolved according to the World Bank’s analysis?

If current trade disputes were resolved with agreements that halve tariffs, the World Bank suggests that global growth could improve by approximately 0.2 percentage points on average in 2025 and 2026, positively impacting the overall economic outlook.

How does the World Bank’s economic projection compare to other organizations like OECD?

The World Bank’s economic projections align with those of other organizations, such as the OECD, which also forecast a slowdown in global growth, estimating it at 2.9% in 2025 and emphasizing the role of trade uncertainties in influencing these forecasts.

| Aspect | Details |

|---|---|

| Global Growth Projection | The World Bank decreased its global economic growth projection to 2.3% for 2025. |

| Historical Context | This rate is the slowest since 2008, excluding global recessions. |

| US Growth Forecast | The 2025 growth forecast for the U.S. was cut to 1.4%, a reduction of 0.9 percentage points. |

| Euro Area Growth | Euro area GDP expectations were revised down to 0.7%, 0.3 percentage points lower. |

| Impact of Trade Uncertainty | Trade uncertainty and international discord are identified as significant factors affecting economic outlook. |

| Potential for Improvement | If trade disputes are resolved and tariffs are reduced by half, global growth could improve by 0.2 percentage points. |

| Negotiations | The U.S. is currently involved in negotiations with China and the EU regarding tariffs. |

| Comparison with OECD | The OECD also projected a slowdown in global growth, estimating it at 2.9% for 2025. |

Summary

World Bank economic projections indicate a sharp decline in anticipated global growth, now forecasted at just 2.3% for 2025. This significant downgrade is attributed to rising trade uncertainties and international discord, factors that have historically undermined economic stability and progress. With a warning of potential further declines should trade tensions escalate, the report underscores the critical need for fruitful negotiations to mitigate these risks. Effectively addressing tariff issues could offer pathways to a stronger economic recovery, emphasizing the interconnectedness of global economies in fostering stability and growth.