Xiaomi Net Profit Hits Record: Analyst Confidence Grows

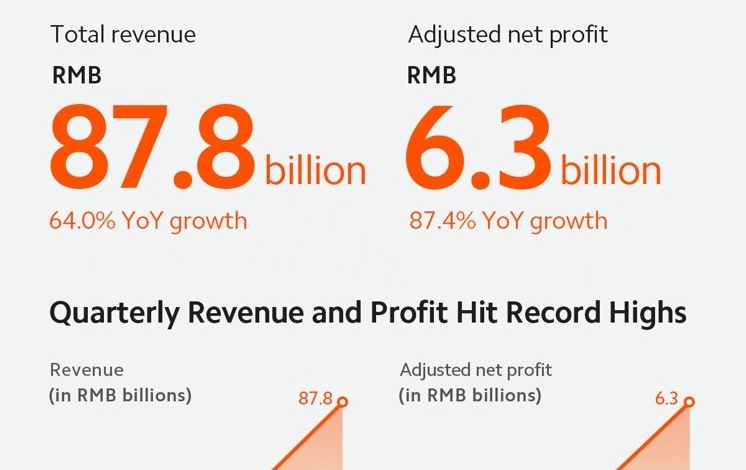

Xiaomi net profit has made headlines recently as the Chinese smartphone giant reported unprecedented earnings for the second consecutive quarter. This remarkable financial performance reinforces the confidence of analysts regarding Xiaomi’s place in the ever-competitive smartphone market. While its absolute earnings still lag behind industry leader Apple, Xiaomi’s strategy of expanding into electric vehicles and AI-driven smart appliances has attracted significant attention. Following the latest Xiaomi earnings report, there has been a noticeable uptick in investor interest, with many analysts revising their stock price targets upward. As Xiaomi continues to experience notable sales growth, particularly in China, its stock has surged, highlighting its potential for future earnings improvements.

The latest financial results from Xiaomi, a prominent player in the technology sector, indicate significant improvements in its overall profitability. Recently, the company’s net income figures have sparked discussions, particularly around its strategic ventures into electric transportation and smart home technologies. Analysts are closely examining these developments, especially following the recent Xiaomi stock analysis, which suggests strong performance in diverse segments like AIoT. Moreover, Xiaomi’s efforts to penetrate the high-end smartphone market contribute to its promising sales growth, making it a notable contender against established brands. As the company navigates challenges in global markets, the spotlight remains on Xiaomi’s innovative approaches and their potential to reshape its financial landscape.

Xiaomi’s Record Net Profit Boosts Investor Confidence

In a remarkable turn of events, Xiaomi has reported a record net profit for the second consecutive quarter, signaling robust growth and stability within the company. This impressive earnings highlight has significantly boosted investor confidence, as evidenced by the surge in Xiaomi’s stock price, which has increased by over 45% year-to-date. The results from Xiaomi’s earnings report have encouraged many analysts to reassess their valuations, further underpinned by the company’s strategic expansion into electric vehicles and its steadfast position within the smartphone market.

Despite still being smaller in comparison to industry titan Apple, Xiaomi’s strong financial performance highlights its competitive edge in the Chinese market. Analysts have noted that Xiaomi’s focus on smart appliances and emerging technologies, particularly through products like its AI-integrated devices, is driving sales growth. The current momentum in Xiaomi’s net profit and overall market share illustrates its potential to carve a dominant space in both the smartphone and electric vehicle sectors, reinforcing its position as a formidable player in the technology landscape.

Analyzing Xiaomi’s Sales Growth and Market Strategy

Xiaomi’s aggressive strategy in capturing market share has paid dividends, particularly in the rapidly growing Chinese smartphone market. By launching competitively priced devices equipped with innovative technology, such as the newly announced Xring O1 chip, Xiaomi is positioned to attract consumers who are looking for high-performance smartphones without the hefty price tag associated with flagship brands like Apple. This strategic pricing model aims to enhance Xiaomi’s sales growth in the higher-end market segment, where profit margins can be significantly improved.

The sales growth observed in Xiaomi’s smartphone sector is complemented by a noticeable expansion into new territories, such as electric vehicles. The anticipated launch of the YU7 SUV is expected to be a game-changer for the company, signaling its intent to diversify and cater to the evolving demands of consumers. Such strategic maneuvers not only aim to bolster Xiaomi’s revenue but also to enhance its brand visibility in competitive markets. Analysts widely recognize that sustained sales growth across different segments is crucial for Xiaomi to achieve its long-term financial goals.

The Impact of Xiaomi’s Electric Vehicle Expansion

Xiaomi’s entry into the electric vehicle market marks a transformative phase in the company’s growth trajectory. The recent unveiling of the YU7 SUV highlights Xiaomi’s ambition to leverage its technological prowess in a new arena. Given the increasing consumer demand for electric vehicles, analysts anticipate that the YU7 will significantly contribute to Xiaomi’s revenue in the coming years. As Xiaomi forges ahead with its plans, the EV sector is expected to act as a pivotal cornerstone in bolstering its overall financial performance.

Moreover, the launch of the YU7 SUV is seen as a crucial element in enhancing Xiaomi’s brand image and market appeal. With a promise of superior performance and a competitive price point likely to undercut rivals like Tesla, Xiaomi aims to capture a substantial market share in the electric vehicle space. This diversification into electric vehicles aligns perfectly with global trends towards sustainability and innovative transportation solutions, presenting Xiaomi with a timely opportunity to expand its business landscape further.

Xiaomi’s Competitive Edge Over Apple

Xiaomi has managed to carve out a significant competitive edge over Apple, especially in the Chinese market. By offering cutting-edge technology at competitive prices, Xiaomi targets a demographic that favors affordability combined with performance. The recent introduction of the Xring O1 chip, boasting superior gaming capabilities and thermal efficiency compared to Apple’s offerings, is a testament to Xiaomi’s potential to disrupt the premium smartphone segment. This innovative chip is expected to feature prominently in Xiaomi’s latest devices, aligning with the company’s strategy to enhance its market share.

While Apple has struggled with various challenges regarding its supply chain, Xiaomi has capitalized on these opportunities to strengthen its foothold. The comparative agility in producing AI-integrated smart appliances further distinguishes Xiaomi in the marketplace. As Apple faces increased scrutiny, Xiaomi seeks to leverage its expanded product range, including electric vehicles, to bolster its revenue and market presence further. This multifaceted approach positions Xiaomi not just as a smartphone manufacturer but as a holistic tech ecosystem provider.

Investor Sentiment and Stock Predictions Post-Earnings Report

In light of Xiaomi’s recent earnings report, investor sentiment has shifted positively, with many analysts adjusting their price targets for the stock significantly upwards. Jefferies analysts, for instance, raised their target to 73 HKD, reflecting optimism regarding Xiaomi’s growth potential and solid financials. This bullish outlook is fueled in part by Xiaomi’s impressive adjusted net income and robust revenue, which surpassed market expectations, enticing more investors to consider Xiaomi as a viable long-term investment.

However, there are varying perspectives among analysts regarding Xiaomi’s stock performance. While some, like Morgan Stanley, see a bright future driven by increasing demand and strategic expansion, others maintain a more cautious approach. JPMorgan’s neutral rating indicates concern over Xiaomi’s ecosystem revenue growth lagging behind, which could pose challenges for achieving high valuations. Despite this, the overarching sentiment remains optimistic as Xiaomi’s strategic initiatives hint at sustained growth and resilience in the technology sector.

The Role of AIoT in Xiaomi’s Business Model

Xiaomi’s integration of AIoT, or Artificial Intelligence of Things, plays a pivotal role in its business model, contributing significantly to sales growth. By designing interconnected devices that utilize AI technology to enhance functionality and user experience, Xiaomi positions itself as a leader in smart home solutions. This innovative approach not only drives sales for its smart appliances but also creates a cohesive ecosystem for users, which strengthens brand loyalty and encourages repeat purchases.

Incorporating AIoT enables Xiaomi to tap into new markets and diversify its revenue streams. As consumers increasingly seek out smart devices that offer convenience and efficiency, Xiaomi’s strategic focus on AI-enhanced products provides a competitive advantage. The company’s ability to control production costs while enhancing product features further supports its market position, enabling Xiaomi to navigate fluctuations in consumer demand and maintain a robust sales pipeline.

Preparing for Xiaomi’s Investor Day

As Xiaomi approaches its upcoming investor day, anticipation among stakeholders is mounting. With investors keen to gain insights into Xiaomi’s strategic direction and future growth initiatives, this event is seen as a crucial moment for the company to solidify its standing in the market. Analysts expect Xiaomi to share details on its ambitious plans for expansion in both the smartphone and electric vehicle sectors, hoping to reassure investors of its long-term vision and profitability.

Clear communication about upcoming products, financial forecasts, and market strategies during the investor day will be instrumental in shaping investor confidence. A successful presentation could further bolster Xiaomi’s stock performance, potentially leading to increased investment and analyst ratings. As Xiaomi prepares to unveil more about its plans, particularly regarding its YU7 electric SUV and new smartphone technologies, the investor day represents a cornerstone for its ongoing narrative of growth and innovation in the tech sector.

Understanding Xiaomi’s Global Expansion Strategy

Xiaomi’s global expansion strategy is focused on leveraging its innovative technology to penetrate new markets and regions. By establishing strategic partnerships and investing in local markets, Xiaomi aims to showcase its comprehensive product ecosystem, which includes everything from smartphones to smart home devices. This approach not only enhances brand recognition but also facilitates customer engagement and loyalty in diverse markets.

As part of its global efforts, Xiaomi has also been keen on balancing competitive pricing while ensuring high product quality. By offering budget-friendly options without compromising on performance, the brand is appealing to a wide range of consumers. This commitment to quality and affordability stands to drive significant sales growth, particularly in emerging markets where economic conditions favor cost-effective solutions. Xiaomi’s strategy underscores its determination to become a key player on the international stage.

The Future of Xiaomi in the Consumer Electronics Landscape

As the consumer electronics landscape continues to evolve rapidly, Xiaomi’s future appears promising. With a strong foundation built on innovation, competitive pricing, and a robust product ecosystem, the company is well-positioned to capitalize on emerging trends. The increasing demand for interconnected devices within the AIoT realm further emphasizes Xiaomi’s competitive stance, promising substantial growth in this space.

Additionally, Xiaomi’s proactive approach to diversifying its product line, particularly through the development of electric vehicles, suggests a commitment to staying ahead of industry trends. As the global market trends toward sustainability and smart technology, Xiaomi’s dedicated innovations and strategic expansions may well allow the brand to maintain its relevance and competitiveness in an increasingly crowded consumer electronics arena. This long-term vision coupled with immediate market strategies will be instrumental in shaping Xiaomi’s path forward.

Frequently Asked Questions

What were the key takeaways from Xiaomi’s latest earnings report regarding net profit?

Xiaomi reported a record net profit of 10.68 billion yuan ($1.48 billion) for the first quarter, exceeding expectations as detailed in their earnings report. This performance reflects strong revenue growth, reaching 111.29 billion yuan, highlighting the company’s robust position in the smartphone and AIoT markets.

How does Xiaomi’s net profit compare to Apple’s earnings in the smartphone market?

While Xiaomi’s net profit is significantly lower than Apple’s, Xiaomi has a larger smartphone market share in China. Xiaomi’s earnings growth underscores its competitive positioning despite the lower absolute dollar amounts compared to Apple, as detailed in recent stock analysis.

What factors contributed to the increase in Xiaomi’s stock following its earnings report?

Following the earnings report, Xiaomi’s stock surged over 45%, attributed to the strong surprise in net profit, particularly driven by its AIoT segment, which enhances its overall earnings potential. Analysts raised their price targets, reflecting increased investor confidence.

How is Xiaomi’s entry into the electric vehicle market expected to impact its net profit?

Xiaomi’s foray into the electric vehicle market with the YU7 SUV is expected to be a key growth driver. Analysts believe that the YU7’s launch could elevate Xiaomi’s average selling prices and margins, contributing positively to its net profit outlook.

What role does Xiaomi’s new Xring O1 chip play in its smartphone market strategy?

The newly announced Xring O1 chip positions Xiaomi to capture share in China’s high-end smartphone market, providing a competitive edge over Apple’s offerings at lower price points. This strategic move is anticipated to enhance sales and support sustained net profit growth.

What are analysts predicting for Xiaomi’s sales growth in the coming quarters?

Analysts are optimistic about Xiaomi’s sales growth due to its expansion into new product areas and the expected positive impact of the YU7 electric SUV launch. They foresee enhanced earnings driven by a combination of strong smartphone sales and increasing demand for its AIoT products.

How does Xiaomi’s diversified product offering influence its overall profitability?

Xiaomi’s diversification into appliances and electric vehicles signifies a strategy to mitigate risks and drive profitability. With nearly 22% of revenue coming from appliances, this approach is likely to enhance Xiaomi’s net profit stability amidst a competitive smartphone landscape.

| Key Point | Details |

|---|---|

| Record Net Profit | Xiaomi reported a net income of 10.68 billion yuan ($1.48 billion) for Q1, surpassing analyst expectations. |

| Market Performance | Xiaomi shares surged over 45% to 50.95 HKD, contrasting with Apple shares which dropped 20% to about $200. |

| AIoT Sector Growth | Strong performance in AIoT helped boost earnings, with analysts optimistic about Xiaomi’s growth. |

| Smartphone Market Share | Despite a cautious outlook, Xiaomi is expected to gain market share in China’s high-end segment. |

| Electric Vehicle Business | Xiaomi’s YU7 SUV launch is anticipated to drive significant short-term growth. |

| Analyst Ratings | Jefferies and Morgan Stanley rate Xiaomi stock positively, while JPMorgan adopts a neutral stance. |

Summary

Xiaomi net profit surged significantly, marking exceptional performance with a record net income of 10.68 billion yuan for the first quarter. This impressive result has bolstered analysts’ confidence in Xiaomi’s stock, showcasing its robust growth amid challenging market conditions. Despite being overshadowed by Apple in terms of absolute profits, Xiaomi’s strategic investments in electric vehicles and AI-powered appliances present ample opportunities for future expansion. As smartphone sales account for a significant portion of revenue, the launch of the YU7 SUV is positioned as a key catalyst for the company’s profitability in the near term.