XRP Futures Surge Signals Strong 2025 Outlook

XRP Futures have recently taken center stage in the cryptocurrency landscape, especially with the impressive surge in trading volume exceeding $542 million on the CME. This innovative financial instrument not only signals a burgeoning global demand for XRP but also indicates a strong outlook for cryptocurrency markets as we approach 2025. Investors are increasingly recognizing the potential of XRP futures, particularly in the context of institutional adoption and evolving market strategies. As CME further integrates XRP trading mechanisms into its offerings, the excitement surrounding Ripple’s innovations continues to grow. Staying updated with Ripple news and developments is crucial for both retail and institutional investors looking to navigate this rapidly changing environment.

The emergence of XRP Futures marks a pivotal moment for futures trading in the crypto sector, offering investors a new avenue to gain exposure to Ripple’s digital currency without the complexities of direct ownership. As institutions increasingly adopt cryptocurrency futures as part of their risk management frameworks, the appeal of these derivative products becomes evident. With the growing popularity of futures trading on platforms like CME Group, which has also introduced Micro XRP contracts, market participants can now experience the benefits of cryptocurrency investments in a regulated environment. This shift is indicative of a broader acceptance of digital assets within traditional finance and foreshadows significant advancements as the industry prepares for a transformative 2025.

Understanding the Surge of XRP Futures on CME

The recent launch of XRP futures on the Chicago Mercantile Exchange (CME) has ignited significant interest in the crypto derivatives market, showcasing a remarkable trading volume exceeding $542 million within just the first few weeks. This surge reflects not only a growing appetite for digital assets among investors but also the strategic positioning of XRP as a pivotal player in the evolving cryptocurrency landscape. With its innovative trading structure, including both standard and micro contracts, the CME XRP futures have become an attractive option for both institutional and retail investors seeking exposure to this asset without the complexities of digital wallets.

This rising popularity is underscored by the diverse participation from investors globally. The data indicates robust trading activity, with a notable 45% of transactions coming from outside North America. Such statistics reveal a strong international appeal, positioning XRP at the forefront of the cryptocurrency futures market. As institutional investor interest ramps up, the potential for XRP futures to reshape risk management strategies within financial markets becomes increasingly apparent. This new trading option not only enhances market liquidity but also reinforces XRP’s role in broader investment portfolios.

Impact of Institutional Adoption on XRP Futures

Institutional adoption is a crucial factor that drives the market dynamics surrounding XRP futures. The CME’s introduction of these futures contracts coincides with significant developments at Ripple Labs, notably their acquisition of Hidden Road for $1.25 billion. This move aims to deepen XRP’s integration within traditional finance ecosystems, paving the way for further adoption. Increased institutional participation can lead to improved market stability and confidence, essential for the long-term growth of XRP in the volatile cryptocurrency landscape.

Moreover, with the recent launch of stablecoin Ripple USD (RLUSD), Ripple is actively enhancing transaction volumes and network liquidity. This strategic move not only bolsters XRP futures trading but also positions Ripple as a formidable competitor in the crypto space. The growing institutional interest demonstrates a shift in perception towards cryptocurrencies, where asset classes like XRP are being viewed not merely as speculative investments but as viable options for diversified portfolios.

2025 Crypto Outlook with XRP Futures

Looking ahead to 2025, the outlook for XRP and its futures trades appears increasingly optimistic. Analysts predict that as institutional interest escalates, XRP’s market cap could witness significant growth. The structured nature of the futures market enables more sophisticated trading strategies, allowing investors to hedge against potential market volatility. These characteristics are crucial for financial institutions as they seek diverse avenues for investment in the fast-evolving landscape of cryptocurrency.

Additionally, the emphasis on XRP’s underlying technology, particularly its transaction speeds and low-cost transfers, positions it favorably against other cryptocurrencies. As enterprises continue to adopt XRP for payment solutions due to its efficiency, the foundation for a solid valuation trajectory up to 2025 is being established. This growth is also reflected in the ongoing evolution of regulatory frameworks which, while challenging, are gradually creating a more favorable environment for cryptocurrencies, thereby enhancing their legitimacy and acceptance in traditional finance.

The Role of Ripple News in Shaping XRP Futures

Ripple news plays a significant role in shaping investor sentiment and market behavior surrounding XRP. Recent developments, particularly in relation to legal matters with the SEC, influence perceptions about XRP’s future viability. As Ripple navigates the complexities of regulatory scrutiny, positive news can contribute to heightened investor confidence and a bullish outlook on XRP futures trading. It further reinforces the notion that XRP is not just a cryptocurrency, but a technology with real-world applications and potential for institutional adoption.

Furthermore, keeping abreast of Ripple’s strategic partnerships and technological advancements is essential for investors interested in XRP futures. Significant announcements about new collaborations, innovations in the XRP Ledger, or market expansions can lead to immediate impacts on trading volumes and market sentiment. Thus, following Ripple news closely can provide valuable insights, enabling investors to make informed decisions and capitalize on market movements.

Why XRP Futures Are Attractive to Retail Investors

XRP futures offer retail investors a compelling entry point into the cryptocurrency market without the pitfalls of direct ownership of digital assets. By trading futures, investors can speculate on the price movements of XRP while benefitting from leverage, which enhances the potential for higher returns on investments. This derivative product allows individuals to manage risk more effectively, making it an appealing option in a market characterized by volatility.

Additionally, with the introduction of micro XRP futures contracts, smaller retail investors now have the opportunity to participate in the market. This accessibility empowers a broader demographic to engage with cryptocurrency trading, making it less daunting for newcomers. As more individuals become familiar with trading options like XRP futures, it signifies a shift towards democratizing access to the digital asset space.

The Competitive Edge of XRP in the Crypto Market

XRP distinguishes itself in the cryptocurrency market through its unique blend of speed, efficiency, and affordability. Unlike energy-intensive blockchain systems, XRP’s underlying technology enables transactions to be settled within mere seconds, coupled with minimal fees. This technical advantage positions XRP as an attractive option for businesses and financial institutions looking for scalable solutions for cross-border transactions.

As the competition among cryptocurrencies intensifies, XRP’s ability to facilitate high transaction throughput without sacrificing speed is increasingly relevant. Ripple’s focus on enterprise adoption further underscores the competitive edge of XRP, as institutions continually seek efficient payment methods. This evolving landscape highlights the potential for XRP to not only remain relevant but to thrive amidst the growing competition within the cryptocurrency sector.

Navigating the Risks of XRP Futures Trading

While XRP futures present several opportunities, it’s imperative for traders to be aware of the associated risks. The cryptocurrency market is notoriously volatile, and price swings can be extreme. Futures trading, while offering leverage, also amplifies the risks, meaning that losses can be magnified if the market moves unfavorably. Investors must implement sound risk management strategies and be prepared for rapid changes in market conditions.

Moreover, the evolving regulatory environment surrounding cryptocurrencies introduces additional layers of complexity. Traders must stay informed about regulatory developments affecting XRP, as legal challenges can significantly impact its market value. By understanding these risks, traders can better navigate the futures market and make more informed decisions when trading XRP.

Technical Analysis of XRP Futures Market Trends

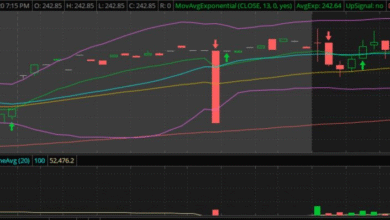

Technical analysis plays a crucial role in understanding market trends for XRP futures. By analyzing price movements, trading volumes, and market sentiment, traders can identify patterns that may indicate future price movements. Tools such as moving averages, Fibonacci retracement levels, and support and resistance zones enable traders to make data-driven decisions, optimizing their trading strategies based on comprehensive market insights.

Additionally, keeping track of macroeconomic indicators and trends in the cryptocurrency space can provide further context for technical analysis. Factors such as trading volumes in the CME XRP futures market, changes in institutional investments, and shifts in regulatory policies can all impact the technical landscape. Hence, a dual approach combining technical analysis with broader market awareness will likely enhance the decision-making process for XRP futures traders.

Future-Proofing Investments with XRP Futures

As investors seek long-term growth in the cryptocurrency market, XRP futures have emerged as a viable option for future-proofing their portfolios. The combination of institutional adoption, technological advancements, and favorable regulatory developments creates a robust environment for potential growth in XRP. By incorporating futures trading into investment strategies, individuals can strategically position themselves to capture future gains while mitigating potential losses.

Moreover, as we look towards 2025 and beyond, the growing acceptance of cryptocurrencies in mainstream finance further solidifies XRP’s potential. By leveraging futures markets, investors can remain flexible and adaptable in their trading approaches, ensuring they are well-prepared to navigate the dynamic nature of the cryptocurrency landscape. This proactive stance fosters resilience, allowing investors to capitalize on emerging opportunities as the market continues to evolve.

Frequently Asked Questions

What are XRP Futures on CME and how do they work?

XRP Futures on CME (Chicago Mercantile Exchange) are derivatives that allow traders to speculate on the future price of XRP without owning the digital asset itself. Introduced on May 19, these cash-settled contracts provide exposure to XRP’s price movements and come in two formats: standard futures (representing 50,000 XRP) and micro futures (representing 2,500 XRP). This structure offers flexibility for institutional and retail investors, aligning with recent trends in cryptocurrency futures.

How has institutional adoption impacted XRP Futures?

Institutional adoption of XRP is a significant factor driving the interest in XRP Futures on CME. In the first month after their launch, XRP Futures achieved over $542 million in trading volume, indicating robust participation from institutional investors. This rising interest suggests that institutions are increasingly recognizing the value of XRP as part of their risk management strategies in cryptocurrency markets.

Can XRP Futures influence the 2025 crypto outlook?

Yes, XRP Futures are expected to positively influence the 2025 crypto outlook. The trading activity and increased institutional participation signal a growing confidence in XRP as a viable asset. Additionally, developments such as Ripple Labs’ acquisition strategies and stablecoin introductions are likely to enhance XRP’s market position, making it a focal point for future investments in cryptocurrency.

What are the technical advantages of XRP that support its use in futures trading?

XRP offers several technical advantages that support its value as a cryptocurrency suitable for futures trading. The XRP Ledger (XRPL) facilitates low-cost, high-speed transactions, with settlement speeds of just three to five seconds and the ability to process 1,500 transactions per second. These features make XRP an appealing option for both institutional and retail traders engaged in futures trading, reinforcing its competitive edge in a crowded market.

What role does Ripple news play in the performance of XRP Futures?

Ripple news significantly impacts the performance of XRP Futures by influencing market sentiment and investor confidence. Announcements regarding regulatory developments, strategic partnerships, and advancements in technology can lead to increased trading volumes and volatility in XRP Futures. As Ripple continues to make headlines, it can drive interest in XRP, benefiting those involved in cryptocurrency futures.

How does the launch of XRP Futures relate to the growing interest in cryptocurrency futures?

The launch of XRP Futures represents a pivotal moment in the growing trend of cryptocurrency futures, providing a regulated environment for trading digital assets. With CME’s established infrastructure, XRP Futures offer institutional and retail investors a reliable way to engage with cryptocurrency markets, reflecting the rising demand and acceptance of digital assets as a viable investment class.

| Key Points | Details |

|---|---|

| CME Launch of XRP Futures | CME launched XRP futures on May 19, generating over $542 million in trading volume within the first month. |

| Institutional and Retail Interest | XRP futures have sparked significant interest, reshaping strategies in crypto risk management. |

| Global Demand | 45% of trading volume came from outside North America, highlighting global appeal. |

| Technical Advantages of XRPL | XRPL supports low-cost and fast transactions with settlement speeds of 3-5 seconds. |

| 2025 Outlook | Optmistic forecast driven by institutional adoption, Ripple USD introduction, and XRP’s scalability. |

| Challenges and Future Potential | Despite concerns regarding XRP’s centralized allocation, utility and global adoption suggest long-term value. |

Summary

XRP Futures are poised to significantly impact the market outlook for 2025, as indicated by the impressive trading volume and institutional interest since their launch. The ability to engage both institutional and retail investors, backed by favorable network advantages and strong global demand, sets a promising stage for XRP in the near future. With an expanding range of supportive financial products, XRP Futures are set to reshape the landscape of crypto trading and enhance liquidity, making them an essential consideration for market participants.