XRP Latam Surge: Meliuz Reports Unbelievable Financial Gains

In the rapidly evolving landscape of cryptocurrency news in Latam, the “XRP Latam Surge” has emerged as a compelling tale of unexpected growth. This surge in XRP adoption signifies a growing acceptance among investors across Latin America, especially as traditional cryptocurrencies continue to dominate the market. Recent insights reveal that XRP has entered the portfolios of increasingly discerning investors, taking a notable second place in asset holdings after Bitcoin. As Brazil implements tariff measures that affect the overall economic climate, the Latam crypto market responds with shifting dynamics favoring the once-overlooked XRP. This development is underscored by robust financial reporting from companies like Meliuz, indicating a pivot toward digital assets amidst the backdrop of changing economic conditions.

The sudden rise of XRP in Latin America can be viewed as an intriguing shift within the region’s cryptocurrency portfolio landscape. As Latin American investors navigate a complex financial environment, alternative cryptocurrencies are gaining more traction, especially with XRP’s notable ascent in popularity. This transformation comes at a time when economic policies, including new tariff measures from Brazil, are reshaping the financial landscape, prompting a reevaluation of traditional asset holdings. Coupled with impressive financial outcomes like those reported by Meliuz, it’s clear that the Latam crypto market is evolving, opening doors for broader cryptocurrency adoption. Such developments highlight the importance of adaptability and innovation among investors seeking growth in this dynamic arena.

The Surge of XRP Adoption in Latam

In recent weeks, the adoption of XRP has witnessed a remarkable surge in Latin America, contrasting with the long-standing dominance of Bitcoin in the region. According to the latest findings from Bitso’s report on the cryptocurrency landscape, XRP has positioned itself as a notable competitor, demonstrating its growing appeal among investors. With 12% of wallets holding this asset, XRP has edged out Ether in popularity, indicating a shift in investor confidence and interest towards this cryptocurrency. This change illustrates how Latin American investors are exploring diverse opportunities in the crypto market, thereby enhancing XRP’s position as a viable alternative.

The rise of XRP in Latam can be attributed to several factors, including its speed and low transaction costs, which are appealing to users in countries where financial systems can be sluggish. With the ongoing developments in the cryptocurrency ecosystem and the broader acceptance of digital assets, XRP is poised to play a significant role in shaping the future of cryptocurrency investment in Latin America. Its increase in adoption demonstrates a more significant trend towards diversifying portfolios beyond just stablecoins and Bitcoin, likely leading to a more dynamic future for the entire Latam crypto market.

Meliuz’s Financial Resurgence amid Cryptocurrency Trends

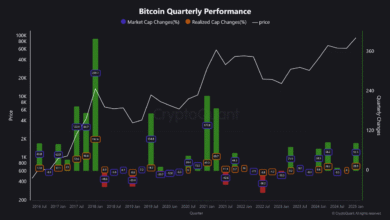

Meliuz, a Brazilian cashback company, has set a new precedent in the financial sector by reporting astonishing financial results following its strategic acquisition of Bitcoin as a reserve asset. The company’s CEO, Gabriel Loures, revealed that Meliuz achieved a stunning 908% yield on Bitcoin within just one quarter, showcasing the tangible benefits of incorporating cryptocurrency into traditional business models. This remarkable turnaround, from a previous loss of over $11 million in 2024 to a net profit of $1.4 million in Q2 2025, exemplifies the potential of cryptocurrency integration in enhancing business performance.

The integration of Bitcoin into Meliuz’s financial strategy has not only improved their profitability but also attracted interest from investors looking to take advantage of the cryptocurrency trend. With Meliuz pioneering fundraising operations for Bitcoin purchases in Brazil, other companies may take a cue from this success, further driving the adoption of cryptocurrencies in the region. This trend signifies a broader movement within Latin American businesses to leverage cryptocurrencies as financial assets, potentially enhancing their market viability in a competitive landscape.

Brazil’s Tariff Measures and the Implications for the Crypto Market

In response to escalating trade tensions, Brazil has rolled out a comprehensive plan, dubbed ‘Sovereign Brazil,’ aimed at mitigating the impact of hefty tariff measures imposed by the United States. This initiative, which includes a staggering $5.55 billion credit line, is designed to support local producers facing increased levies. While these economic strategies are set to alleviate the immediate financial burden on businesses, they also raise questions about Brazil’s broader trade relations, especially as Latin America continues to evolve within the global cryptocurrency landscape.

As Brazil navigates through these tariff challenges, it may inadvertently affect the crypto market dynamics, particularly regarding investor confidence. The balance between traditional financial mechanisms and the burgeoning cryptocurrency sector remains delicate, with companies like Meliuz showcasing the potential benefits of BTC integration. How Brazil’s economy adapts to these pressures could influence the trajectory of XRP and other cryptocurrencies in the region, possibly leading to increased adoption as businesses seek innovative ways to secure their financial futures amidst changing global economic conditions.

Why XRP is Emerging as a Preferred Cryptocurrency in Latin America

XRP has steadily emerged as a preferred cryptocurrency among Latin American investors primarily due to its unique attributes that address regional financial challenges. With many countries facing instability and high transaction costs, XRP’s efficiency in cross-border payments offers a compelling alternative for those looking to mitigate these issues. This growing appeal is reflected in its increasing presence in digital wallets across Latam, positioning the asset as a practical solution for many investors seeking alternatives to traditional banking systems.

Furthermore, XRP’s resilience during times of market volatility has contributed to its reputation in the region. As investors in Latin America seek to diversify their portfolios amid economic uncertainty, the shift towards adopting XRP serves a dual purpose: enhancing liquidity while minimizing transaction costs. As these trends continue, we may witness XRP solidifying its status not just as a digital asset, but as an integral component of the evolving financial ecosystem within Latin American markets.

The Landscape of Cryptocurrency News in Latam

The cryptocurrency news landscape in Latin America is rapidly transforming, with more investors and businesses leaning towards digital assets. This shift is largely driven by increased awareness and education surrounding cryptocurrencies, propelled by significant media coverage and industry reports, such as those released by Bitso. As the crypto market continues to expand, there is a growing demand for reliable news sources that provide insights into market trends, investor behaviors, and regulatory developments affecting the region.

In this evolving environment, cryptocurrencies like XRP and Bitcoin are frequently featured in discussions, as they exemplify the changing ethos of financial investments. Local exchanges and financial institutions are tapping into this surge by offering educational resources and promoting the benefits of cryptocurrency adoption. By shedding light on recent trends and significant financial results, such as those reported by companies like Meliuz, the discourse around cryptocurrency becomes more mainstream, encouraging higher levels of engagement and participation from the broader public.

Brazil’s Economic Policies and Their Effect on Crypto Adoption

As Brazil grapples with new economic policies, the implications for cryptocurrency adoption are significant. The recent announcement of the $5.55 billion credit line under the ‘Sovereign Brazil’ plan reveals the government’s commitment to supporting local businesses as they navigate the evolving economic landscape shaped by international trade conflicts. While these measures primarily aim to stabilize traditional sectors, they create a fertile ground for cryptocurrency to flourish as businesses seek innovative financial solutions to counteract external pressures.

With the unveiling of tariffs and countermeasures, businesses are increasingly exploring diverse asset classes, including cryptocurrencies, to enhance their resilience. As the Brazilian market becomes more open to digital currencies, it is expected that investors will turn towards cryptocurrencies like XRP, viewing them not just as speculative investments but as essential components of diversified portfolios. This shift could catalyze widespread cryptocurrency adoption in Brazil, helping to integrate these assets into the financial mainstream.

The Role of Stablecoins in the Latam Crypto Market

Stablecoins play a crucial role in the Latin American cryptocurrency market, offering a hybrid solution that combines the volatility of cryptocurrencies with the stability of traditional currencies. In regions characterized by economic instability, stablecoins provide a safe haven for transactions and savings, allowing users to hedge against local currency fluctuations. Their growing popularity among crypto investors highlights the demand for reliable digital assets that facilitate seamless transactions across borders without the risks associated with typical cryptocurrencies.

As the crypto market in Latam matures, the significance of stablecoins is becoming more evident, particularly as businesses look for ways to incorporate them into their financial strategies. Companies like Meliuz, which has successfully integrated Bitcoin into their operations, may also consider stablecoins as part of their portfolio to balance volatility with stability. This dual approach not only enhances transactional efficiency but also broadens the appeal of cryptocurrencies to a broader audience, thus contributing to increased adoption across the region.

Future Projections for XRP in Latin America

The future of XRP in Latin America appears promising as more investors recognize its potential as a key player in the evolving financial ecosystem. With its unique features and advantages, XRP is well-positioned to meet the demands of users looking for efficient payment solutions. As the market matures, we can expect to see enhanced integrations with various financial platforms, making XRP a staple in both individual and institutional portfolios.

Looking forward, the trajectory of XRP will likely be influenced by ongoing developments within the broader cryptocurrency market, regulatory changes, and the involvement of local exchanges like Bitso. As the landscape continues to shift, XRP’s ability to adapt and provide value will be paramount in solidifying its place within the Latin American crypto market. This growth can further stimulate investment and innovation across the region, cementing XRP’s status as an essential digital asset for years to come.

Frequently Asked Questions

What is the impact of XRP adoption on the cryptocurrency news in Latam?

XRP adoption is significantly reshaping the cryptocurrency landscape in Latam. Recent reports show that XRP has become a preferred asset among investors, ranking second in crypto portfolios behind Bitcoin. This surge in adoption reflects an increasing interest in diverse cryptocurrency options beyond traditional choices, influencing cryptocurrency news in Latam.

How did Meliuz achieve its stellar financial results amidst the surge of XRP in Latam?

Meliuz posted exceptional financial results, reporting a net profit of $1.4 million, partly due to its strategic shift to include Bitcoin in its portfolio. This decision, along with XRP’s rising popularity, reflects a broader trend in the Latam crypto market where innovative financial strategies are gaining traction.

What factors are contributing to the XRP surge in the Latam crypto market?

The surge in XRP adoption in the Latam crypto market is driven by increased investor interest and the diversification of crypto portfolios. Reports indicate that XRP has overtaken Ether, making it a key player in the region’s cryptocurrency scene, signifying a shift away from solely relying on Bitcoin.

How do Brazil’s tariff measures affect the crypto landscape, particularly XRP adoption?

Brazil’s recent tariff measures may indirectly benefit XRP adoption as investors seek alternative assets to hedge against economic uncertainty. The turbulence in the Brazilian economy has led to increased interest in cryptocurrencies like XRP, which can act as a stable investment amidst financial fluctuations.

What are the implications of Meliuz’s BTC yield on XRP adoption in Latam?

Meliuz’s impressive Bitcoin yield of 908% underscores the potential benefits of cryptocurrency investment. As more companies see the financial gains from integrating cryptocurrencies into their operations, such as Meliuz’s success, this may further drive XRP adoption in the Latam region and attract more investors.

| Key Highlights | XRP Growth in Latam | Meliuz Financial Success | Brazil’s Tariff Countermeasures |

|---|---|---|---|

| Week’s Crypto Highlights in Latam | |||

| XRP adoption surges as a popular alternative asset in Latam portfolios. | XRP has overtaken Ether, becoming the second-most held cryptocurrency in the region at 12%. | ||

| Meliuz reports 908% yield on Bitcoin holdings, showcasing the potential of BTC for companies. | Meliuz’s shift to BTC resulted in a net profit of $1.4 million in Q2 2025. | ||

| Brazil unveils $5.55 billion aid package for producers affected by US tariffs. | Countermeasures are part of efforts to mitigate tariff impacts on Brazilian exports. | ||

Summary

XRP Latam Surge marks a significant shift in Latin America’s cryptocurrency landscape, as XRP has emerged as a prominent asset alongside traditional cryptocurrencies. This week’s report highlights XRP’s growth, showing its rise to the second-most held digital currency in the region, overtaking Ether. The successful financial outcomes of firms like Meliuz and proactive measures from Brazil’s government indicate the growing importance of cryptocurrencies in shaping the economic future of Latin America.