Yum Brands Q2 2025 Earnings Miss Expectations

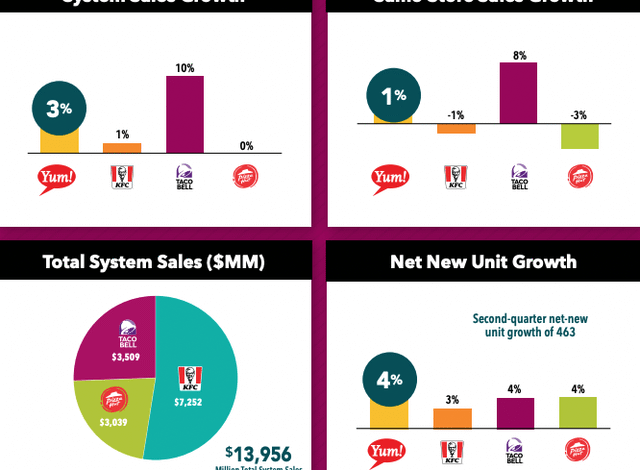

Yum Brands Q2 2025 Earnings were recently unveiled, revealing a mixed bag for investors and analysts alike. The company reported earnings that fell shy of expectations, generating an adjusted earnings per share of $1.44 compared to the anticipated $1.46. Additionally, revenue for the quarter was reported at $1.93 billion, just below the expected $1.94 billion mark, highlighting challenges in the fast food landscape. Notably, both Pizza Hut and KFC faced declines in U.S. same-store sales, raising concerns about their revenue performance moving forward. As investors digest the Yum Brands earnings report, the analysis of YUM stock will be crucial in understanding its future trajectory amid this backdrop of increased competition and evolving consumer preferences.

The latest financial disclosures from Yum Brands shed light on their performance for Q2 2025 and set the stage for a robust analysis of their business strategies. In this quarter’s results, the quick-service giant faced hurdles, particularly with dips in Pizza Hut sales, signaling possible shifts in consumer demand. Furthermore, insights into KFC’s revenue trends will be essential for stakeholders monitoring the brand’s resilience. As we delve into YUM’s quarterly results, it becomes imperative to assess the broader implications for the company, including the impacts on forthcoming strategies and market positioning. With such comprehensive data, investors and analysts alike are poised to evaluate Yum Brands’ financial stability and growth potential in the fast-paced fast-food industry.

Yum Brands Q2 2025 Earnings Review

Yum Brands recently unveiled its Q2 2025 earnings, which revealed critical insights into the company’s continuing performance struggle amidst fluctuating market conditions. The earnings report highlighted an adjusted earnings per share of $1.44, falling short of the anticipated $1.46, which raised concerns among investors about the ongoing operational challenges at its flagship brands like Pizza Hut and KFC. With revenue totaling $1.93 billion, again slightly below expectations of $1.94 billion, this quarter’s performance indicates a potential downturn in consumer spending and competitive pressures affecting the fast-food giant’s growth trajectory.

The earnings results paint a mixed picture; while net income exhibited a year-on-year increase from $367 million to $374 million, concerns about same-store sales cannot be overlooked. Specifically, both Pizza Hut and KFC reported declines in U.S. same-store sales, provoking questions regarding the effectiveness of Yum’s current strategies to rejuvenate its brand appeal and sales performance. Investors are advised to monitor the trends in Yum Brands’ financial performance closely to assess how these challenges might affect the company’s long-term growth and stability.

Impact of Pizza Hut Sales Decline on Yum Brands

One of the most concerning aspects of Yum Brands’ Q2 2025 results is the decline in sales at Pizza Hut, which has been a cornerstone of the company’s offerings. A dwindling customer base and stiff competition in the pizza segment have contributed to a downturn in same-store sales, indicating that the brand is losing its competitive edge. As consumers explore new dining options, the drop in sales at Pizza Hut reflects broader changes in consumer preferences and behaviors, warranting a comprehensive analysis of how the brand can innovate to attract customers back.

This decline directly correlates with Yum’s overall financial health, as Pizza Hut has historically been a significant contributor to the company’s revenue. Analysts are expressing concerns that without revitalization efforts, Pizza Hut may drag down Yum Brands’ profitability further, affecting stock performance (YUM stock analysis). It raises an essential question: How will Yum Brands reposition Pizza Hut to reclaim market share in an increasingly diverse and competitive food industry?

KFC Revenue Performance in Q2 2025

KFC’s performance in Q2 2025 also displayed mixed signals, with revenue figures indicating a struggle to maintain strong growth amidst the shifting market dynamics. The second quarter revealed that KFC is facing challenges that have been compounded by rising food costs and evolving consumer tastes. Despite its robust brand recognition and loyal customer base, KFC must adapt its menu and marketing strategies to align with contemporary dietary preferences and competition from emerging fast-casual concepts.

The challenges facing KFC not only influence its own performance but also have implications for Yum Brands as a whole. If KFC can’t rebound in the coming quarters, it could further strain Yum’s profitability and investor confidence, as performance across these major brands is often interconnected. Analysts are keenly watching how Yum Brands will address these hurdles and potentially implement changes to improve KFC’s revenue performance moving forward.

Analyzing Yum Brands Earnings Report and Future Outlook

Analyzing the Yum Brands Q2 2025 earnings report provides vital insights into the company’s future trajectory amid challenging market conditions. While the reported earnings and net income showed slight improvements year-over-year, the overall performance fell below Wall Street’s expectations, prompting analysts to reassess their forecasts for Yum stock moving forward. The expected growth that was anticipated has been undercut by recent declines in sales across flagship brands, which highlights the urgent need for strategic adjustments.

Additionally, the evolving landscape of consumer preferences post-pandemic necessitates that Yum Brands refine its offerings and improve operational efficiency. Continued scrutiny of costs, coupled with innovative marketing strategies and menu adaptations, will be crucial for enhancing customer engagement. Investors should stay alert to upcoming strategic initiatives from Yum Brands that may bolster future performance and help stabilize YUM stock in potential downturns.

Strategic Responses to Financial Results

In light of the Q2 2025 financial results, Yum Brands must adopt strategic responses to address the challenges highlighted in the earnings report. One potential pathway involves investigating customer feedback and trends to pivot their offerings better in accordance with consumer preferences. By innovating their product lines and focusing on new approaches to marketing and development, Yum can work to rekindle interest in brands like Pizza Hut and KFC amid stagnant same-store sales.

Furthermore, Yum Brands may consider leveraging technology to enhance operational efficiencies and reduce costs, ultimately boosting its bottom line. Exploring partnerships, expanding delivery services, and utilizing data analytics to refine marketing strategies could provide a competitive edge. As they navigate these challenging times, the effectiveness of Yum’s strategic responses will be pivotal in defining its performance trajectory in the coming quarters.

Yum Brands Stock Analysis Post Q2 2025 Results

Following the release of the Q2 2025 earnings report, a thorough analysis of YUM stock is crucial for investors looking to gauge the company’s financial health and future performance potential. Despite a slight uptick in net income year-over-year, the overall disappointing results in terms of revenue and same-store sales pose concerns for shareholders. Analysts will need to re-evaluate their targets and recommendations as they assess how the decline in sales at major brands may affect investor confidence and stock valuation moving forward.

The market’s reaction to these results will also be pivotal in shaping the perception of Yum Brands’ resilience. Investors are likely to scrutinize the company’s strategic initiatives aimed at reversing the declining trend in sales at Pizza Hut and KFC. Effective communication of these strategies will be essential in restoring trust and assuring that Yum can adapt to changing market conditions, which could, in turn, positively influence YUM stock performance in the aftermath of these financial revelations.

Future Challenges for Yum Brands

As Yum Brands moves forward from its Q2 2025 earnings report, numerous challenges lie ahead that could significantly impact the company’s success. The competitive landscape within the fast-food industry is rapidly evolving, with rising players capitalizing on trends toward healthier and more sustainable eating options. This dynamic forces Yum to stay ahead of the curve and not only focus on revamping existing brands but also consider expanding into areas that appeal to modern consumers.

Additionally, market volatility and rising operational costs present substantial hurdles for Yum Brands as it aims to optimize profitability. The ability to mitigate these inflationary pressures while maintaining product quality and customer satisfaction will be critical. Fostering innovation and agility in operations may hold the key for Yum to navigate these challenges effectively, ensuring growth and stability amid a turbulent market environment.

Innovative Strategies to Revitalize Brands

To counteract the declining sales and sluggish growth indicators observed in the Q2 2025 financial results, Yum Brands must implement innovative strategies to revitalize its core brands, particularly Pizza Hut and KFC. One approach could include enhancing the digital ordering experience, as a growing number of consumers prioritize convenience and speed. By investing in technology and user engagement, Yum can create a more responsive and appealing dining experience that meets modern customers’ needs.

Additionally, Yum Brands might explore new marketing strategies that resonate with a younger demographic, leveraging digital platforms to cultivate brand loyalty. Collaborations with popular influencers and creating appeal through distinctive promotional campaigns could reinvigorate customer interest and draw lapsed patrons back to Pizza Hut and KFC. The success of these initiatives hinges on how effectively Yum Brands can align its operations with contemporary consumer preferences and behaviors.

Investor Sentiment and Market Reaction

The investor sentiment surrounding Yum Brands has undeniably been impacted by the disappointing figures revealed in its Q2 2025 earnings report. Following the unveiling of the results, there may have been heightened apprehension regarding the sustainability of Yum’s growth trajectory and its ability to fulfill performance expectations in the future. Shareholders are now more attuned to how operational difficulties at major brands could affect overall profitability and, consequently, YUM stock performance.

Market reactions may also be driven by both immediate and strategic long-term implications of these earnings results. The expectation from investors is that Yum Brands’ management will respond proactively to address the challenges highlighted, particularly as they relate to sales performance at Pizza Hut and KFC. How effectively Yum communicates its strategic vision and adapts to market demands will be pivotal in shaping investor perceptions in the months following this earnings release.

Frequently Asked Questions

What were the key highlights from Yum Brands Q2 2025 earnings report?

Yum Brands Q2 2025 earnings report revealed a second-quarter net income of $374 million, equating to $1.33 per share, which marked an increase from the previous year’s $367 million. However, adjusted earnings per share were $1.44, falling short of the expected $1.46. Total revenue reached $1.93 billion, slightly below the forecasted $1.94 billion.

How did Pizza Hut perform in Yum Brands Q2 2025 financial results?

In Yum Brands Q2 2025 financial results, Pizza Hut faced challenges with a decline in U.S. same-store sales, which impacted overall performance. Investors and analysts are particularly noting this trend as a concern for the brand’s future growth.

What are the implications of KFC revenue performance in the Q2 2025 earnings?

The KFC revenue performance in Yum Brands Q2 2025 earnings highlighted difficulties in achieving growth, as it too experienced declines in U.S. same-store sales. This underperformance has raised questions about the brand’s competitive strategy and potential recovery plans.

How do Yum Brands earnings impact YUM stock analysis?

The Yum Brands earnings results, particularly the Q2 2025 report, are significant for YUM stock analysis as they suggest a potential slowdown in growth momentum. Analysts will closely scrutinize these results to assess future stock performance and market sentiment.

What trends are reflected in Yum Brands Q2 2025 Earnings concerning U.S. sales?

Yum Brands Q2 2025 earnings reveal a concerning trend with both Pizza Hut and KFC reporting declines in U.S. same-store sales. This trend indicates potential challenges in customer retention and market competition, which investors should watch closely.

| Key Metric | Q2 2025 Actual | Wall Street Expectations |

|---|---|---|

| Earnings per share (adjusted) | $1.44 | $1.46 |

| Revenue | $1.93 billion | $1.94 billion |

| Net income | $374 million ($1.33 per share) | |

| Year-over-year net income comparison | Increased from $367 million ($1.28 per share) | |

| Net sales growth | 10% increase |

Summary

Yum Brands Q2 2025 Earnings revealed mixed results, with earnings slightly underperforming analyst expectations. Despite reporting a net income increase from the previous year, both Pizza Hut and KFC faced challenges in the U.S. market, reflected in a decline in same-store sales. The highlighted figures indicate a need for Yum Brands to reevaluate strategies moving forward to regain momentum in the competitive fast-food industry.