Zero-Knowledge Proofs: The Future of Regulatory Compliance

Zero-knowledge proofs (ZKPs) are revolutionizing the landscape of privacy-preserving technology, allowing users to prove their knowledge of information without revealing the information itself. As blockchain integration becomes increasingly relevant in today’s financial systems, ZKPs could play a pivotal role in enhancing regulatory compliance without compromising sensitive data. Howard Wu, founder of the Aleo Protocol, highlights how this innovative approach enables institutions to validate transactions while maintaining user privacy, addressing one of the biggest hurdles faced by traditional finance. With the rise of sophisticated privacy solutions, companies can leverage ZKPs to minimize operational risks and reduce compliance costs, ultimately leading to substantial competitive advantages. As organizations navigate the complexities of integrating ZKPs within established frameworks, they stand to gain not only security but also trust in an evolving digital landscape.

In the world of cryptography and data security, the concept of proving knowledge without disclosure—often referred to as ‘zero-knowledge proofs’—is gaining traction as a transformative solution for many industries. These privacy-centric methods are crucial for balancing the need for transparency with the necessity of confidentiality in sensitive transactions. As businesses begin to adopt advanced privacy-preserving technologies, alternative phrases like ‘confidentiality protocols’ and ‘non-disclosure validations’ underscore the innovative approaches being taken to integrate these systems into traditional operational frameworks. The Aleo Protocol exemplifies how such mechanisms can enhance compliance strategies while ensuring data integrity, making it an essential topic for organizations looking to thrive in a tech-driven economy. With the continuous development of these privacy tools, regulatory landscapes are expected to adapt, fostering a more secure environment for both businesses and consumers.

The Transformation of Regulatory Compliance with ZKPs

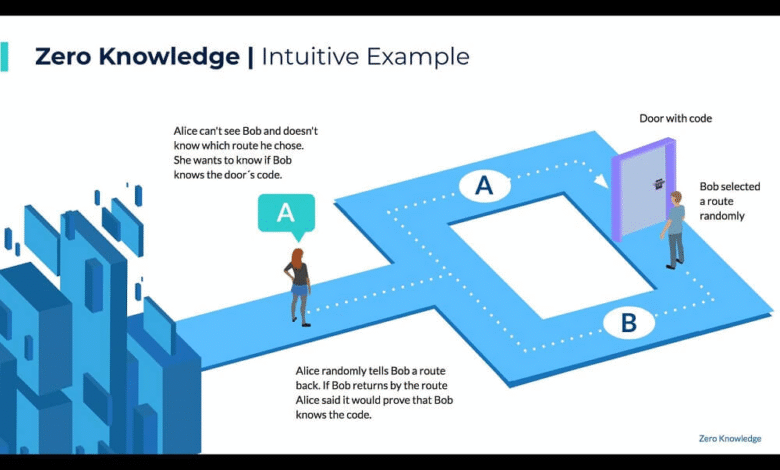

Zero-knowledge proofs (ZKPs) represent a revolutionary approach to regulatory compliance in the evolving landscape of blockchain technology. By allowing one party to prove to another that a specific statement is true without revealing any confidential information beyond the validity of the statement itself, ZKPs can fundamentally alter how organizations handle sensitive data. For financial institutions, this means they can demonstrate adherence to regulations without exposing customer identities or transaction details, significantly reducing the risk of data breaches and privacy violations.

As regulatory bodies around the world grapple with how to incorporate emerging technologies into their frameworks, ZKPs offer a solution that could align compliance requirements with the need for user privacy. For instance, banks could use ZKPs to prove their compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations while safeguarding client data. This capability not only enhances trust between financial entities and regulators but also paves the way for a more secure and transparent financial ecosystem.

Challenges in Integrating Aleo Protocol into Traditional Systems

Integrating the Aleo Protocol into existing traditional finance (TradFi) systems poses significant challenges, primarily due to the inherent complexity of blockchain integration. The Aleo Protocol leverages ZKPs, designed to enhance privacy and enable compliance, yet institutions face hurdles in understanding how these technologies fit into their current operational frameworks. For success, organizations must realize that adopting ZKPs is not merely a technical upgrade but requires a holistic transformation of their compliance and governance models.

Moreover, as Howard Wu mentions, the shift towards implementation comes with increased responsibility for organizations to bridge the gap between legacy systems and new technologies. Financial institutions need to undertake comprehensive employee training, update their policies, and redesign workflows to accommodate these revolutionary privacy-preserving technologies. This cultural shift toward embracing blockchain solutions like Aleo reflects a growing realization among TradFi executives that innovation is not merely advantageous but necessary for maintaining competitive viability in an increasingly digital world.

Educating Executives on Privacy-Preserving Blockchain Benefits

Education plays a pivotal role in facilitating the adoption of privacy-preserving technologies within traditional financial institutions. However, it is essential for executives to focus on the practical applications of ZKPs rather than getting lost in the complex technical details. Howard Wu emphasizes that understanding how ZKPs can reduce operational risk and lower compliance costs is critical for TradFi leaders. This pragmatic perspective allows executives to view ZKPs as tools that can enhance their strategic positions rather than mere technological innovations.

For instance, Wu illustrates how ZKPs can lead to reduced risk exposure by limiting the amount of sensitive data that organizations need to manage. By adopting Aleo’s solutions, institutions can fulfill regulatory demands while minimizing their data liability—facilitating safer transactions and enhancing trust with clients. These educational initiatives empower decision-makers to champion ZKPs, propelling the transformation of their organizations and the broader financial sector towards a more secure and efficient future.

Creating a Transparent and Efficient Financial Ecosystem

The advent of privacy-preserving technologies like ZKPs could significantly contribute to the creation of a more transparent and efficient financial ecosystem. By ensuring that compliance with regulations does not come at the expense of individual privacy, these tools enable institutions to uphold their responsibilities while promoting customer trust. As financial systems undergo modernization, incorporating such technologies can lead to seamless and secure transactions, fostering an environment that enhances both innovation and accountability.

Furthermore, as Wu points out, the integration of ZKPs into financial services can facilitate cross-border payments and tokenized securities by reducing regulatory frictions. With the capability to audit transactions without accessing sensitive data, ZKPs foster interoperability among diverse systems. This transformative approach not only simplifies compliance but also propels institutions toward a future where innovation and regulation coexist harmoniously, driving growth in global commerce.

ZKPs and the Future of Privacy in Finance

Looking toward the future, the role of zero-knowledge proofs in the financial sector promises to redefine the relationship between privacy and compliance. As regulators increasingly recognize the necessity of data protection, ZKPs are well-positioned to serve as a bridge between surveillance and privacy—allowing institutions to function efficiently without compromising sensitive information. Wu envisions a time when ‘ZKP-native’ regulatory frameworks will emerge, tailored to support both user privacy and operational transparency.

As this landscape evolves, the potential applications of ZKPs will continue to expand, addressing various regulatory requirements while enhancing user trust in financial services. By effectively utilizing these privacy-preserving technologies, financial institutions can not only adhere to compliance standards but also differentiate themselves in a highly competitive market. This alignment of compliance and customer-centricity could herald a new era in finance, where privacy is not only respected but recognized as a fundamental pillar of modern financial operations.

The Role of Governance in Adopting Privacy Technologies

Effective governance is crucial for the successful integration of privacy-preserving technologies like ZKPs into traditional financial systems. As organizations embark on this journey, establishing robust governance structures is essential to navigate the complexities of compliance and data protection requirements. This entails not just technical reforms but also a reevaluation of existing policies and frameworks to ensure that they accommodate the innovative nature of blockchain technologies.

In this context, Wu emphasizes the importance of retraining compliance teams to adapt to new governance models that rely on advanced technologies. By focusing on integrating ZKPs into their compliance processes, financial institutions can maintain regulatory integrity while fostering a culture of privacy-centric governance. With strong oversight mechanisms in place, organizations can embrace the benefits of Aleo’s offerings, ultimately leading to more resilient and responsive operational structures.

Navigating the Regulatory Landscape for Blockchain Integration

The regulatory landscape surrounding blockchain integration is both complex and dynamic, requiring institutions to stay informed about evolving guidelines. Policies are continually developing in response to the challenges posed by cryptocurrency and decentralized finance, and organizations must be proactive in seeking clarity to ensure compliance. In this context, ZKPs serve as a vital asset, offering mechanisms for organizations to validate transactions without exposing sensitive data.

As financial institutions work towards navigating this shifting regulatory environment, they must also engage in dialogue with regulatory bodies to advocate for frameworks that incorporate the implications of privacy-preserving technologies. By demonstrating the practical benefits of ZKPs in regulatory compliance, organizations can contribute to shaping policies that reflect the realities of modern finance, ultimately paving the way for broader adoption of blockchain technologies across sectors.

Unlocking the Value of ZKPs in Financial Institutions

The potential of zero-knowledge proofs (ZKPs) in unlocking value for financial institutions is becoming increasingly apparent. By implementing these technologies, organizations can optimize their compliance processes while simultaneously protecting customer privacy. This dual benefit enhances operational efficiency, reduces costs associated with data breaches, and lowers the complexity of navigating regulatory frameworks. As Howard Wu illustrates, ZKPs allow institutions to operate transparently without compromising sensitive information.

Additionally, ZKPs can provide a competitive edge in the marketplace as firms increasingly seek to differentiate themselves through enhanced security measures. By successfully incorporating ZKPs into their operations, financial institutions not only address regulatory requirements but also boost customer confidence in their ability to safeguard personal data. This strategy positions organizations to thrive in a landscape where privacy and security are paramount, paving the way for sustained growth and innovation.

Adapting to Decentralization: The Future with Aleo

Adapting to the principles of decentralization presents both opportunities and challenges for traditional financial institutions. The Aleo Protocol, built on the foundation of zero-knowledge proofs, offers a pathway for these organizations to transition into a decentralized future while ensuring compliance and maintaining privacy. Executives must recognize that this shift involves more than just technology; it requires a transformation in mindset and operational approach.

By embracing the decentralized principles inherent in Aleo, financial institutions can explore innovative solutions that align with the values of transparency and trust. This evolution hinges on the successful integration of governance structures that accommodate decentralized technologies, ultimately fostering a financial ecosystem that is inclusive and secure. As institutions embark on this journey, the potential of Aleo and ZKPs to reshape the future of finance remains monumental.

Frequently Asked Questions

What are zero-knowledge proofs (ZKPs) and how do they enhance privacy-preserving technology?

Zero-knowledge proofs (ZKPs) are cryptographic methods that allow one party to prove to another that they know a value without revealing the value itself. This technology significantly enhances privacy-preserving solutions by ensuring sensitive information remains confidential, even in cases of regulatory compliance. Leveraging ZKPs, organizations can validate transactions and identities without exposing customer data, thus streamlining trust in digital interactions.

How does the Aleo Protocol utilize zero-knowledge proofs for regulatory compliance?

The Aleo Protocol employs zero-knowledge proofs (ZKPs) to enable organizations to demonstrate regulatory compliance while protecting sensitive customer information. By using ZKPs, Aleo allows businesses to verify compliance with financial regulations without disclosing underlying data, thus mitigating risk and fostering confidentiality in transactions within blockchain integration.

What challenges do financial institutions face when implementing ZKPs in blockchain systems?

Financial institutions encounter several challenges in implementing zero-knowledge proofs (ZKPs) within blockchain systems, notably regulatory uncertainties and technical complexities. As regulatory frameworks evolve, institutions must navigate the integration of ZKPs into existing systems. This includes updating governance structures and ensuring compliance while leveraging the privacy-preserving benefits offered by ZKPs to enhance operational efficiency.

Can you explain how ZKPs can reduce operational risks for traditional finance (TradFi) executives?

Zero-knowledge proofs (ZKPs) can significantly reduce operational risks for traditional finance (TradFi) executives by minimizing the amount of sensitive data that organizations need to handle, thus lowering the chance of data breaches. Additionally, ZKPs facilitate proof of compliance with regulations without requiring the disclosure of customer information, enabling companies to reinforce trust while ensuring compliance in their operations.

What role does education play in the adoption of zero-knowledge proofs (ZKPs) in financial institutions?

Education is crucial for the successful adoption of zero-knowledge proofs (ZKPs) in financial institutions. Executives need to comprehend the strategic benefits and practical applications of ZKPs rather than the technical intricacies. Understanding how ZKPs can provide competitive advantages and facilitate regulatory compliance will help institutions leverage this privacy-preserving technology more effectively in their operations.

What potential do ZKPs have for shaping future regulatory frameworks?

Zero-knowledge proofs (ZKPs) have significant potential to reshape future regulatory frameworks by introducing methodologies focused on data minimization and user privacy. By enabling more frequent and less invasive compliance verifications, ZKPs could streamline regulatory processes while maintaining essential oversight. This can lead to ‘ZKP-native’ regulatory frameworks, enhancing both privacy for individuals and compliance efficiency for institutions.

How can ZKPs facilitate the integration of blockchain technologies into existing financial systems?

ZKPs facilitate the integration of blockchain technologies into existing financial systems by providing a secure method for verifying transactions and identities without the need to disclose sensitive information. This capability allows financial institutions to adopt blockchain solutions more confidently, mitigating privacy risks related to customer data while benefiting from the efficiencies of decentralized technologies.

What is the significance of regulatory compliance in the context of zero-knowledge proofs?

Regulatory compliance is critically significant in the context of zero-knowledge proofs (ZKPs) because it allows organizations to meet regulatory requirements without compromising customer privacy. By leveraging ZKPs, companies can conduct necessary verifications and audits while protecting sensitive information, ultimately fostering a balance between compliance with laws and the preservation of user confidentiality in their transactions.

| Key Point | Description |

|---|---|

| Regulatory Challenges | Historically, regulatory uncertainty hindered blockchain integration into traditional finance, now emphasis is on implementation. |

| The Role of Zero-Knowledge Proofs (ZKPs) | ZKPs offer a way to maintain privacy while ensuring compliance, allowing institutions to prove regulatory compliance without revealing sensitive data. |

| Education for Adoption | Financial executives need to understand the practical applications of ZKPs rather than the technical details to drive adoption. |

| Operational Benefits | ZKPs can reduce operational risks, lower compliance costs, and create competitive advantages for financial institutions. |

| Future of Regulation | There’s optimism for developing ZKP-native regulatory frameworks that focus on privacy while ensuring compliance. |

Summary

Zero-knowledge proofs (ZKPs) present a groundbreaking solution for enhancing privacy within regulatory environments. As blockchain technology evolves, the need for integrating ZKPs into traditional financial systems becomes increasingly evident. This integration not only addresses regulatory compliance challenges but also minimizes operational risks and enhances data security. The potential of ZKPs to reshape the regulatory landscape by creating privacy-preserving frameworks can lead to a more efficient and transparent financial ecosystem. In summary, ZKPs stand at the forefront of regulatory technology, capable of transforming the way financial institutions approach compliance and data management.