Bitcoin Miner Outflow Signals Caution in Whale Accumulation

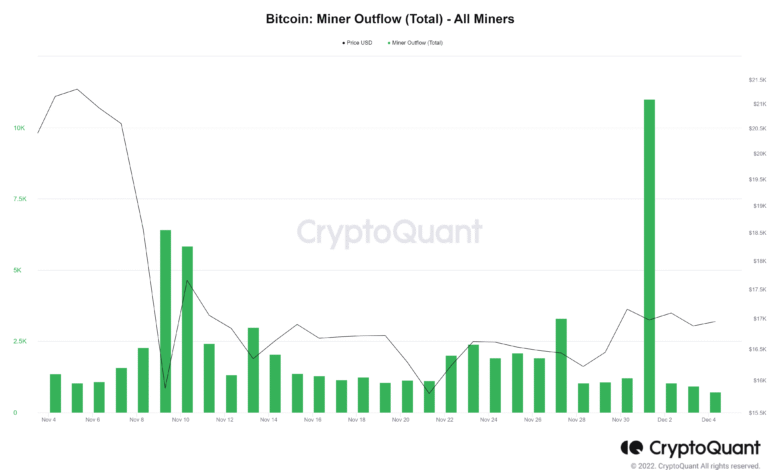

Bitcoin miner outflow has become a focal point of attention, as recent data reveals a significant shift in the behavior of miners in the crypto market. According to the latest Cryptoquant report, daily outflows from miners have escalated, contributing to the ongoing analysis of Bitcoin price movements and miner profitability. These shifts raise questions about the potential implications on whale accumulation and overall market trends, as the dynamics between supply and demand continue to evolve. Amid warnings of decreased miner profitability and heightened selling pressure, analysts are urging caution among investors. As the market navigates these fluctuations, understanding the interplay of miner outflow and broader crypto market trends could be crucial for making informed trading decisions.

In the world of cryptocurrencies, the phenomenon of miner outflows describes the sudden release of Bitcoin from mining operations into the market, often indicating underlying market tensions. As highlighted in the recent analytics, the outflow of these cryptographic assets can impact the balance of whale accumulation and affect price analysis for Bitcoin and other digital currencies. Particularly, shifts in miner behavior are closely monitored as they reflect changes in their profitability and the overall sentiment of the crypto landscape. With fluctuating profit margins for miners, it’s essential to gauge how such dynamics influence broader market trends and the potential for future price movements. As the crypto space evolves, understanding the implications of miner activity on supply can provide valuable insights for investors and enthusiasts alike.

Understanding Bitcoin Miner Outflows

Bitcoin miner outflows have recently come under scrutiny as analysts observe a significant trend affecting the cryptocurrency market. According to a Cryptoquant report, there was a notable miner outflow of 15,000 BTC on April 7, which marked the third-largest outflow in 2025. This event was spurred by spot prices dipping to $74,000, pushing miners to offload their reserves amidst dwindling profitability. The overall miner profitability has seen a sharp drop from 53% to 33% since late January due to increasing hashrate and reduced transaction fees, raising concerns about continued selling pressure in the market.

Such miner outflows highlight a critical relationship between profit margins and market dynamics. As miners continue to sell off their holdings, the Bitcoin market could experience fluctuations that might inhibit a sustainable price recovery. With the ongoing bearish sentiments as captured by Cryptoquant’s metrics, it’s essential for market participants to monitor miner behavior closely. The lack of miner accumulation during this phase suggests that miners are adjusting to lower profitability and market conditions that could suppress future rally opportunities.

The Impact of Whale Accumulation on Bitcoin Prices

Whale accumulation patterns are instrumental in predicting Bitcoin price movements and overall market trends. The recent Cryptoquant report indicates that whale outflows have slowed to approximately 300,000 BTC from a significant 800,000 BTC reported in late February. Despite this reduction in outflow, the accumulation rate has reached a two-month low, reflecting a landscape marked by caution rather than optimism. The data reveals that while whales may be taking a step back, they are not entirely exiting the market. Instead, they seem to be emboldened by the prospect of future price dips as macro conditions dictate their next moves.

This cautious approach from whales is problematic for upcoming price action, particularly as external factors like U.S.-China trade tensions play a role in diminishing risk appetite among larger investors. Historically, heightened engagement from whales has preceded significant price rallies. However, the current scenario suggests a stalling in accumulation, which could result in further range-bound behavior for Bitcoin prices unless a decisive shift occurs. Analysts point out that a notable increase in whale accumulation might set the stage for a bullish breakout, provided positive sentiment is also mirrored in miner activities.

Analyzing Crypto Market Trends Amidst Miner Pressure

The intersection of miner pressure and crypto market trends is a critical focal point in understanding Bitcoin’s short- to medium-term price outlook. The Cryptoquant report emphasizes that selling pressure from miners has not only contributed to immediate price fluctuations but also indicates underlying vulnerabilities in the broader market. As miners continue to release significant volumes of Bitcoin into circulation, usually motivated by lowered profitability metrics, this creates an environment where sustained price growth is hindered.

Moreover, broader economic signals suggest that while miner outflows may alleviate, they do not necessarily guarantee an upturn in market sentiment. The inability of both miners and whales to partake in aggressive accumulation raises red flags about Bitcoin’s price resilience. It indicates that potential buyers might await more favorable conditions before committing capital. Ultimately, understanding these dynamics offers essential insights for crypto investors and traders looking to navigate this shifting landscape.

Whale Behavior and Its Connection to Miner Profitability

The delicate balance between whale behavior and miner profitability is crucial in determining market dynamics within the cryptocurrency space. As noted by Cryptoquant, whales have been realizing losses from their holdings since Bitcoin prices fell below the $80,000 mark. This realization has resulted in a net reduction of around 30,000 BTC over the past week alone. The interdependence of whale selling and miner profitability becomes evident as miners, facing shrinking profit margins, are pressured to liquidate their positions.

A decline in miner profitability, currently at 33%, often leads to heightened market volatility, especially when coupled with the actions of large holders. If whales continue to accumulate at lower price levels while miners liquidate excess supply, this could lead to two conflicting forces within the Bitcoin market — the potential for price recovery against the backdrop of significant selling pressure. Therefore, observers should stay alert to these evolving trends as they significantly impact the price trajectory of Bitcoin.

Macro Economy and Its Impact on Bitcoin Accumulation

In analyzing the effects of the macro economy on Bitcoin accumulation, it’s essential to consider significant global factors such as trade tensions and monetary policies. The recent report by Cryptoquant highlights how U.S.-China tariff disputes have influenced the risk appetite of both whales and miners, which subsequently affects their accumulation behaviors. As these geopolitical tensions continue, risk-averse sentiments among investors increase, leading to a decline in both whale accumulation rates and miner inventory stabilization, two critical components for a bullish market scenario.

The connection between macroeconomic indicators and crypto market tendencies cannot be overlooked. When these conditions deteriorate, it often results in a marketplace where participants are hesitant to make significant investment moves. This hesitancy from whales limits upward price momentum. Unless broader economic stability is restored, it seems likely that Bitcoin’s price could remain caught in a range-bound state, unable to realize its full potential as a digital asset class.

Bitcoin Price Analysis: Current Trends and Future Outlook

Current trends in Bitcoin price action exhibit a period of consolidation influenced by both whale activity and miner outflows. The implications of a stalling accumulation phase, as reported by Cryptoquant, suggest we may be on the cusp of stagnant price movement unless significant changes in both miner and whale behaviors are observed. With accumulative rates plunged to 0.5%, this period may be reminiscent of previous bear market stages, raising questions about immediate recovery options for Bitcoin.

To gain insight into future price movements, Bitcoin price analysis must incorporate technical indicators alongside understanding the sentiment reflected in miner profitability and whale accumulations. Traders and investors should remain diligent, as short-term price movements could be largely driven by either renewed confidence from whales or tactical liquidations from miners, both of which indicate significant potential risks and opportunities in the marketplace.

Strategizing for Opportunities in Bitcoin Trading

In navigating today’s unpredictable Bitcoin trading environment, having a strategic approach is crucial. Given the current data from Cryptoquant, where miner pressure and whale caution dominate the landscape, investors should consider a multifaceted strategy that includes market timing and opportunity recognition. With Bitcoin currently experiencing heightened selling pressure, there may exist attractive entry points for disciplined traders looking to capitalize on lower price ranges.

Additionally, evaluating market sentiment and macroeconomic signals can enhance trading strategies significantly. Traders must remain observant of key metrics, such as changes in miner profitability and shifts in whale accumulation trends, as these factors could provide insights into potential upward movements or continued bearish behavior. The incorporation of such analysis facilitates a more informed decision-making process for traders in the Bitcoin arena.

The Long-Term Outlook for Bitcoin Amid Changing Conditions

While short-term strategies are essential for trading Bitcoin effectively, understanding the long-term outlook is vital for holding periods. Analysts from Cryptoquant argue that unless both miner outflows stabilize and whale accumulation resumes, Bitcoin’s ability to break free from its current range may be stunted. The dynamics of the current marketplace reflect a delicate balance, where bearish indicators threaten to overshadow bullish sentiments, calling for a cautious approach from long-term investors.

Investors should analyze how external factors, combined with internal market conditions, influence Bitcoin’s resilience. This involves not only following miner profitability trends but also monitoring broader economic conditions. Only time will tell whether Bitcoin can reclaim its momentum, but strategic foresight will be required to navigate the opportunities and challenges. For now, those investing in Bitcoin should prepare for continued market fluctuations while keeping an eye on potential shifts that could lead to long-term profitability.

Frequently Asked Questions

What is Bitcoin miner outflow and how does it affect the market?

Bitcoin miner outflow refers to the volume of Bitcoin that miners sell or transfer to exchanges for various purposes, such as covering operational costs or realizing profits. High miner outflow can indicate increased selling pressure in the market, potentially leading to downward price trends, while lower outflow might signal reduced selling pressure and possible price stability or recovery.

How does miner outflow relate to whale accumulation in the Bitcoin market?

Miner outflow is closely related to whale accumulation as both affect Bitcoin supply dynamics. When miners sell large amounts of Bitcoin, it can counteract accumulation by whales, who typically buy and hold large volumes for long-term investment. If miner outflow remains high, it may prevent whales from accumulating significant amounts, negatively impacting Bitcoin price trends.

According to the Cryptoquant report, what recent trends have been observed regarding Bitcoin miner outflow?

The latest Cryptoquant report indicates that Bitcoin miner outflow has increased selling pressure, with notable transfers like a 15,000-BTC outflow contributing to market caution. This indicates that miners are capitulating amid contracting profitability and higher operational costs, reflecting broader challenges in the Bitcoin ecosystem.

What factors influence Bitcoin miner profitability and therefore their outflow?

Bitcoin miner profitability is influenced by several factors including Bitcoin’s market price, hashrate, and transaction fees. When Bitcoin prices fall significantly, as noted in recent analyses, miners’ profitability decreases, leading to increased outflow as they seek to cover costs or lock in remaining profits, thereby affecting market trends.

How can Bitcoin price analysis incorporate miner outflow data?

Bitcoin price analysis can integrate miner outflow data by monitoring changes in outflow volumes and their correlations to price movements. A spike in outflow often suggests selling pressure that could affect Bitcoin prices negatively, while decreased outflow may signify a potential price stabilization or recovery, highlighting shifts in market sentiment.

What is the significance of the Cryptoquant Bull Score in relation to miner outflow and Bitcoin prices?

The Cryptoquant Bull Score is a sentiment gauge that reflects market conditions regarding Bitcoin’s price. A low Bull Score, especially below 50, suggests persistent selling pressure, including from miner outflows, signaling that the market may stay range-bound or face downward trends until accumulation increases and market sentiment improves.

| Key Point | Description |

|---|---|

| Wholesale Bitcoin Selling | Sales have decreased but not entirely disappeared, indicating cautious behavior in the market. |

| Miner Outflow | Recent transfers show significant outflows from miners, particularly a large 15,000 BTC transfer on April 7, indicating pressures on their profitability. |

| Accumulation Rate | The accumulation rate has stagnated at 0.5%, the slowest since mid-February, suggesting limited confidence among investors. |

| Market Sentiment | Cryptoquant’s Bull Score Index points to bearish sentiment, having remained below 50 for most of the past 60 days, reflecting past bear market conditions. |

| Macro Factors | Ongoing U.S.-China tariff tensions are contributing to dwindling demand among major holders, further complicating the accumulation situation. |

Summary

Bitcoin miner outflow remains a critical concern as it reflects ongoing pressure within the mining community. Recent reports indicate that while wholesale selling has cooled, miners have been actively transferring significant amounts of Bitcoin, highlighting persisting financial challenges. The accumulation rate is stagnant, suggesting a lack of confidence in the market. Without a substantial increase in accumulation or stabilization among miners, Bitcoin prices may stay range-bound, hindered by potential supply challenges.