Reinsurance Risk Pools: Earn Up to 23% APY with Ethena

Reinsurance risk pools have entered the spotlight as Ethena collaborates with Re to offer an unprecedented opportunity for stablecoin holders. By depositing stablecoins into these reinsurance pools, users can potentially earn a staggering 23% APY, revolutionizing how decentralized finance (DeFi) interacts with traditional insurance markets. This partnership allows individuals to earn substantially higher yields than typical insurance premiums through a mechanism that democratizes access to a $1 trillion plus reinsurance sector. Engaging with reinsurance risk pools not only provides lucrative financial benefits but also enables participants to contribute to impactful investment opportunities. As Ethena’s synthetic dollar protocol integrates with Re’s innovative platform, the future of stablecoin yield generation is indeed bright, leveraging the stability and potential of crypto-assets like USDe, which are supported by collateral such as staked ethereum and bitcoin.

Reinsurance risk pools represent a cutting-edge solution in the evolving landscape of decentralized finance. By enabling users to channel their assets into diversified portfolios that are typically reserved for institutional investors, these pools open the door to robust yield generation strategies. The collaboration between Ethena and Re signifies a monumental shift, as it allows everyday investors to engage with the multi-trillion dollar reinsurance market, unlocking new possibilities for financial growth. This innovative approach not only enhances the yield on stablecoins but also introduces a new layer of impact investing, where earnings are tied to risk management and insurance dynamics. In essence, participation in these reinsurance pools is not just a financial decision, but a step toward a more inclusive financial ecosystem.

Understanding Reinsurance Risk Pools

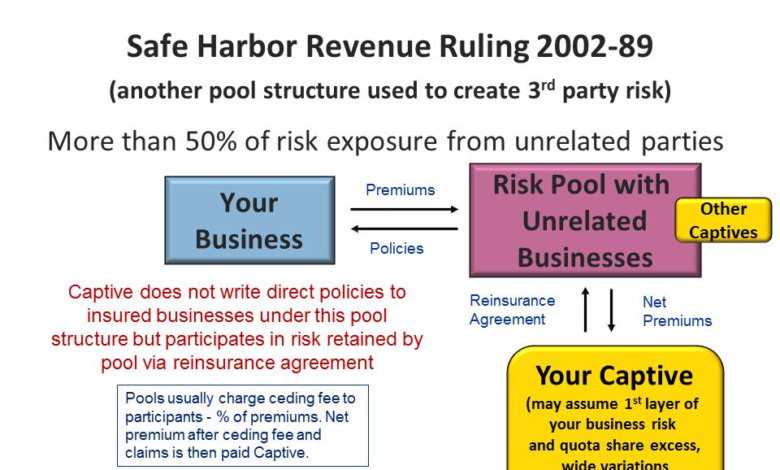

Reinsurance risk pools represent a revolutionary approach in the decentralized finance (DeFi) landscape, merging the realms of insurance and blockchain technology. By pooling funds from various investors, these risk pools mitigate individual exposure while maximizing potential returns. This collaborative investment model not only diversifies risk across numerous policies but also enhances the yield opportunities for investors. Users can deposit stablecoins, like Ethena’s USDe, into these pools and, in return, benefit from lucrative yields that can reach up to 23% APY.

The partnership between Ethena and Re heralds a new era for stablecoin holders seeking higher yield generation. By accessing a traditionally opaque market, investors can now reap benefits from the reinsurance sector, typically reserved for larger institutional players. With Re’s qualified Cell Managers overseeing these risk pools, participants can rest assured that their investments are being managed effectively, thereby unlocking the potential for both capital growth and enhanced financial stability.

Earning Through the Ethena Re Partnership

The integration of Ethena with Re provides a novel opportunity for stablecoin users to earn competitive yields on their assets. By depositing stablecoins into Re’s reinsurance pools, users not only gain access to diversified portfolios but also enjoy the advantages of potential quarterly redemptions and early liquidity options through platforms like Curve Finance. This structure reflects a progressive shift in how decentralized finance is leveraging established financial mechanisms such as insurance, offering a fresh avenue for income generation.

Moreover, the Ethena Re partnership stands out in its commitment to safety and profitability. Backed by cryptocurrency assets like staked Ethereum (stETH) and Bitcoin (BTC), Ethena’s stablecoin USDe offers a secure entry point into the broader reinsurance market. The anticipated yield, significantly exceeding traditional DeFi yields, positions this partnership as a pioneering example of how digital currencies can intersect with established financial markets, creating a win-win for users looking to enhance their portfolios.

In addition to the high APY offerings, the traditional barriers to entry into the reinsurance market are broken down, allowing retail investors to tap into earnings from insurance premiums. This democratization of access not only enhances individual portfolios but also amplifies the impact within the broader DeFi ecosystem.

The Future of Stablecoin Yield in DeFi

As decentralized finance continually evolves, the future of stablecoin yield plays a crucial role in shaping investment strategies. The collaboration between Ethena and Re illustrates a significant leap forward, where stablecoins are no longer just a means of digital currency but a powerful tool for wealth generation. With returns as high as 23% APY, stablecoin yield opportunities are catching the attention of savvy investors who are looking to optimize their asset growth.

This shift not only impacts the financial landscape but also paves the way for more innovative solutions tailored for the future. The integration of insurance models into the DeFi space signifies a broader acceptance and understanding of the role that traditional markets can play in empowering decentralized financial systems. Future developments may see even more products emerge, providing various pathways for users to leverage their digital assets in secure, yield-generating avenues.

Unlocking the Potential of Decentralized Finance

Decentralized finance has revolutionized how individuals interact with financial systems, and with partnerships like Ethena and Re, the potential is only beginning to be unlocked. Users are now able to diversify their portfolios beyond conventional investments, getting involved with reinsurance risk pools that promise high yields and innovative financial structures. This new access allows individuals to earn stablecoin yield while minimizing risks associated with traditional financial products.

Furthermore, the growing popularity of decentralized finance signifies a shift in trust dynamics between investors and platforms. With mechanisms in place such as qualified Cell Managers managing reinsurance pools, investors can feel more secure in their ventures. This level of transparency and risk management fosters an environment ripe for growth and adaptation, crucial for survival in the fast-paced world of digital finance.

Mitigating Risks in Decentralized Insurance Models

Investing in decentralized insurance products, particularly through reinsurance risk pools, comes with its unique set of risks. While the potential to earn yields as high as 23% APY is enticing, participants must consider factors such as market volatility, insurance underwriting losses, and regulatory challenges. Understanding these risks is crucial for anyone looking to partake in this emerging financial landscape.

However, risk mitigation strategies are being embedded into the design of these offerings. By offering early redemption options and managed portfolios by experts, users can engage in these opportunities while maintaining oversight and control over their investments. Embracing a diversified approach, coupled with regular risk assessments, can further enhance the safety net for investors venturing into decentralized insurance models.

Regulatory Landscape for Decentralized Finance

The evolving nature of decentralized finance has drawn the attention of regulators worldwide, raising questions about compliance and legal frameworks. As platforms like Ethena and Re bridge the gap between traditional finance and the decentralized realm, it becomes imperative to navigate the regulatory landscape cautiously. Ensuring that investments are compliant not only protects users but also legitimizes the market as a whole.

In addition, as regulatory bodies adapt to the growing influence of digital currencies and decentralized models, the dialogue between policymakers and innovative platforms will be essential. Continued engagement between the two parties is critical to foster a healthy environment that supports innovation while safeguarding investor interests. This partnership can pave the way for more robust regulations that encourage responsible growth in the DeFi sector.

Tokenization and the Future of Insurance Premiums

Tokenization stands at the forefront of financial innovation, particularly in the realm of reinsurance. By converting insurance premiums into digital assets, platforms like Re have made it possible for retail investors to enter markets previously dominated by institutional players. This shift not only democratizes access but also enhances liquidity and usability of investment vehicles in the decentralized finance space.

Through tokenization, premiums can be efficiently managed and tracked, providing both transparency and ease of access for users wishing to capitalize on potential yields. This evolving model presents exciting prospects for future developments where other financial instruments may also adopt tokenization, continuing to blur the lines between traditional finance and decentralized innovations.

Transforming Investment Strategies in a Digital Age

In the digital age, transforming investment strategies is essential for adapting to a rapidly changing financial ecosystem. The emergence of decentralized finance, with highlights like the Ethena and Re partnership, is redefining how individuals think about their investment options. With high-yield returns available through reinsurance risk pools, savvy investors are looking for alternative strategies that provide both security and income.

As traditional forms of investment yield diminishing returns, participants in the decentralized landscape are increasingly shifting to explore options such as stablecoin yield generation through processes like risk pooling and insurance tokenization. This shift not only reflects a nuanced understanding of risk but also signals a broader trend of embracing innovation in financial practices.

Accessing Global Markets through DeFi Protocols

Decentralized finance protocols are democratizing access to global markets, offering opportunities for retail investors to engage with investment vehicles previously out of reach. The integration of Ethena with the Re platform exemplifies this phenomenon, presenting users with opportunities to invest in diversified reinsurance portfolios that yield substantial returns. This enables a broad audience to tap into the wealth traditionally associated with large financial institutions.

Furthermore, as DeFi continues to disrupt conventional finance, the implications for global access cannot be overstated. Geographic barriers are dismantled, allowing investors from various backgrounds to contribute to and benefit from complex investment strategies, such as those involving reinsurance risk pools. As this trend evolves, the potential for inclusive financial growth in diverse economies could transform the entire investment landscape.

Frequently Asked Questions

What are Reinsurance Risk Pools and how do they relate to decentralized finance?

Reinsurance risk pools are investment mechanisms that allow participants, such as Ethena users, to deposit stablecoins into diversified portfolios to generate returns. By providing access to the $1 trillion reinsurance market, these pools connect decentralized finance (DeFi) users with non-correlated yield opportunities, enhancing the growth potential of crypto assets.

How can users earn up to 23% APY through Reinsurance Risk Pools?

By depositing stablecoins like USDe and sUSDe into Re’s reinsurance risk pools, users can potentially earn up to 23% APY. This high yield is achieved through investment in diversified reinsurance portfolios managed by qualified Cell Managers, which leverage traditional insurance premiums to create stable returns in a decentralized finance environment.

What stablecoins can I deposit in Ethena’s Reinsurance Risk Pools?

In Ethena’s reinsurance risk pools, users can deposit USDe and sUSDe stablecoins. These assets are designed to be backed by crypto collateral such as staked Ethereum (stETH) and Bitcoin (BTC), allowing participants to engage in decentralized finance while accessing premium-based yields from the reinsurance market.

What are the risks associated with investing in Reinsurance Risk Pools?

Investing in reinsurance risk pools does come with risks such as market volatility, potential insurance underwriting losses, and regulatory hurdles. Users should consider these risks before depositing stablecoins into the pools, even with the potential for significant returns like the reported 23% APY.

How does Ethena’s partnership with Re enhance stablecoin yield opportunities?

Ethena’s partnership with Re enhances stablecoin yield opportunities by allowing users to earn substantial APY through reinsurance risk pools. This collaboration makes it possible to access high-yield, premium-based returns from global reinsurance markets, which were previously unavailable to retail investors in the decentralized finance landscape.

What is the process for early redemption of investments in Reinsurance Risk Pools?

Investors in Reinsurance Risk Pools can avail themselves of quarterly redemptions. Additionally, the platform plans to offer early redemptions via Curve Finance soon, providing flexibility for users who wish to access their investments before the end of the liquidity period.

How are insurance premiums utilized in Reinsurance Risk Pools?

In reinsurance risk pools, insurance premiums are tokenized and used to deploy capital into global reinsurance markets. This innovative approach allows decentralized finance participants to earn yield from a traditionally unaccessible segment of finance while benefiting from the safety net provided by diversified reinsurance portfolios.

What is the significance of the 23% APY in the context of Reinsurance Risk Pools?

The 23% APY offered through Reinsurance Risk Pools is significant because it represents a substantially higher yield compared to conventional DeFi staking options. This high return potential reflects the innovative integration of stablecoins into a massive $1T reinsurance market, offering users a unique opportunity for non-correlated, premium-based income.

| Key Point | Details |

|---|---|

| Partnership Overview | Ethena partners with Re to enable yield earning via reinsurance risk pools. |

| Purpose | Users can deposit stablecoins into risk pools managed by Cell Managers to earn high yields. |

| Yield Potential | Potential returns are stated at up to 23% APY, significantly higher than traditional DeFi options. |

| Tokenization of Insurance | Re tokenizes insurance premiums, making the reinsurance market accessible to retail investors. |

| Cryptocurrency Connection | USDe stablecoin backed by crypto assets (staked ETH and BTC) connects to a $1T+ reinsurance market. |

| Redeemability | Quarterly redemptions are available, with potential early redemptions through Curve Finance. |

| Risks | Includes market volatility, underwriting losses, and regulatory challenges. |

| Future Impact | Emphasizes not just yield but also the impact of decentralized finance. |

Summary

Reinsurance Risk Pools represent a revolutionary approach in decentralized finance by allowing users to earn considerable yields through reinsurance. By partnering with Re, Ethena has tapped into the vast potential of the reinsurance market, offering up to 23% APY on stablecoin deposits. This innovation not only democratizes access to high-yield investment opportunities but also integrates traditional financial mechanisms within the blockchain ecosystem. As the market evolves, reinsurance risk pools stand to redefine the investment landscape, providing both lucrative financial returns and impactful utility.